The internet is not lacking in prognosticators telling you which stocks you should or shouldn’t buy. If any of these folks are being compensated — even indirectly — to promote an investment, then they are breaking the law. Today, the Securities and Exchange Commission took action against 27 individuals and companies for their part in hyping up investments without disclosing that money had changed hands. [More]

stock market

Feds Go After Stock-Picking Writers That Were Secretly Paid To Hype Up Investments

Federal Reserve Says It Will Keep Interests Rates Low For 2 More Years

In a move meant to ease uncertainty in the markets, the Federal Reserve pledged to keep interest rates low for the next two years. The Fed’s target rates, which banks use to set loan rates, have been close to zero since 2008, and previously said they would stay there for “an extended period.” The two-year designation is a sign that the Fed expects the economy to remain in troubled waters until at least 2013. [More]

Stock Market Drops Most Since 2008

The stock market continued diving on Monday, with the Dow falling 5.6% and the S&P down 6.7%, the biggest sell-off since December 2008. [More]

Stocks Rally On Positive Jobs Report, Then Fizzle

Markets opened on an upswing Friday as the labor report came in at 117,000 jobs added for July, higher than the predicted 85,000. The unemployment rate even ticked downwards to 9.1% from 9.2% in June. But the rally quickly evaporated as concerns about the growing European debt crisis and how government spending cuts might stymie economic growth took precedence. [More]

Stocks Fall On Global Economy Fears

Global stocks fell broadly Thursday afternoon amid worsening concerns about a global economic cooling and a European debt crisis. Each of the three major US indexes were down, deleting all the gains they had made so far this year. [More]

SEC: Stock Market "Flash Crash" Caused By Single $4.1B Sale

Officials today announced they can trace May’s stock market flash crash to a single transaction. On May 6, 2010, at 2:32 pm, Waddell & Reed Financial of Kansas initiated the sale of 75,000 E-Mini Standard & Poor’s 500 futures contracts. A sale of this size, about $4.1 billion worth, would usually happen over five hours, but instead the trading algorithms sold them within 20 minutes “without regard to price or time.” At 2:42 pm, markets starting plunging 5% in five minutes. [More]

Formerly Beloved Technical Analyst For Wall Street Warns Massive Market Crash Coming

Pick any Roland Emmerich disaster movie and randomly select a scene–that’s more or less what Robert Prechter, a market forecaster who was widely lauded as a technical analyst in the 1980s, says is coming to the Dow, writes the New York Times. [More]

If Only You'd Bought Apple Stock Instead Of An Apple Computer Back In '97

Apple fans boast of the company’s hardware and software reliability, but product performance has got nothing on Apple’s ability to rock the stock market. According to KyleConroy, it would have been much smarter to have invested in Apple stock rather than computers. [More]

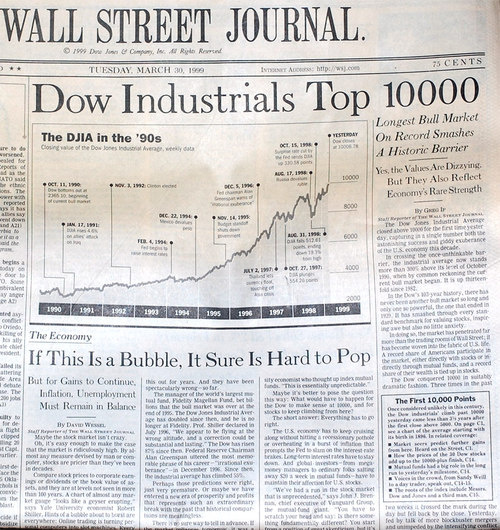

WSJ 1999: "If This Is A Bubble, It Sure Is Hard To Pop"

I just found this awesome Wall Street Journal front page from 1999 covering the first time the Dow broke 10,000. It’s full of unintentionally hilarious crap that gives keen insight into how we got into this economic catastrophe in the first place. Full-size inside.

Dow Breaks 10,000, Officially Disconnects From Prosperity Of Normal Americans

The Dow broke 10,000 today for the first time in a year. Hoorays. It’s like the 90’s all over again for the very first time, only this time we’re not even going to pretend like you’re invited to the party. P.S. When you account for a 25% devaluation in the dollar, it’s really only 7,537. [ZeroHedge]

The Best Way to Maximize Your Investment Return

There are three variables that impact the total return investors receive from an investment: the amount saved, the return rate, and the amount of time invested. Most investors spend a good amount of time and effort trying to increase all three. But what if we can’t do all three, if we’re inhibited by time, skill, knowledge, or ability (after all, many fund managers spend a lifetime trying to eek out an additional 1% return with limited success.) If we could only focus on one of the factors to impact, which is the best option? What is the best way to maximize investment returns?

If You're Losing Money In Stocks You're Dumber Than A Fifth Grader

To win a state contest, four Wisconsin fifth graders took a hypothetical $100,000 and more than doubled it in 10 weeks, according to an AP story. The kids focused on financial stocks, which they correctly figured had bottomed out. Out of the 15 stocks they fantasy-invested in, 13 were profitable, the biggest winners being Deutsche Bank and JP Morgan. The kids won a trip to the New York Stock Exchange, where they were surely viewed with utter exasperation.

What The Heck Is An ETF?

f you are making regular contributions over time – say, investing a certain dollar amount each week or month – buying an index fund is more cost-effective. If you are rolling over a lump sum, however, you might choose an E.T.F.

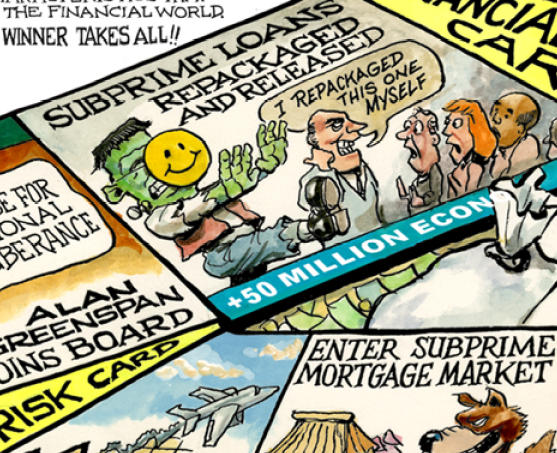

The Economist's Credit Crunch Game Makes Subprime Loans Fun Again!

We think the idea of “Credit Crunch,” a print-it-yourself board game in this week’s issue of The Economist, is great. We’re not convinced it’s exactly cost-effective to print the board, cards, and money with your own equipment, though—as someone suggests in their comments section, maybe a web-savvy reader should create an online version.

Jim Cramer Did Not Actually Say What He Said Yesterday… Or Something

Yesterday, Jim Cramer annoyed Ann Curry by saying the following words on her little television program, which is known as The Today Show: “Ok, whatever money you may need for the next five years, please, take it out of the stock market. Right now. This week. I do not believe that you should risk those assets in the stock market.”

What Does The Bailout Mean For You?

So, Congress finally passed the bailout bill. You know about the Treasury’s newfound $700 billion, and you’ve heard about the snipped golden parachutes, but what does the 451-page week-old shotgun savior of a bill actually mean for you?

../..//2008/10/01/in-one-brain-melting-two-minute-clip/

In one brain-melting two-minute clip, watch all the media frenzy, punditry, and cable-news excitement of the financial meltdown, courtesy of CNN’s own Rick “The Twitter Board Is Blowing Up!” Sanchez. [YouTube]

SEC, Treasury Throw More Sandbags Into The Wall Street Flood Waters

The SEC has temporarily banned short selling of 799 financial stocks, and the Treasury Department has said that it would guarantee (temporarily?) money market funds up to the amount of $50 billion. The New York Times called this move “startling” because money market funds have long been considered one of the safest investments — about as safe as a savings account.