The Joint Economic Committee has released a report estimating 2 million foreclosures by 2009, causing $71 billion in lost housing wealth.

real estate

Hiring Unlicensed Contractor Like Inviting Devil Into Your Parlor

You might think you’re saving a buck by going with their advertised cheap services, but they’re bidding without insurance, worker’s compensation, or training. MSNBC’s new investigative series “Home Wreckers” tapes a police sting operation aimed at snatching up sketchy contractors. One of the guys is accused by several homeowners of low-balling bids, which then end shoot up in price over the course of the project. He also takes customer’s money and then never finishes the repairs. The police search his car and find ecstasy hidden in it. The police show off pictures of other contractors who were found to be convicted child molesters, on probation for attempted murder, registered sex offenders, on a state’s 10 most wanted list, and on Megan’s List. They advise to only hire licensed and bonded contractors, as they have to go through background checks and drug tests. You wouldn’t want to let some ex-con in your house, or around your kids.

../../../..//2007/10/24/merril-lynch-a-79-billion/

Merril Lynch a $7.9 BILLION write-down from sub-prime mortgage losses. [CNN Money]

../../../..//2007/10/24/just-to-ask-his-mortgage/

Just to ask his mortgage service about his home loan cost $9.99/minute – the same rate charged by many phone sex-operators. But only with the former do you have a chance of really getting schtuped. [Credit Slips]

FDIC Chair Suggests Fixing Rates To Solve Mortgage Crisis

Sheila C. Bair, the chair of the FDIC, suggests that lenders “restructure all 2/28 and 3/27 subprime hybrid loans for owner-occupied homes in cases where the borrower has been making timely payments but can’t afford the reset payments. Convert these to fixed-rate loans at the starter rate.”

WaMu's Net Income Down A Whopping 72%

The “housing correction” is turning out to be “more dramatic and more rapid” than Kerry Killenger, WaMu’s chairman and chief executive had expected.

10 Worst Housing Markets For Sellers

Moody’s economic research company released new projection models sussing out the top ten places in which you don’t want to be trying to sell a house.

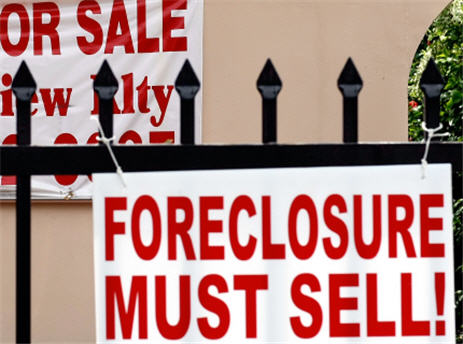

Foreclosures Doubled In September

Last month saw twice as many foreclosures than last September, says RealtyTrac, the foreclosure tracking organization.

../../../..//2007/10/11/risky-mortgages-werent-just-for/

Risky mortgages weren’t just for the poor and financially unsophisticated, spikes in high-rate loans were seen across the income spectrum. [WSJ via Consumer World Blog]

../../../..//2007/10/10/a-increase-in-spammers-trying/

A increase in spammers trying to capitalize on the housing crisis can mean only one thing: spammers can read newspapers. [Symantec]

No More Home Equity? Bust Out The Credit Card, Consumer Borrowing Is Up

With home equity harder to find these days, one might suspect that there would be a drop in consumer borrowing. Nope.

The Non-Fancy Way To Buy A House

With all the talk about people finding out their no-money-down, interest-only, and option-ARM mortgages weren’t such a great deal, it’s refreshing to hear these pieces of advice about the fiscally conservative way to buy a house, via Moneycrashers:

Baltimore Feeling The Pain Of The Housing Slump

In the spring quarter, 25 percent of the foreclosures were in the city itself. The numbers are up even in Belair Edison, a stable working-class neighborhood of neat, two-story row houses adjacent to a picturesque wooded public park.

Investigate Neighborhoods Online With Real Estate Gossip Sites

You find a home you love, and the asking price makes it practically a steal. But you wonder: how do you know it wasn’t built on top of a “relocated” cemetery? Or what if it’s only a few blocks away from the city’s longest-running crackfest? Thanks to several websites and blogs, new home shoppers can now collect “real world” data about prospective neighborhoods and real estate from actual residents, other buyers, and anonymous brokers out to sabotage the competition.

Fight Foreclosure Roundup

October is here, which can only mean one thing: $50 billion in option-ARM mortgages ratcheting up to higher interest rates. Here’s four posts of ours that can help affected homeowners see their way clear:

Countrywide Mortgage Adjustment Getting Outsourced To India

An excellent NYT article alludes to Countrywide Mortgage’s AOL-esque culture of phone reps only concerned about boosting their personal stats, regardless of the ruin it would spell for its customers.

Neighbors Complain Of "Unbearable Stench" Coming From Gordon Ramsay's Restaurant

Can having a “nice” restaurant in the neighborhood ruin your property values?