It’s easier to understand the subprime mortgage meltdown and how it’s erasing gains in the global markets with the humorous little metaphor we heard offered on the BBC world service this morning from the editor of Britain’s MoneyWeek magazine. She likened the “eventuality” (seeing as we’re not quite ready to call it a crisis yet) to a butcher shop. It used to be that retail banks kept mortgages on their books for the life of the loan, but within the past five years, they realized that you instead of just eating the porkchop among your family, you can chop it into “tiny bits” and make them into “loads and loads of sausages” and sell them to everyone.

stocks

../../../..//2007/08/15/smaller-fries-investing-diversely-will-still/

Smaller-fries investing diversely will still experience queasiness, but they’re seen as pulling ahead in the long-term; it’s more the fancy pants cats using esoteric financial instruments like hedge funds and derivatives who have the most to fear in the current crunch, NYT reports.

Arbitration Firms Fail To Disclose Conflicts Of Interest In Consumer Disputes

The Donald’s lost 80% of their $60 mil stock portfolio after following the advice of Piper Jaffrawy, which told them to keep their money in Level3 Worldcom stocks well after the tech bubble imploded, the New York Times reports. As of April 18th, 2001, the firm still rated Level 3 a “strong buy,” even though the stock had dropped to $13.06 from $50…

../../../..//2007/07/20/warren-buffet-likes-index-funds/

Warren Buffet likes index funds. [Bankrate]

Example Of Multiple Buy Low Sell Highs

As far as our novice eyes can tell, this transaction chart, found at thewallstreetbully, demonstrates the concept we posted last week of buying low and selling high within a single investment over time.

Thinking Differently About "Buy Low, Sell High"

We’ve been reading this weekend’s New York Times mutual funds report sitting on our kitchen table a little bit at a time for breakfast and something we saw in, “Don’t Pay Tax Twice On Your Fund Gains” changed how we thought about the old adage of “Buy Low, Sell High.”

"Now, Everyone Wants A Dishwasher."

We were discussing expanding our mutual fund portfolio (not hard, as it only contains ONE fund right now) with our step-father and mentioned adding in some international and European funds.

Shape Your Portfolio Balance For Investment Success

Want to know the one tip that will make you a successful investor? No, this isn’t a sales pitch for some get-rich-quick stock trading program. It’s a bit of good investing advice from Business Week on the factor that most separates excellent investors from average Joes.

What Are "12b-1 Fees?"

Another factor to consider when choosing a mutual fund are its 12b-1 fees, which are basically money the fund managers take out to pay for running and marketing the fund.

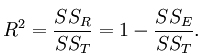

What Is R-Squared?

We’re trying to learn more about mutual funds, which we find quite frightening, so let’s start by breaking down some terms, like R-squared, a measure of volatility. Here’s what Vanguard says:

Companies That Retool Reputation See Stock Boost

Businesses with better reputations reap rewards in the stock market, reports BusinessWeek. This graphic shows how some company’s stock would appreciate if the companies had more street cred. A spin campaign won’t do the trick, though, reputation is based on concrete action…

7 Common Mental Money Mistakes

WSJ round up seven mind games people play that can have them short-changing their personal finances.

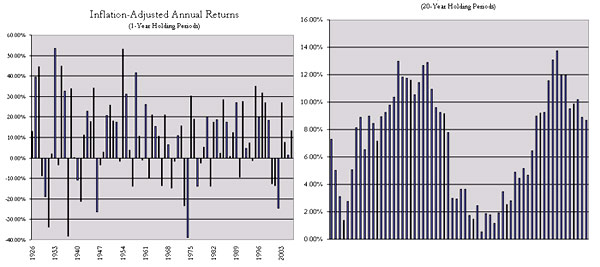

Don't Want To Lose Money In The Stock Market? Buy And Hold For 20 Years

The longer you hold stocks, the better your inflation adjusted returns are, AllFinancialMatters demonstrates. For instance, compare the S&P 500 Annual Real Returns from 1926-2006 with a 1-year holding period vs a 20-year in the picture above.

What Are "Expense Ratios?"

For the new investor considering mutual funds, one important comparison basis is their expense ratio.

What Is Dollar-Cost Averaging And Why Is It Bunk?

Dollar cost averaging (DCA) is a method of investing whereby you spend a fixed amount on a stock per month, regardless of price.

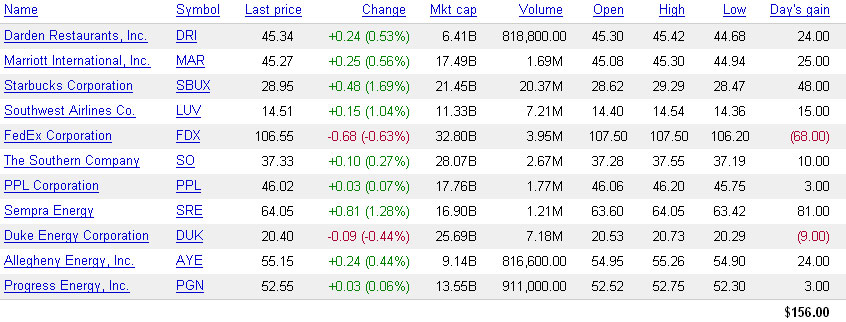

The Consumerist ACSI Fund v2.0

Based on your suggestions, we redid The Consumerist ACSI fund mock portfolio. We changed it from 100 shares to $1000 worth of each company, rounded down to whole shares. This way the highest stocks won’t have an undue influence on the portfolio’s performance.

The Consumerist ACSI Fund

We made a mock portfolio buying 100 shares of companies scoring high on the American Customer Satisfaction Index (ACSI).

How To Beat The Stock Market: Buy Companies With High Customer Satisfaction Scores

Using a back-tested paper portfolio and an actual case, the authors of a study published in the Journal of Marketing found that companies at the top 20% of the the American Customer Satisfaction Index (ACSI) greatly outperformed the the stock market, generating a 40% return.