Even though recent surveys indicate that the overwhelming majority of Americans want more regulation of payday lending, federal lawmakers are attempting to strip the Consumer Financial Protection Bureau of any authority over these short-term, high-cost loans. [More]

reform

Retailers Ask Congress To Please Not Roll Back Dodd-Frank Debit Card Reforms

Both the banking industry and conservative lawmakers are hoping that the incoming Trump administration will agree to repeal the 2010 Dodd-Frank Financial Reforms, but many in the retail world are calling on Congress to retain at least the portion of the law involving debit card transactions. [More]

Supreme Court Deadlock On Immigration Puts Immigrants At Increased Risk For Fraud, Deportation

Yesterday, a deadlocked U.S. Supreme Court stymied the White House’s hopes to enact large-scale immigration reforms that would have allowed millions of immigrants to remain in the country. While this lack of a decision doesn’t necessarily mean the end of the program, it will inevitably create confusion for those directly affected by the case, while fostering a breeding ground for fraudsters seeking to take advantage of immigrants uncertain of their status. [More]

Millions In Campaign Contributions Enable The Title Loan Cycle Of Debt

Each year, thousands of consumers lose their vehicles – often their largest asset – after taking out small-dollar, high-interest auto title loans to cover expenses. Despite hundreds of attempts by lawmakers to rein in the often predatory auto title market, generous campaign donations from the industry’s leaders have created a cycle in which consumers are plunged deeper into debt, while title lenders continue lining their pocketbooks. [More]

Student Loan Borrower’s Bill Of Rights Would Reform Disclosure And Servicing Standards

In recent weeks, legislators have introduced a range of bills aimed at addressing student loans and revamping the laws governing those debts. Today, that push continued with the reintroduction of a bill that would ensure student borrowers are treated fairly and understand the range of options at their disposal. [More]

So, What's In The Financial Reform Bill?

Our leaders were up late hashing out a version of the new financial reform bill and yes, apparently they have come to some agreement. But what’s in there? [More]

Late Payments Are Dropping Thanks In Part To The CARD Act

Banks and card issuers warned against the credit card reforms that went into effect a few months back, but so far it’s been a good thing for consumers, according to new delinquency numbers. [More]

Are Corporate Boards Ruining American Businesses? This Book Says Yes

The new book Money for Nothing looks at corporate boards: how they’re frequently hand-picked and ruled by the CEOs they’re supposed to keep in check, how they’re sidelined by various conflicts of interest and lack of accountability, and how the worst ones have massively screwed shareholders. [More]

Senate Passes Health Care Reform Bill

In case you missed it, Senate Democrats managed to succeed at their goal of pushing through some sort of health care reform bill before Christmas Day–the chamber voted this morning 60-39 along party lines and passed the bill. Up next: the Senate and House have to get together and negotiate some final version. If you want to compare what’s in the House and Senate versions, the New York Times has put together an excellent side-by-side comparison tool.

Bernanke Says The Recession Is "Likely Over"

Good news? Federal Reserve Chairman Ben Bernanke says that the recession is over, but that it won’t really stop the rise of unemployment — currently at a 26-year high of 9.7%.

Is Cheap Food To Blame For Our Expensive Health Care?

Michael Pollan thinks so. He’s got an op-ed in the NYT where he examines the relationship between or expensive health care and our cheap fast food.

AmEx, Discover Ditch Overlimit Fees

American Express and Discover will no longer bill customers who exceed their credit limits, according to company spokespeople. The creditors aren’t eliminating the fees because they care about their customers. No, they’re providing what American Banker calls “the first concrete examples of how a new law will restrict issuers’ abilities to turn a profit.” The new CARD Act that Congress passed in May requires consumers to opt-in before they can exceed their credit limits. Since overlimit fees, which can reach $39, aren’t very profitable for creditors, they decided to ditch the fees altogether.

Comprehensive Food Safety Reform Moves Forward In Congress

The House Energy and Commerce Committee just approved comprehensive food safety reform, setting it up for consideration on the House floor in the coming months. The Food Safety Enhancement Act was approved by voice vote, indicating bipartisan support and suggesting a relatively smooth passage through the entire House.

California To Fight Health Insurance Rescissions?

The LA Times is reporting that California Insurance Commissioner Steve Poizner will reveal new regulations aimed at stopping a controversial health insurance practice in which customers with costly illnesses are retroactively dropped.

Here's How The CARD Act Will Actually Change Credit Cards

Bob Sullivan at MSNBC—who coincidentally was one of the speakers at our event last night—has published a list of myths and facts about the new credit card bill. His article dispels some of the misinformation that’s out there right now about just what the act does, and what card companies are going to do in retaliation.

Get Informed About Credit Card Reform

As we prepare to talk credit card reform with the Obama folks, we want to make sure you’re all able to follow along at home. Inside, we present a cornucopia of fact sheets, charts, and links about the fight for credit card reform.

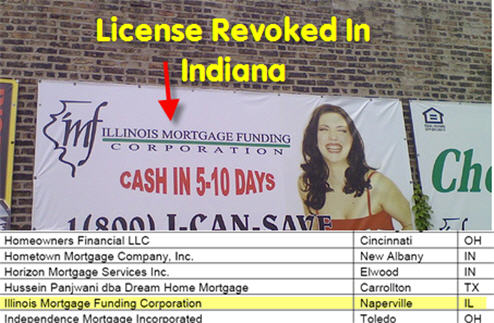

Oh Sh*t! 40% Of Indiana's Mortgage Brokers Lose Their Licenses

40% of Indiana’s mortgage brokers have lost their licenses because they did not comply with a new law aimed at “raising the standards” of the mortgage lending industry. The law requires mortgage brokerages to “name a principal broker with at least three years experience who has passed a state exam and will oversee his company’s business affairs,” says BusinessWeek. Sounds reasonable, doesn’t it?