Auto manufacturers continue to whittling down the number of unidentified vehicles equipped with potential shrapnel-shooting airbags a month after Japanese parts maker Takata deemed the safety devices defective. The latest round of expanded recalls goes to Toyota, which added another 1.37 million to its recall list. [More]

regulators

NHTSA Says It Could Take Days Or Weeks Before All Takata Recalled Vehicles Are Identified

Japanese auto parts maker Takata finally buckled under pressure from federal regulators Tuesday, declaring that nearly 33.8 million vehicles sold in the United State come equipped with airbags that can spew pieces of shrapnel upon deployment. While about 17 million of those vehicles had already been part of recalls by major automakers, millions of others have yet to be identified, leaving consumers wondering if they’re driving around with what some people have likened to an explosive device in their steering wheel. [More]

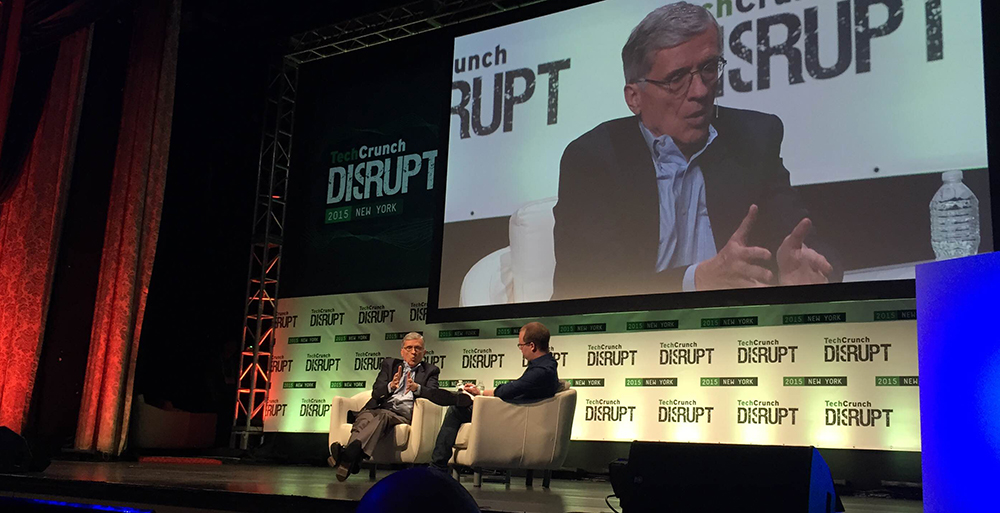

FCC Chair: Comcast Made Right Decision Scrapping Merger; Plan For Net Neutrality Is “Not To Lose”

We’re barely into May, and it’s already been an incredibly busy year for the FCC. Even major issues like a spectrum auction and a ruling on municipal broadband were overshadowed by the two huge proceedings around net neutrality and the Comcast/TWC merger. And so when FCC chairman Tom Wheeler sat down for a “fireside chat” at the TechCrunch Disrupt conference in New York this week, he had a lot to say. [More]

There Are Two Things That Could Stop The Comcast/TWC Merger, And We Might Get Both

Update: Comcast is reportedly planning to back out from the merger deal as early as tomorrow in the face of the likely opposition from both the FCC and Justice Department. [More]

Takata To Double Airbag Replacement Production To 900,000 Kits By September

After facing increased scrutiny by federal regulators in recent weeks regarding an investigation into the massive airbag recall and lack of new safety devices, Japanese auto parts maker Takata announced it will double production of replacement airbags in the next six months. [More]

FTC Challenges Sysco Acquisition Of US Foods

Sysco’s in-person meetings with the Federal Trade Commission didn’t have the desired effect. The foodservice supply giant wanted approval for its planned acquisition of competitor U.S. Foods, but the FTC thinks that Sysco wants to gobble up too much of the market. The commissioners voted 3-2 to block the merger. [More]

Fifth Third Bank Has 100 Million Reasons To Want To Keep Offering Payday-Like Loans

When the four banks still offering customers payday loan-like services announced they would discontinue their often under-fire products, they likely knew their bottom-line would take a hit. One of those institutions, First Third Bank announced this week that changes to its program resulted in the loss of millions of dollars in revenue, providing an example of why it can be difficult to persuade lenders to ditch the profit-making, but financially devastating programs. [More]

Regulators Investigating Honda, Nissan For Loss Of Power Steering Issues

Here’s the thing about power steering –– it helps drivers keep control of their vehicles, and when the system fails the likelihood of an accident increases. For those reasons, and after receiving numerous consumer complaints, regulators have opened two separate investigations into Honda and Nissan-produced vehicles that lose power steering capabilities. [More]

New Policies Aim To Make It Easier For First-Time Home Buyers To Get Mortgages

Some first-time home buyers face an uphill battle when it comes to obtaining a mortgage following the housing crisis. But new policies created by federal regulators aim to make it easier for consumers to buy the home of their dreams. [More]

Uncle Sam, Pre-Marital Counselor: The Approval Process Ahead For Comcast And TWC

The proposed merger of Comcast and Time Warner Cable, as it currently stands, looks like it could be a good move for the businesses and a bad move for consumers. But right now it’s still just that: a proposed merger. In order for this corporate marriage to move forward, federal regulators first have to approve the union–and that’s where it gets tricky. [More]

What Can A Regulator With A Sense Of Ethics Do After Leaving The Feds? Try Not To Become A Lobbyist.

After many years building your career, you’ve reached such a level of good reputation and success that you’ve been tapped to lead a major federal regulatory agency for a few years. Wow! That’s real power. Great job! But your term ends, or the administration changes, and your time in charge of the agency is done. You feel strongly that you’ve got another decade or two in you before retirement, though. So what’s your next move? [More]

FCC Asks Verizon To Investigate 911 Calls Dropped Amid Snowstorm

When several thousand Verizon customers needed to dial 911 during a January snowstorm in the D.C. area, they were left hanging by the provider. The FCC has asked Verizon to investigate why an estimated 10,000 911 calls were dropped. [More]

10 Things You Don't Know About The Goldman Sachs Case

The media spin cycle is churning out its typically tepid hogwash about the SEC’s suit against Goldman Sachs. The Big Picture skewers 10 myths about the case and gets to the heart of the matter: Goldman is screwed. Here’s why: [More]

Be Your Own Financial Regulator

Any sort of federal agency to protect consumers from abuse from the financial industry is months, or possibly years, away, notes Linda Stern of Reuters. That’s why you shouldn’t depend on such an agency to protect you in the meantime. In fact, you can take her advice and use it no matter what happens at the federal level.

WaMu Told Washington That Adjustable Rate Mortgages Were Safer Than Some Fixed Ones

The Associated Press says that a review of regulatory documents shows that years before the subprime mortgage crises developed into a full blown economic meltdown— the government ignored warnings and listened instead to lobbyists who represented some of the same banks that have now failed.

Banks Want To Forgive Credit Card Debt — But The Government Says No

The next wave of the credit crisis — the skyrocketing defaults on credit cards — is coming in and odd alliances are being formed. The Consumer Federation of America, along with the Financial Services Roundtable ( a self-described “major player on Capitol Hill and with the regulators” which represents the securities, investment, insurance and banking industries) has requested a “special program that would allow as much as 40 percent of credit card debt to be forgiven for consumers who don’t qualify for existing repayment plans.”

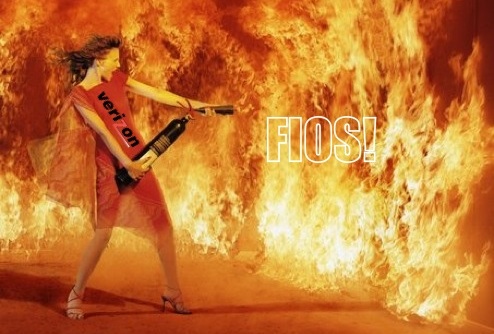

Most Verizon FIOS Installations Violate National Electric Standards

A two-year investigation has concluded that most Verizon FIOS installations fail to meet national safety standards, and could cause fires or electrocutions. FIOS is famous for house fires, but New York’s Public Service Commission first started its investigation back in 2006 after several inspectors discovered improperly grounded installations.

Two More Banks Fail, Including The Largest Arizona-Based Bank

Yesterday the FDIC shuttered the 28 branches of the First National Bank of Nevada and the First Heritage Bank. Federal regulators will perform a nifty little magic trick over the weekend, and on Monday, the branches will reopen as Mutual of Omaha Bank. Aren’t bank failures fun?!