If you’re married and the two of you own your house, is your legal title recorded as “joint tenants” or “community property”? If you bought it recently, odds are good it’s “community property” (and it should also include “with right of survivorship”).

personal finance

Help for the Retirement-Challenged

There’s a huge gap between many Americans’ perceptions of what life in retirement will be and the practicalities of what their finances will allow. The former is often a time of limited work, relaxation, and enjoying the twilight years of life while the latter forces decisions about working longer, relying more on relatives, and doing without past pleasures and purchases. This gap exists for good reason — it’s expensive to retire in the United States. The amount of savings needed to support today’s retiree, who can be expected to live a couple decades or so longer, is mind-blowing and, for many, unattainable.

Couple Shreds Credit Cards, Spells "No New Debt"

Robert and Helena shredded all their credit cards and arranged them to spell out “NO NEW DEBT” to cement their commitment to getting out of credit and living a debt-free life. According to the blog post over at JosephSangll where this picture appeared, the couple haven’t incurred any new debt in the two months since taking the picture. For some people it just takes a little ritualistic madness to break the cycle of debt dependency.

Find Out What Your IRS Refund Will Be

What’s your tax refund for 2007 going to look like? Go to this withholding calculator at the IRS website with your paycheck at your side, answer the questions, and they’ll give you a good estimate of what your refund will be. They will also give you suggestions for changing your withholdings.

Preface From Financial "Life Planning" Book

The basic principle of “life planning”—that to succeed at managing your personal finances, you have to incorporate personal elements like your values and beliefs—seems reasonable enough, but rushing to B&N or Amazon to buy yet another financial advice book sure feels an awful lot like more of the same. However, since this excerpt is basically the preface to the book, we thought it was worth sharing. It’s like browsing in a bookstore without having to leave your desk! $avings!

10 Tips For Lowering Your Taxes

This list of ten tips to reduce taxes was published nearly a year ago, but they’re still relevant, and we thought now would be a good time to share them before Kiplinger releases its new “10 Ways” list later this month. Among the tips: make sure you load up your retirement accounts and flexible spending accounts, and remember that the government gives you a 2 ½ month grace period on reimbursing yourself from an over-funded flex account.

E*Trade Raises Rates On Online Savings Accounts, CDs

E*Trade increased the rates on a variety of banking products this week in an effort to woo back depositors spooked by their recent troubles. Here’s how they’re looking:

Get Those Credit Card Rate increases Canceled

A Kiplinger reader shares his strategy for getting ridiculous rate increases on his three credit cards rolled back to their original rates. It’s a technique that’s probably familiar to a lot of Consumerist readers when negotiating for lower rates in general: be polite but unyielding, know where you stand as far as leverage (it helps to have a perfect history with the company), start with basic customer service, and then escalate as needed.

Shop Online Safely With Temporary Credit Cards

Almost every time we write about fraud or identity theft, savvy readers will point out in the comments that many card companies offer temporary credit cards—virtual accounts tied to your real one that expire after one use, or a few days, or after a certain spending limit is reached. We thought it might be a good time to remind readers about these services, as well as password-protected and so-called “anonymous” credit cards.

E*Trade Is Bailed Out, But At A High Price

Citadel Investment Group has agreed to provide E*Trade with $2.5 billion in cash to bail it out of trouble, reports BusinessWeek. The cash includes a purchase of $3 billion worth of E*Trade’s “toxic, asset backed securities” at 29 cents on the dollar, for a total cost of about $800 million. In exchange, E*Trade’s CEO Mitch Caplan must resign.

National Average Interest Rates

Here’s a slice of national average interest rates for credit cards, CD’s, auto loans, mortgages, and home equity, via Bankrate.

The Long Johns Explain The Subprime Meltdown

John Bird and John Fortune are British satirists who, as The Long Johns, explain in eminently practical terms exactly how the subprime meltdown came to be.

Capital One Introduces DIY Credit Card Offer

If one of the goals of credit card marketing is to give customers the illusion of choice and control, then Capital One has just outdone itself with its new Card Lab, where you can construct the card offer you desire from a menu of options. Your available options are determined by which general credit score category you pick: Excellent, Above Average, Needs Improvement, or Limited History. When you select certain options, others go away. At the end, you’ve self-selected the “perfect” offer, and possibly saved yourself from the hundreds of thousands of junk mailings* Capital One would otherwise send to you on a daily basis.

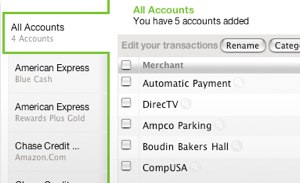

A Casual Review Of Mint.com

Michelle Slatalla, the Erma Bombeck-David Pogue hybrid who writes casual articles about the Internet for the average person (she’s the mom who pestered her daughter on Facebook this past summer), has published a Chatty Cathy review of personal finance site Mint.com. Her verdict: it’s nice to not have to go to multiple sites; the aggregated information is a good feature; security worried her at first, but she’s okay now that she knows Mint is a read-only site and they don’t have her account numbers, just user names and passwords; and she has actually used the ads that Mint displays—not to open new lines of credit, but to negotiate lower interest rates for existing accounts.

Thinking About Financial Portfolios Makes Shoppers Spend More

Consumers can be cued to spend more through a series of simple “priming” questions. A study in the Journal of Consumer Research split subjects into two groups. One was asked a series of questions about the contents of their wallets: Did they have any library cards? Did they carry pictures or cash? How many other wallets did they own? The other was asked about their financial portfolio.

../../../..//2007/11/26/4-ways-for-small-business-owners/

4 ways for small-business owners to save on next year’s taxes. [WSJ]