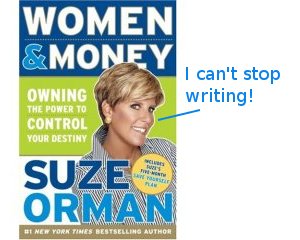

Now you don’t have to dress up in corporate casual-wear and spend half the day screaming in a studio audience to get something free from Oprah, because for the next day she’s giving away digital versions of Suze Orman’s new book “Women & Money” on her website, from now until 8/7c February 14th. Downloads are available in English and Spanish versions, PDF only.

personal finance

../../../..//2008/02/13/heres-20-plus-ways-to/

Here’s 20 plus ways to get of your debt forever. Probably the most important one is changing your attitude and making debt something that you’ve decided to rip into with ferocity and persistence. [Dumb Little Man]

Bank of America Angers More Customers With Unjustified Rate Hikes

More about Bank of America’s inexplicable rate hikes against good customers who never pay late: the Charlotte Observer talks to some recent recipients of BoA’s infamous rate-increase letters from the past few weeks. The first person they talk to is a 60-year-old woman who “had never been late on a credit card payment, just refinanced her home at a lower interest rate, and just been rewarded by her credit union with a lower rate on her credit card there.” Bank of America just raised her card from 13% to 24.99%.

What You Can Learn About Personal Finance From The Life Board Game

Want to teach your kids about personal finance? Then pull out the classic board game “Life.” Personal finance blogger Life teaches several practical money lessons including:

What Do I Have To Do To Get My $600 Tax Credit?

Eric writes:

You’ve had a lot of press about the stimulus plan that’s about to send some cash my way. There’s been coverage all over the place, and everyone misses the most important part. What, EXACTLY, do I have to do to get this credit? I know I qualify. Do I have to send in an extra form? Is there a box I check? Am I supposed to expect the gov’t to actually do something right and take care of it themselves?

Yes. This is (probably) the easiest $600 you will ever made. Just file your taxes, sit back, and wait for the hot government scrizzle to come pouring into your mailbox.

Study Links Speeding Tickets And Risky Trading

People who get a lot of speeding tickets also engage in risky investing behavior, according to a new study. Finnish researchers compared a speeding ticket database and a database of all the trading portfolios of Finnish households. Their findings suggest that for these speeders, a sensible long-term investment strategy simply isn’t interesting enough for them. They crave the thrill and excitement of churning over their investments more frequently. Each successive speeding ticket and investor received correlated to an 11 percent increase in their portfolio turnover. On average, the stocks they bought didn’t do any better than the ones they had just sold.

Don't Be Ashamed To Ask Friends Or Family For A Loan

Taking a private loan from friends or family can be a win-win proposition, not necessarily a shame-filled dish with a side order of failure. Private loans are an ideal way to reduce the amount you need to borrow from a bank—instead of paying loan application fees, processing fees and higher rates, you can save money while offering attractive yields to your friends and family.

Maloney Introduces Credit Card Bill Of Rights; Lending Institutions Smirk

The Credit Card Bill Of Rights Act, which was introduced on Thursday in the U.S. House of Representatives, would limit interest rate hikes and late fee penalties that credit card companies use to unfairly squeeze profits from customers.

../../../..//2008/02/08/consumers-are-not-being-as/

Consumers are not being as big sluts with their credit cards as they slowly discover that they have no money. [WSJ]

Collection Agencies Sending Out 1099-C Forms For Zombie Debts?

It seems that some bottom-feeding debt collection companies—the ones who buy old debts that are frequently beyond the point where you can be sued for collection (what the FTC calls “time-barred debts”)—purchase old debts, mark them up with incredibly high penalties and fees, then “forgive” them and write them off as tax losses and send the debtors 1099-C forms—which means you have to pay taxes on the forgiven amount. If this happens to you, here are a few things you should consider first.

Who's Afraid of Taxes? Not You!

All across America people are collecting forms, sorting receipts, and assembling documents — all in an effort to deal with the dreaded tax man. For many, the whole prospect of filing taxes is a frightening experience, but it doesn’t have to be that way. Yahoo Finance lists seven common tax terrors and how you can deal with each of them. Their list includes:

Why Is Bank Of America Raising Interest Rates On Its Good Customers?

BusinessWeek has just published an article about Bank of America’s recent surprise mailings in January to some of its customers, announcing “that it would more than double their rates to as high as 28%, without giving an explanation for the increase.” These customers have good credit scores and hadn’t made any late payments, and those who called Bank of America to ask why this was happening weren’t given clear reasons. Industry experts say Bank of America has reached a “new level” of “lack of transparency in raising rates,” beyond anything Citigroup and JP Morgan Chase currently practice, because BoA is apparently using some undisclosed internal metric to determine who gets the rate hike.

USAA Customer? Make Sure Your Checks Haven't Been Cashed Twice

This morning, Mary logged onto her USAA bank account to check her balance and was surprised to find that her rent check had been cashed twice while she was asleep. She was eventually able to get through to a human and get the problem addressed, but it wasn’t easy. And she may not have been the only one affected.

Easily Compare Wholesale Mortgage Rates Online

Mortgage Professor has a great no-frills online tool for tracking the wholesale mortgage rates. Just go here, Select your geographic area, and time period to look at. Choose whether you want your data in chart or table format (I suggest table, as the chart data isn’t as up to date), and what kind of mortgage you want to look at. You can further sort the results by FICO, loan purpose, loan size, type of documentation, or size of down payment. The data comes from Amerisave. A great way to check out mortgage rates, and how strong you have to be to get them. Plus, you can use it to compare how much of a markup your broker is charging.

../../../..//2008/02/07/9-things-star-wars-can/

9 Things Star Wars can teach us about frugality. Number one: “1) They do their own maintenance and repairs. Rebels don’t take the x-wing into the local Space Lube Garage.” [Wise Bread]

Mortgage Broker Confessions

“When I have a client I really don’t like — he’s a pain in the ass — that’s when I charge as much as I can get out of them,” one mortgage broker told the Joe Consumer blog. That’s right, a lot of mortgage broker fees are bullshit. It’s important to get a good faith estimate and shop around for things like your title and escrow.