../../../..//2007/11/26/woman-pays-debt-on-foreclosed/

Woman pays debt on foreclosed home, only to have it sold out from under her anyway. [Newsday]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2007/11/26/woman-pays-debt-on-foreclosed/

Woman pays debt on foreclosed home, only to have it sold out from under her anyway. [Newsday]

Forbes has put together a list of the best and worst housing markets in the U.S. Think every market is dropping? Apparently not. Salt Lake City, you’re doing just fine. So far. Overall, the picture isn’t as rosy:

The Organization for Economic Cooperation and Development is predicting that mortgage-related write-offs could reach $300 billion, says the New York Times. Although major U.S. financial institutions have placed their estimates at around $50 billion, the OECD says that “a rougher period may yet await financial markets.”

A Boulder couple lost 25% of their property after a neighbor used the legal principle of “adverse possession” to west control of it. For 25 years, Richard McClean and Edith Stevens used part of a vacant lot owned by their neighbor, the Kirlins. They extended their rock garden into it, held parties, and stacked wood upon it. Recently they filed to suit to take control of the land. The judge ruled that since the Kirlins hadn’t contested the Stevens use before, they were less attached to the property, and awarded the claim to the litigants. Naturally, the case has caused an uproar in the Boulder community who are delighted to have discovered a land grabber within their midst. The Kirlins plan to appeal, and the Boulderites plan to hold protest picnics among the lots scrabbly grass and weeds.

H&R Block Inc., our nation’s largest tax preparer, is now missing CEO Mark “Anybody Wanna Buy A Subprime Lender?” Ernst, after losing $1 billion in the subprime meltdown.

Government-sponsored mortgage lender Freddie Mac, the second largest U.S. mortgage company, posted a $2 billion loss for the third quarter and warned that it may not have enough cash to cover its mortgage commitments.

../../../..//2007/11/19/dont-buy-a-house/

Don’t buy a house near an airport: a Swedish study has found a correlation between living near noisy airports and “an elevated risk of high blood pressure due to noise pollution.” [Reuters]

There’s big ramifications to a federal court’s dismissal of 14 foreclosure cases because the bank couldn’t prove that they owned the mortgage note, reports NYT.

../../../..//2007/11/15/the-hot-new-financing-trend/

The hot new financing trend that’s taking the mortgage industry by storm: 30-year fixed mortgages! [Bankrate]

Don’t open any new lines of credit or go crazy with the credit card purchases between your home loan’s approval and the actual closing date, warns Ilyce R. Glink (doesn’t it look like we just tapped a bunch of keys at random to spell that name?) at Inman Real Estate News. Your lender will pull a second credit report before closing to make sure that you’re still capable of paying your loan—so if you’ve done anything in the interim that could impact your ability to pay, rest assured it will show up.

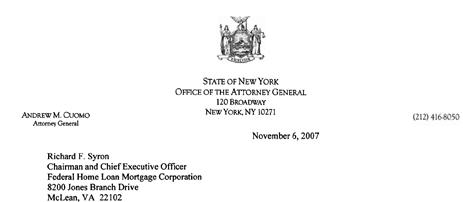

New York Attorney General, Andrew Cuomo has subpoenaed the nation’s two largest financiers of home mortgages, Fannie Mae and Freddie Mac in his investigation into the “systemic fraud” that has infected the business of real estate appraisals.

For years homeowners have been using their soaring-in-value homes as ATMs, drawing money out to finance whatever they wanted. No more. Falling home prices mean that your house is no longer a source of cash.

Jason and Kerri Brown of Greenville, S.C. found a secret room, hidden behind a bookcase, in their newly purchased home. When they entered the room, they found a note that said “You found it!”

Five years ago, Jordan Fogal’s dream house was turned a living hell after her builders ripped her off with shoddy construction and then hid behind the arbitration clause in the contract. Now she’s become a crusader against mandatory binding arbitration. [More]

Home mortgage defaults rose 22% in September.

Foreclosure tracking firm RealtyTrac has been delivering lots of bad news this year, not least of which is some sobering numbers on Real Estate Owned properties or REOs. An REO is what happens when a home cannot be sold at auction and becomes the property of the lender.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.