The wallet-sized – or larger – smartphone constantly tethered to your hand may often be seen as your connection to the outside world. Each time you surf the web, connect with friends, make purchases and check your bank account, it’s collecting mountains of data about you. And that data could soon be analyzed to determine if you’re creditworthy. [More]

personal information

Conflicts In Patient Privacy Laws Often Leave Student Health Records Vulnerable

When a college student seeks medical treatment at a campus healthcare facility, they probably expect they will be afforded the same discretion as all consumer are under HIPAA (the Health Insurance Portability and Accountability Act). But thanks to a separate, often conflicting federal law, that isn’t always the case. [More]

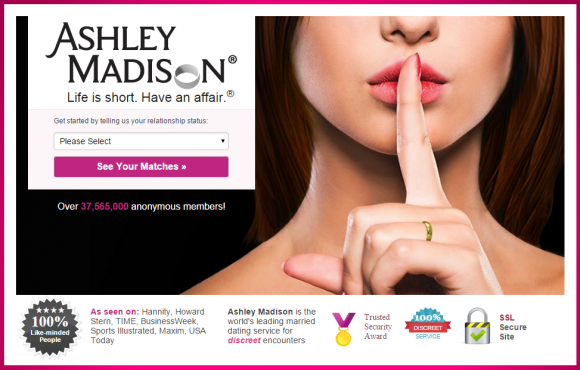

Ashley Madison Says It’s Secured All Customer Data After Hack Attack

After a group of hackers posted a sampling of user data stolen from AshleyMadison.com, the parent company of the dating site for cheaters says it’s secured all customer information that was allegedly leaked. [More]

Senator Pushes For System To Notify Consumers ‘The Moment Access To Their Credit Is Requested’

It seems like every day, another retailer, service provider, or government agency falls victim to a data breach, and if a hacker uses that stolen info to open up a new line of credit in your name, you may not know until long after the fact. One lawmaker is hoping to curb identity theft by giving consumers a heads-up whenever their credit reports are accessed. [More]

Man Arrested For Allegedly “Corrupting” Wells Fargo Employees In Scheme To Access Customer Accounts

As a bank customer, you generally have an expectation that employees of said bank won’t share your personal or account information with someone that isn’t, in fact, you. But what happens when a person calls the bank claiming to be an account holder in the midst of an emergency and in need of quick cash? Federal prosecutors say that was the basis for a recent bank fraud scheme targeting Wells Fargo customers and employees. [More]

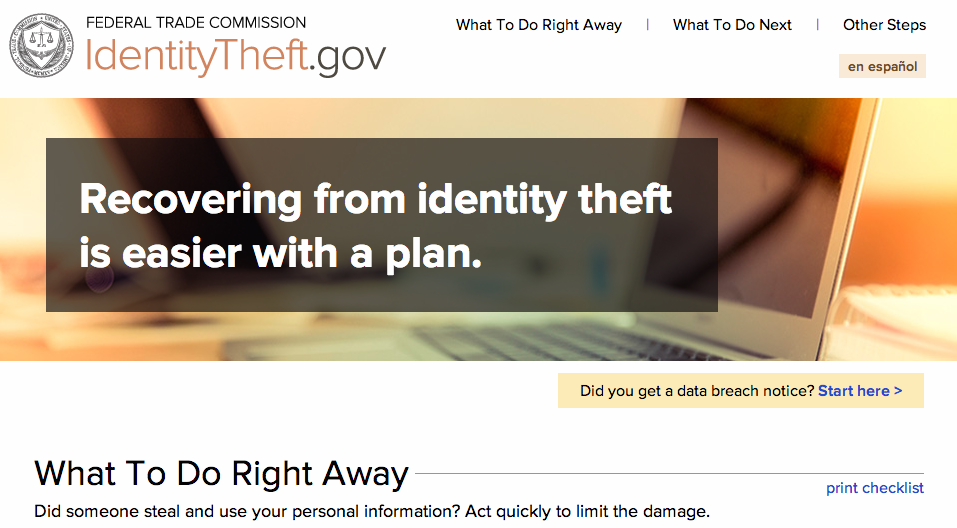

FTC Rolls Out Interactive Resource For Victims Of Identity Theft

With seemingly daily reports of new data breaches and related scams, it’s no secret that identity theft is now more of a concern than ever. In an effort to help victims work their way through the process of restoring and protecting their identities, the Federal Trade Commission has launched a new online interactive tool. [More]

Nearly 70 Million Americans Had Their Personal Information Compromised In 2014

Given the sheer number of high-profile data breaches in recent years, and the varying levels of personal information stolen, it can be difficult to quantify how many American consumers were affected. A new survey tries to answer the questions of how many people have had their info stolen (a lot) and what consumers are doing to protect themselves (not much). [More]

Digital Privacy And Parental Rights Act Would Put Restrictions On The Use Of Student Data Online

Students are more dependent than ever on technology and the Internet for their education, but those same apps and online learning tools that help educate them could be putting their personal information at risk if shared improperly. Nearly a month after it was first expected, a pair of U.S. representatives have introduced a bill aiming to restrict third-party use of students’ sensitive personal data. [More]

The Other Danger Of Online Payday Loans: Identity Theft

Many people who seek online payday loans are already in a very vulnerable position when they take on the added risk of the excessive interest rates and often exorbitant fees associated with these short-term loans. But there’s another danger possibly lurking in the payday shadows: Having all their personal and financial data end up in the hands of cyber criminals. [More]

HSBC Finance Says Some Mortgage Customers’ Information May Have Been Compromised

Customers of HSBC’s U.S.-based finance division are the latest victims of a data breach, the bank confirmed this week in a letter to the New Hampshire Attorney General. [More]

Your Personal Data Could Be For Sale In RadioShack Bankruptcy Auction

Have you handed your name, address, e-mail address, or phone number over to RadioShack as part of a purchase or, inexplicably, when you returned an item that you bought with cash? As the bankruptcy auction of the smoldering remains of The Shack continues into its second day, we’ve learned that one of the assets for sale is RadioShack’s customer list, which includes more than 65 million mailing addresses and more than 13 million e-mail addresses. Update: The bankruptcy auction’s privacy ombudsman says that customer information isn’t for sale. Yet. [More]

Health Insurer Premera Blue Cross Latest Hack Victim, 11M Consumers Affected

Just a month after tens of millions of consumers’ personal information was breached in the hack of health insurance firm Anthem, another U.S.-based insurance provider says it was the victim of a cyber attack affecting as many as 11 million customers. [More]

IRS Impersonation Scam Is Largest In History, Cost Consumers $15.5M

The 2015 tax season has been fraught with complications, from the fraudulent use of tax returns to the “dirty dozen” scams meant to tear consumers away from their money. During a Senate Finance Committee hearing exploring ways in which consumers could better be protected from such hustles, federal investigators divulged more information about one of the most prevalent tax-time scams in recent years, saying it has now targeted 366,000 taxpayers to the tune of $15.5 million. [More]

Anthem Hack Included Personal Information For 78.8 Million Customers & Employees

Nearly three weeks removed from the detection of a massive data breach, health insurer Anthem Inc. is releasing more details about the scope of the hack, including the fact that personal information for about 78.8 million was compromised. [More]

IRS Issues List Of “Dirty Dozen” Scams Taxpayers Should Be On The Lookout For This Year

Each tax season fraudsters manage to separate taxpayers from billions of dollars by using aggressive schemes such as impersonating Internal Revenue Service agents or employing emails and websites designed to gather consumers’ personal information for fraudulent use. This year, the IRS has issued a list of the “Dirty Dozen” scams consumers should guard against. [More]

IBM Report: Workers Using Dating Apps On Company Phones May Pose Security Risks

Whether you have a company-issued phone or you use your won for both work and play, finding love through dating apps on your device may increase the risk of a security breach for your employer, a new report from IBM says. [More]

Morgan Stanley Fires Employee Accused Of Stealing Data From Up To 350K Clients, Posting Some Info Online

Another day, another bank reveals that client information was leaked where it shouldn’t have gone leaking: Morgan Stanley notified authorities and fired an employee accused of stealing data from up to 350,000 wealth-management clients and allegedly posting some of that information online. [More]

Woman Receives Home Depot Package With Fire Starter, Tons Of Shredded Checks, Bank Statements

A Colorado woman got more than she bargained for when ordering a fire starter for Home Depot: A box full of other people’s shredded checks and bank statements. [More]