By definition, price gouging is the act of increasing the prices of goods, services, or commodities to a level much higher than is considered reasonable or fair. It’s also just a shady thing to do, especially when it involves people already reeling from a natural disaster. To that end, Texas is suing three businesses for allegedly price gouging consumers before and after Hurricane Harvey. [More]

consumer protection

Coolest Has To Ship 20,000 Rewards To Kickstarter Backers By 2020

The Coolest was the hottest Kickstarter campaign of 2014, but a substantial number of people who paid at least $165 plus shipping for the party device still don’t have their coolers. Now a case filed against the company by Oregon’s Department of Justice has been resolved, and the company has three more years to ship out remaining backer rewards. [More]

IKEA Recalls 1.7 Million Topple-Prone Dressers In China After Media Frenzy

Swedish home-goods merchant IKEA is a global retailer, which unites all of humanity in having the exact same dressers in our bedrooms. While the Malm and other dressers that are especially prone to toppling over were recalled in the United States and Canada, the company sold the products in its stores all over the world, and they weren’t recalled in other markets, notably the European Union and or China. Now, after two weeks of state-controlled media fuss, IKEA in China has recalled the dressers. [More]

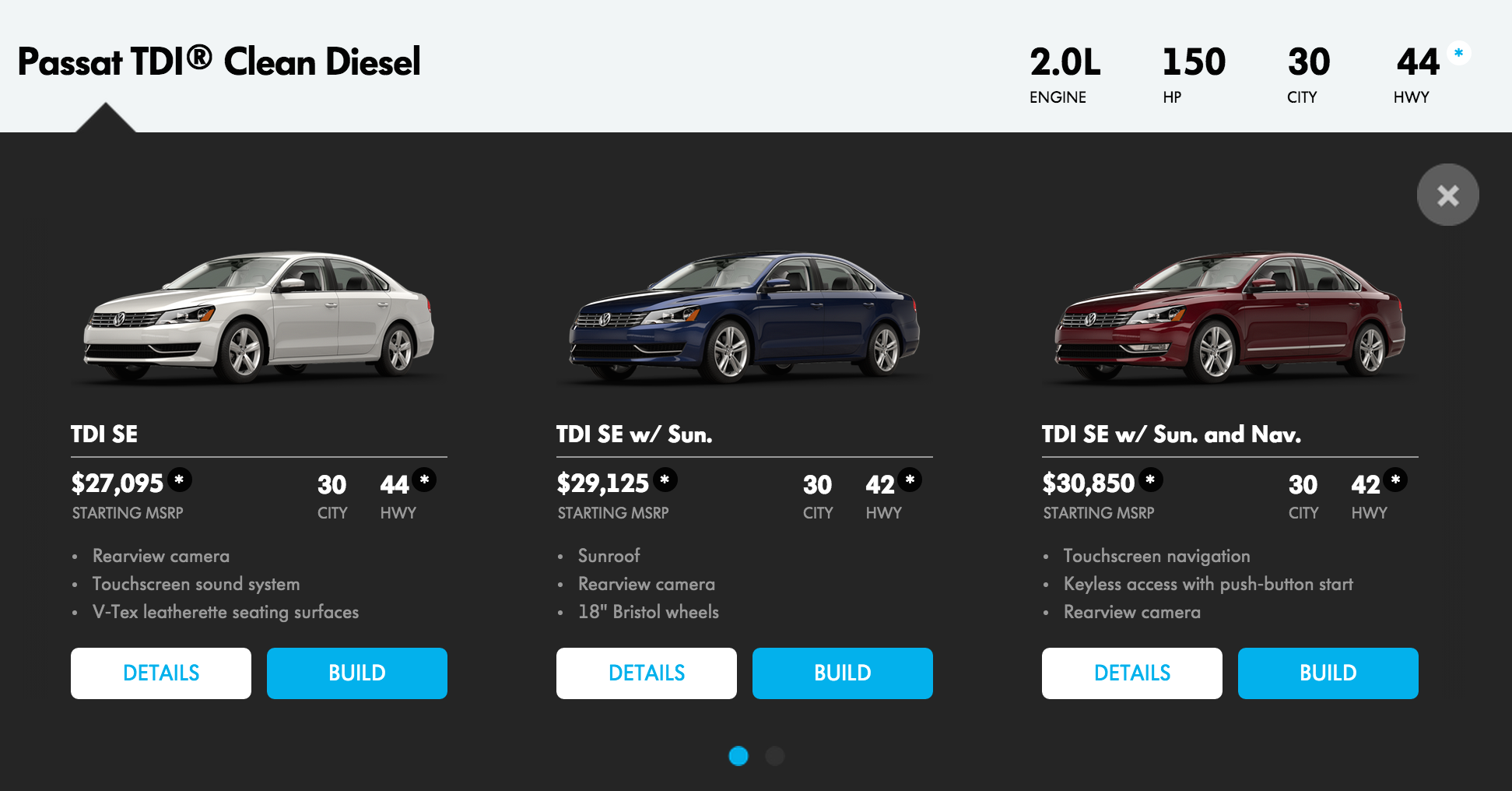

West Virginia Sues VW Over Deceptive Advertising For Vehicles Equipped With “Defeat Devices”

Since the Environmental Protection Agency revealed that Volkswagen had rigged its “clean diesel” to cheat on emissions tests, a number of consumers and cities have sued the carmaker. Now West Virginia becomes the first state to join the list of those alleging the company tricked car-buyers into paying thousands of dollars more for supposedly environmentally-friendly vehicles. [More]

What You Should Know About Rent-To-Own Retail Models: Extra Costs, High Interest Rates

Rent-to-own stores offer cash-strapped consumers the ability to take home a new refrigerator, living room furniture set and hundred of other items by allowing them to pay a little each month. But, as we’ve reported in the past, what seems like a convenient years-long payment plan often adds hundreds – even thousands – of dollars to the price tag of a product. To ensure potential customers of rent-to-own stores know what they’re getting into, our colleagues at Consumer Reports put together a helpful video spelling out the potential dangers of such retail models. [More]

Settlement: Turns Out A Product Has To Actually Be Made In Vermont To Bear That Label

When you hear the word “Vermont,” perhaps images of snowy peaks, crackling, cozy fires and maple syrup spring to mind. It’s a winter wonderland! Everything from there smells of snow and touch of roasting marshmallows! But just because you want people to associate your product with the wintry northern state doesn’t mean you can just slap a “Made In Vermont” Label on it and call it a day. [More]

California Court: Online Merchants Can Demand Personal Info To Verify Credit Card Purchases

While a California consumer protection law dating back 22 years is all good when it comes to brick-and-mortar stores, the state’s Supreme Court ruled today that online merchants can collect personal information from buyers using credit cards. Companies like Apple and Ticketmaster had argued that they need data like home addresses and phone numbers to verify credit card purchases and prevent fraud, and the court agreed in a 4-3 decision. [More]

White House: GOP Efforts To Block Confirmation Of CFPB Director Will Hurt Consumers

Deputy Director of the National Economic Council, Brian Deese, spoke with Consumerist today during a conference call where he stressed the importance of Richard Cordray’s confirmation as director of Consumer Financial Protection Bureau, a confirmation that was blocked earlier today by Senate Republicans. [More]

House Considering Three Bills That Could Erode Consumer Protections

Our ever-vigilant parents at the Consumers Union are taking action against three new bills set to be vote on in the House of Representatives Friday, publishing a letter to show how proposed reforms in the bills would contribute to damaging many consumer protections. [More]

Send Your Ideas To The Consumer Financial Protection Bureau's New Website

ConsumerFinance.gov, the newly created Consumer Financial Protection Bureau’s new website, is live and in full effect. So is their Twitter, Facebook, Flickr and YouTube. They want your suggestions and ideas so send ’em in! As they announced on their website their central role is “to make markets for consumer financial products and services work for America…The CFPB belongs to the people it serves. If you have suggestions, we want to hear them.” [More]

7 Clauses To Beware Of In Your Cruise Contract

Cruise line contracts are drafted by the company’s lawyers and contain nothing in the way of consumer protection. For instance, if you get sick and the ship’s doctor treats you and you die, your family can’t sue the cruise line for malpractice. [More]

Consumer Advocate Says Protection Agency Should Be Like Harvard's Elizabeth Warren

Jeff Sovern at Public Citizen has a simple message for the Washington bureaucrats who will soon create the new Consumer Financial Protection Agency: Put Elizabeth Warren in charge and build the agency in her image.

Why Elizabeth Warren, you ask?

Chamber Of Commerce Attacks Proposed Consumer Financial Protection Agency

Maybe you forgot about the proposed Consumer Financial Protection Agency in all the health care sound and fury, but it’s still out there, and financial companies are still very much against it. Now the U.S. Chamber of Commerce is launching an ad campaign that shifts the focus from credit card companies to smaller businesses that they insist will be affected, although the scope of the proposed agency is still kind of unclear.

Vote On Consumer Financial Protection Agency Delayed Until September

This week, Rep. Barney Frank (D-MA) postponed a vote on a bill creating a Consumer Financial Protection Agency (CFPA) until September when lawmakers return from recess. The delay is partly due to other more pressing issues, but mainly due to unexpected (really?) pushback from the financial industry.

Enlightened Nation To Banks: Either Explain Excessive Fees Or Eliminate Them

Australian consumers will soon be able to challenge any bank fee that they consider “unreasonable,” thanks to a new law that could save consumers up to $1 billion. Banks that want to keep levying excessive fees for late payments and overdrafts will need to prove that the charges are reasonable by revealing the true processing costs behind the fee.