Reputable companies that sell personal emergency alert devices might air disturbing TV ads, but at least they mean well, don’t lie in their ads, and–here’s the important thing–don’t bombard America’s seniors with robocalls about the “free” alert system they’ve been given. The attorney general in Florida and the Federal Trade Commission have teamed up to stop this scam further up the food chain. [More]

seniors

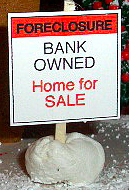

Despite Regulations, Survivors Face Foreclosures After Reverse Mortgage Borrower’s Death

There are a number of reasons someone might take out a reverse mortgage: to pay for prescriptions or medial care, to subsidize their daily living expenses or even to settle their fear of becoming a burden to their family. But the product that was designed to keep elderly consumers in their homes is now wreaking havoc on their surviving loved ones. [More]

Pizza Hut Manager Attacks Old Man

A 27-year-old Pizza Hut manager in Winnipeg, Manitoba, went bonkers last Friday and dragged a 76-year-old customer to the ground over a payment dispute. The manager was arrested, and the customer returned the next afternoon to dine, because he is afraid of nothing.

Scammers String Along 82-Year-Old For Four Years, Leave Him Penniless

Here’s another reason to have a sit-down with your elderly relatives and make them promise that if they ever, ever find out they’ve won some money in a lottery they didn’t enter, they should tell family members immediately.

Wachovia To Pay $144 Million For Bilking "Gullible" Seniors

Wachovia will pay $144 million for helping telemarketers prey upon the elderly. The Office of the Comptroller of the Currency spanked the morally bankrupt institution with one of the largest fines ever levied—but before seeing a penny of settlement money, seniors will need to fill out detailed claim forms and navigate a complex bureaucracy.

Dateline Investigates Shady Annuity Salesmen Targeting Seniors

Dateline did a hidden camera investigation into the world of shady annuity salesmen targeting seniors and playing on their emotions to lock their life savings away in funds they may never live to receive the benefit from, or pay stiff penalties, not disclosed in the sales pitch, for early withdrawal. In this clip, Dateline producers attended “Annuity University,” a two-day session run by Tyrone Clark to teach them how to sell to elders. He settled with the state of Massachusetts after he published a sales pamphlet that told salespeople to treat seniors “like they were selling to a twelve year old” and to hit their “fear, anger, and greed buttons” to make the sale. He also sells questionable self-promotional tools and services. In one of them, a fake radio guy will call up the salesperson and interview them like they’re a financial expert on the radio. The session is recorded and the salesman gets CDs to pass out, so they can pass themselves off as legitimate financial advisers. Video, inside…

$753 Airline Tickets End Up Costing Two Seniors Nearly $10,000

Two seniors who bought $753 roundtrip tickets to Rome ended up paying nearly $10,000, thanks to flight delays and airlines reneging on their promises. The Lopilatos had a flight on American Airlines from LAX to JFK, then continuing on to Rome on Alitalia. The flight was scheduled to arrive in New York three hours before their flight to Rome, but it didn’t and they missed the flight to Rome. At first, American got them seats on a plane to London and then on to Rome on British Airways, for free. But then all of a sudden the seats were gone and now the tickets were $2,065 each. Not wanting to miss their tour group, the couple agreed. Then when they went to come back from Rome, Alitalia canceled their return flight because they missed the outbound, another $2,000+ in return tickets. When they tried to get refunds, each airline blamed the other and denied liability. How to avoid the same thing happening to you? Fly nonstop.

From $2 Million To Foreclosure On An Ameriquest Subprime Mortgage

Frances Joy Taylor had had about $2 million in assets, which she intended to leave to her church, before she met a businessman named Tyrone Dash. Dash took over her affairs and “methodically liquidated or leveraged almost everything she owned: her bank accounts and securities, her insurance policies, her credit cards, her two apartment buildings and, ultimately, her home,” says the Seattle Times. Frances suffers from Alzheimer’s.

How To Avoid The Medicare Donut Hole

Anyone who has Medicare and takes lots of drugs or a few very expensive ones (or who has an older relative who does) knows about the dreaded “donut hole”—the gap in coverage that happens each year if you have to spend a lot of money on prescriptions. If you’re above the poverty level but don’t have good gap insurance, it can be financially devastating. The New York Times notes that for a quarter of at-risk patients, planning ahead with generics may help you skirt the donut hole altogether. The big stumbling block is that you have to be prepared to discuss your personal finances with your doctor.

AARP Can Double Costs For Seniors

The L.A. Times is reporting that AARP products are not always the best deal for senior citizens. The American Association of Retired Persons is susceptible to a profit motive; $400 million – 40%, of their annual budget – is generated from “royalties and service provider relationship management fees” gleaned from products, such as Medigap insurance, sold to its 38 million members.