What drove the mortgage bubble in the years leading up to the 2008 financial crisis wasn’t just ill-prepared home-buyers signing on to subprime, adjusted-rate mortgages they couldn’t afford, or the lenders who effectively gave up on underwriting these loans so as to bundle and resell as many of them as possible. There were also credit rating agencies that gave these mortgage-backed bonds the seal of approval, even when they were worthless. [More]

subprime mortgages

DOJ, States To Sue Moody’s Credit Rating Agency For Role In Mortgage Meltdown

Morgan Stanley To Pay $2.6B To Settle Charges Of Selling Troubled Mortgages Leading Up To The Financial Crisis

The Department of Justice has struck a multi-billion dollar deal with Morgan Stanley in what is expected to be one of the last major steps in resolving investigations related to banks’ roles in the subprime mortgage crisis. [More]

Georgia Counties Sue HSBC, Say Bank’s Prejudiced Loans Cost Them Millions

Three counties in Georgia have filed suit against HSBC, claiming the bank pushed minority borrowers into expensive, subprime mortgages. But these banks aren’t suing on behalf of the wronged borrowers. Instead, they allege that the predatory practices ultimately resulted in lost tax revenue, decreased property values and other damages. [More]

Whistleblower Involved In Outing Big Banks Says Keeping It Secret For 3 Years Wasn’t Easy

Not being able to tell your family why you were out of work and broke for three years would be something most of us couldn’t even imagine. One of the whistleblowers involved in the investigation that led to this year’s $25 billion mortgage settlement with some of the nation’s biggest banks says he had a pretty rough time waiting things out, while not being able to utter a word to his loved ones. [More]

Wells Fargo Receives $175 Million Slap On Wrist Over Discriminatory Loan Allegations

Three years after it began looking into allegations that Wells Fargo had systematically discriminated against minority loan applicants by pushing them into risky, high-cost subprime loans — regardless of their qualifications — the U.S. Dept. of Justice has come to a $175 million settlement with the bank. [More]

SEC Charges Goldman Sachs With Fraud

The SEC today announced civil fraud charges against Goldman Sachs and VP Fabrice Tourre. The chargea allege that Goldman ripped off investors by allowing a client who bet against the housing market to pick the mortgage securities being sold to other investors who were also investing in the housing market. [More]

Affidavits On How Wells Fargo Gave "Ghetto Loans" To "Mud People"

Here’s the official court filing (PDF) so you can get the full details on how Wells Fargo pushed or even fraudulently placed black borrowers into sub-prime loans, even when those borrowers could afford prime loans, along with an office environment where employees threw around racist slurs, calling black borrowers “mud people” and their mortgages “ghetto loans.” The official statements referenced in the NYT article are in this document in full. The affidavits begin on page 48. Two screenshots inside…

Loan Officers Detail Wells Fargo's Blatantly Racist Subprime Loans

UPDATE: Read the affidavits here.

Two Economists From The University Of Chicago Explain What The Hell Just Happened

It’s one thing to understand what just happened to the financial markets, and yet another to actually be able to explain what just happened. Thankfully, Steven Levitt from Freakonomics walked down the hall and found two economists from the University of Chicago (Doug Diamond and Anil Kashyap,) who gave him the best explanation I’ve been able to find about what the hell just happened.

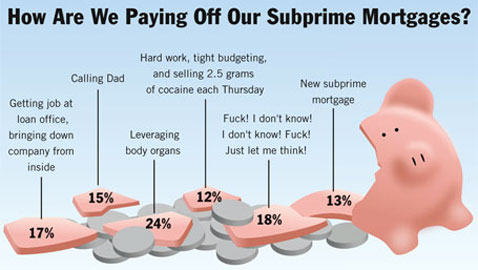

How Are We Paying Off Our Subprime Mortgages?

But with liquidity drying up, the last, and most hilarious, option is probably shrinking…

FICO Removing "Authorized Users" From Calculations; Credit Piggybackers Scores Dropping

No longer will consumer credit scores be able to get a free ride on another’s credit report; FICO has removed “authorized user” accounts from their calculations.