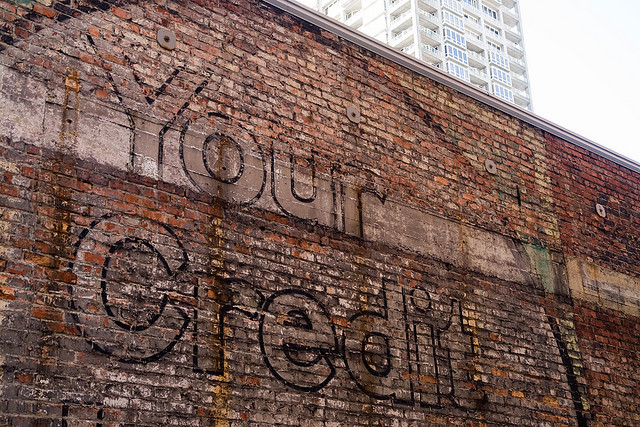

Senator Pushes For System To Notify Consumers ‘The Moment Access To Their Credit Is Requested’

It seems like every day, another retailer, service provider, or government agency falls victim to a data breach, and if a hacker uses that stolen info to open up a new line of credit in your name, you may not know until long after the fact. One lawmaker is hoping to curb identity theft by giving consumers a heads-up whenever their credit reports are accessed.

Today, New York Senator Chuck Schumer announced a proposed plan that aims to better protect consumers from falling victim to identity thieves by directing the three national credit reporting agencies (CRAs) – Experian, Equifax and Transunion – to create a notification system to alert consumers whenever access to their credit is requested.

Currently, credit bureaus are not required to provide consumers with notification when a third-party asks if their credit is in good standing.

“The most frightening thing to many people is that they have no idea whether they have been the victim of an attack until it’s too late,” Schumer said in a letter to the CRAs. “Too many people have faced the reality of learning that someone else has opened new lines of credit in their names only once their score has already been run into the ground.”

Under the plan, the CRAs would be required to notify individuals by phone or email anytime there is an inquiry rewarding their credit. The alerts would be made even if the inquiry were authorized, such as those made when an individual applies for a loan, credit card or mortgage .

The voluntary system would be similar to notifications that consumers receive from credit card companies when there is an instance of suspicious activity.

If someone receives the notification they would then have the ability to freeze their credit before new purchases are made or before access to credit turns into costly fraud.

“Despite widespread hacking and identity theft across the country, consumers are not notified when access to their credit is requested to create a new account,” Schumer said in a statement. “Instead, consumers are often in the dark until their credit is drained or their credit score has tanked.”

Schumer says that if the CRAs are unwilling to take the lead on such a system, she would work with relevant federal regulators or pursue legislation to ensure mandate the adoption of a notification system.

Schumer announces plan that would require consumers be notified the minute access to their credit is requested [Sen. Charles Schumer]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.