Here’s what really happened with United Airlines’ stock losing 99% of its value on that bankruptcy story from 2002 that people though was new. This is what happens when you let the robots do your thinking for you…

stocks

../../../..//2008/09/10/now-that-the-magic-accounting/

Now that the magic accounting party is over, Fannie Mae and Freddie Mac are to be removed from the S&P 500 starting Wednesday. The minimum market cap a company needs to be allowed in the index is 5 billion. Freddie’s market cap is $614 million and Fannie’s $1.04 billion. [AP]

6 Horrible Investing Mistakes

It’s scary times for investors, so Bankrate has “6 Deadly Investing Mistakes” to avoid, most of which involve you not freaking out.

Personal Finance Roundup

Four Ways to Improve Your Resume [Yahoo Hotjobs] “Here are four tips on how you can power up your resume for today’s more competitive job search arena.”

You’re dead: Where’s your 401(k)? [MSN Money] “If you should die before spending all your hard-earned retirement savings, any number of things could happen to the remaining money. Don’t let it fall into the wrong pockets.”

7 Secrets to Picking Great Funds [Kiplinger] “These methods will help you choose wisely and give your portfolio a boost. Some may surprise you.”

When Should You Downgrade Your Car Insurance? [The Simple Dollar] “How do you know when the time is right to downgrade your car insurance?”

4 Ways to Reduce a Gadget’s Power Drain [Smart Money] “Here are four ways to cut your gadgets’ energy consumption.”

— FREE MONEY FINANCE (Photo: PaulBarwick)

Oil Prices Drop, Sadly

The price of oil dropped $2.19 today, to $117.91, spurring a stock market and dollar rally. Sounds like good news. Except that it’s dropping because the market thinks more people won’t be able to afford to drive their cars as much. Who’s up for a “staycation?”

Personal Finance Roundup

The Promotion That Got Away: 5 Ways to Bounce Back [Yahoo HotJobs] “Nearly everyone has been passed over for a job they ‘deserved.’ If and when that happens there are five important steps to take.”

../../../..//2008/07/30/you-starbucks-haters-out-there/

You Starbucks haters out there can rejoice, because the company just posted its first quarterly loss EVAR “of $6.7 million, or 1 cent per share, compared with a year-earlier net profit of $158.3 million, or 21 cents per share.” Store closures and restructuring are to blame, as well as the fact that nobody can afford anything anymore. [Reuters]

../../../..//2008/07/29/colgate-palmolive-has-reported-a-19/

Colgate-Palmolive has reported a 19% increase in quarterly profits, and says it’s partially due to price increases (but also greater volume sales and a weak dollar). [Reuters]

Personal Finance Roundup

Seven Websites That Saved Me Money in the Last Week [The Simple Dollar] “Here are seven websites I used to directly save money over the last week, my exact purchases and savings, and how much cash they saved me.”

S&P 500 Enters Bear Market

Since the Dow made it look so fun, the S&P today dipped into its first official bear market since 2002. A bear market is usually defined as a 20% drop in securities prices from their high (Not a hard feat when the financials were hyped up on imaginary money from worthless mortgages). Is it time to sell, sell, sell? Not unless you’re retiring tomorrow, tomorrow, tomorrow. Investopedia says the best thing to do when you see a bear in the market is the same as when you see one in the woods: “Tuck in your arms and play dead!” In other words, don’t go crazy selling stocks at a loss. In both cases, fighting back can leave you bleeding, although toughing it out won’t be a pleasant experience either. And if you have money leftover after filling up your car, it’s actually a buying opportunity. Which I guess is like playing dead in front of the momma bear while your buddy gathers up all the cubs while mamma is occupied and then later you and your buddy train them to harvest honeycombs for you.

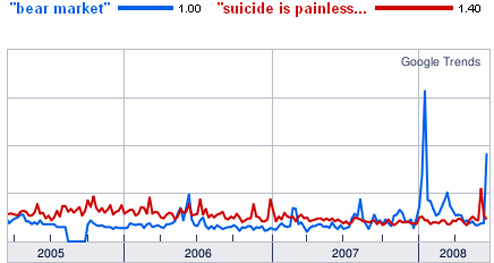

Dow Enters Bear Market

Finally having lost over 20% from its October high, the Dow has entered into a bear market. An unrelated story about an investor-fleecing hedge fund manager who tried to make his disappearance prior to his incarceration look like he took his own life provides context in a Google Trends graph.

Personal Finance Roundup

9 big credit card myths [MSN Money] “What you don’t know could hurt you.”

Your Complete Portfolio in Only Seven Investments

It’s almost part of human nature to make investing more complicated than it needs to be. Seemingly endless investment options, elaborate tax shelters, real estate “no money down” programs and the like certainly muddy the investment landscape. But CNN Money has taken the opposite view and attempted to simplify a model portfolio into a list of only seven basic investments…

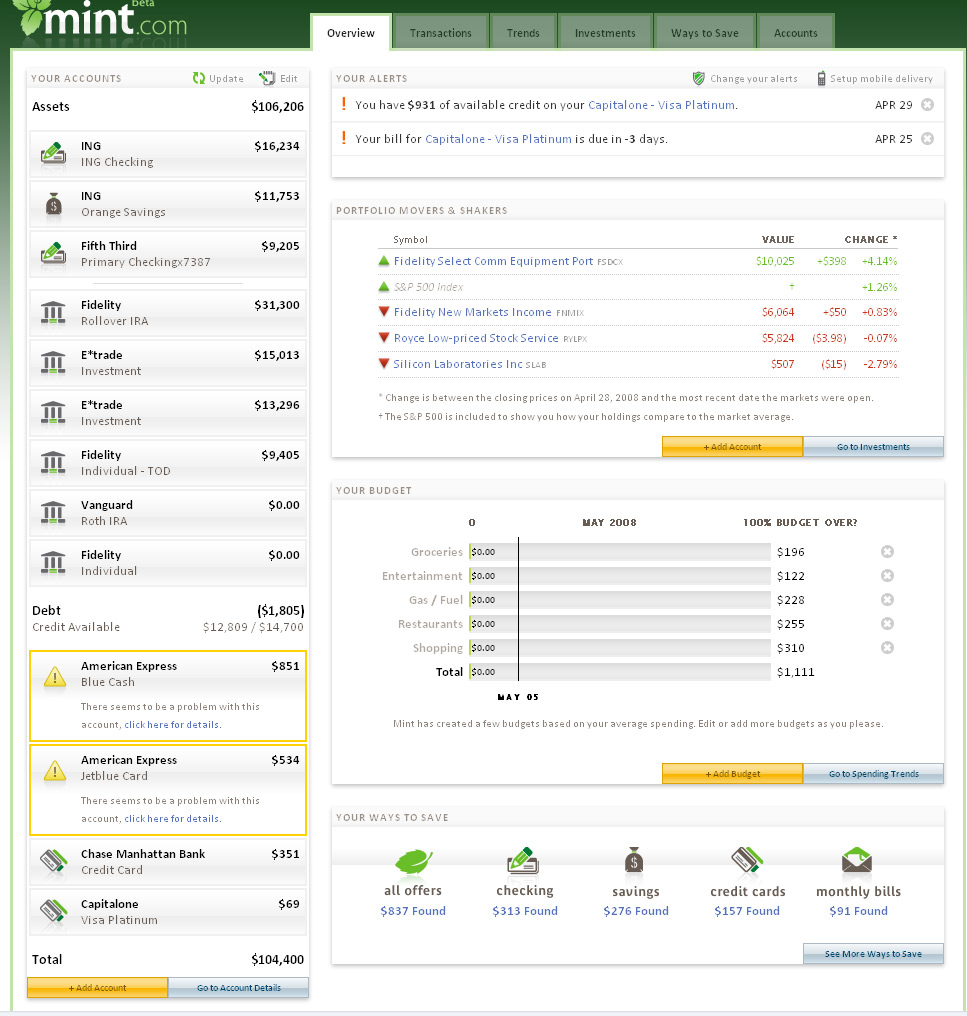

Mint.com's Plans For Portfolio Recommendations

I asked Mint.com whether they would be adding some features to their new investment tracking tool similar to what they do with credit cards and banks. When you add your credit cards and banks to Mint, it has a section where they recommend different credit cards to switch to and show you how much savings or lower APR you can get. In response, CEO Aaron Patzer said that in the future they will identify the lowest cost brokerage for you based on how often you trade and with how much money, as well as, and, this is very important, exposing management fees and expense ratios.Very cool. Investors could really benefit by such transparent access to investing-rleated feesFor a good perspective on how fees can really chew up your nest egg, read our post, “How Your 401(k) Is Ripping You Off“

Review Of Mint.com's New Investment-Tracking Features

I got to check out personal finance management site Mint.com’s new investment-tracking component before the private beta launches tomorrow. You can now add Brokerage, IRA, 401k and 529 assets. The two biggest things it offers are line graphs, and a way to see all the fees, dividends, deposits and withdrawals in one, clear, organized window. Unlike with the credit card tracking, they don’t seem to be making any suggestions about how you might save money by switching to a different investment firm. You also can’t yet push assets between accounts through Mint. As before, you will have to give up your username and password to your various financial services to let Mint scrape the data. The new brokerage features are hardly mind-blowing, but by having investment-tracking now Mint can basically be your entire financial dashboard, you just can’t touch all the levers yet. Sexy screenshots, inside…

../../../..//2008/05/02/personal-finance-management-site-mintcom/

Personal finance management site Mint.com is launching a beta for its new investment tracking system on May 6th. [Mint]

../../../..//2008/04/03/warren-buffett-invests-like-a/

Warren Buffett invests like a girl, and you should too. [The Motley Fool]

Why You Shouldn't Invest in Your Company's Stock

Stories are emerging of Bear Stearns employees with significant losses in their company stock-based retirement holdings. Examples: a nine-year employee has reported losing $600,000 and a seven-year veteran lost $400,000. Similar stories are likely to emerge in months to come. And though subsequent reports may not feature staggering amounts like these, there are sure to be many with losses that are devastating to their personal finances. This situation underscores a basic guideline of investing: don’t put more than 10% to 20% of your portfolio value into your company’s stock. Why?