Reader Ben awoke to a rude discovery. Somehow another account had been linked to his Paypal account, and the new account was $2,000 in the red. Paypal was knocking on Ben’s door, telling him to pay up, or else. They locked up his account and froze his cash. When he protested, they treated him like a criminal. [More]

personal finance

How Lower Credit Scores Cost You More Money

People talk a lot about credit scores. Bands play songs about them in TV ads that try to sell you credit reports. It’s generally known that a higher score is better than a lower score. But what really is the difference between a person with a 820 and one with a 620? Is one a better person than the other? Not necessarily, but the person with the 620 score can expect to pay $227 more a month on a $216,000 30-year fixed rate mortgage. Here’s the breakdown. [More]

Private Equity Bets Big Bucks On "Buy Here Pay Here" Dealerships

In the second of a three-part series on “Buy Here Pay Here” dealerships, used car lots that target subprime borrowers with easy credit and triple the national average interest rates, the Los Angeles Times looks at how private equity firms have flocked towards the growing industry, lured by 38% margins. [More]

Personal Finance Roundup

The Case for the Mileage Based Credit Card [Free Money Finance] “There is a case to be made that, for some people, mileage based credit cards may actually be more valuable.”

5 ways to sabotage your retirement [MSN Money] “You may not necessarily be thinking of retirement when you celebrate a promotion, but maybe you should be.”

The Art of Online Portraiture [Wall Street Journal] “LinkedIn research shows that a page with a profile picture is seven times as likely to be viewed as a page without one.”

Bad Manners Can Cost You A Fortune [Smart Money] “The nicer you are the more likely you are to make money and snag bargains.”

9 Steps To Switch Your Bank Account [One Cent at a Time] “If you are dissatisfied with your bank and want to switch, you might want to follow the steps below.”

"Buy Here Pay Here" Dealerships Investigated

The Los Angeles Times has an excellent investigation into the national “Buy Here Pay Here” auto dealership phenomenon. These used car sellers purposefully target bad credit borrowers and offer them what no one else will: the chance to buy a car on credit. All they have to do is agree to 20-30% interest rates, a price well above the car’s Blue Book Value, and aggressive repo practices if they fail to pay up. But it’s not a big deal if they don’t. Borrower failure is baked into the business plan. [More]

What You Need To Know When Transferring Credit Card Balances

Credit card companies like to lure in new customers with impressive-sounding balance transfer officers, but they don’t just do that to be nice. There are usually fine-print catches associated with the deals, and they’ll bite you if you overlook them. [More]

Senator Is Victim Of Credit Card Fraud, Thieves Rack Up $12,000 At Walmart

It’s a measure of the brazenness and ubiquity of identity theft that a U.S. Senator has become the latest victim of credit card fraud. Thieves stole the credit card numbers belonging to Senator Daniel Inouye (D) of Hawaii, embedded them on the magnetic strip of a fake credit card, and went on a $12,000 Walmart shopping spree. [More]

Top 10 States With Highest Debt Per Capita

Are you in a state that has saddled its citizens with a big debt load per person? This list tells you. It may surprise you that the state with the highest debt per capita is also the one with the most penny loafers per capita. [More]

Personal Finance Roundup

25 Ways to Make Money Today [Wise Bread] “Some are obviously a little easier than others, some require skill, some are a bit silly, but all of them are within reach for most of us.”

How to Be a Better Investor [Kiplinger] “Step one: Recognize — and overcome — the psychological hurdles that influence our behavior.”

How to Work at Home: 4 Ways to Convince Your Boss [Moneyland] “If you’d like to give [working from home] a try, but your employer has reservations, here are four ways to win over the boss.”

6 tips to make your nest egg last. [MSN Money] “Certain steps can help maximize the amount of money you’ll have when the paychecks stop.”

The 10 Best Places to Retire in 2012 [US News] “These cities will meet your retirement lifestyle needs and suit your budget.”

Bill Introduced To Let You Keep Your Account Number When You Switch Banks

When you switch phone companies, you’re allowed to keep your phone number. So why isn’t there this “number portability” for bank accounts? Well, a bill has been introduced in Washington to let you do exactly that. [More]

Personal Finance Roundup

How to Know When to Quit [Get Rich Slowly] “Winners quit all the time. They just quit the right stuff at the right time.”

Weird stuff that hurts home values [MSN Money] “All sorts of factors can diminish what your home is worth, such as the way your house compares with others in the area, your neighbors or a faulty appraisal.”

10 Concrete Tips To Dine Out For Less: Save Money When Eating Out [The Digerati Life] “Here are 10 glorious tips to help you make the most out of dining out.”

Where to Find 7% Yields [Smart Money] “Preferred shares issued by real estate trusts are one of today’s few sources of healthy investment income.”

Best jobs for fast growth [CNN Money] “If you’re stalled or burned out, these fast-growing fields (with relatively low barriers to entry) can help you earn more, get ahead and put life back into your career.”

Get $12 In Chase Credit Card Balance Transfer Class Action

You can file to get $12 because of a settlement in a class action lawsuit against Chase which alleged the bank enticed customers with promo interest rates on balance transfers, but then didn’t do a good enough job of telling them when the rates would expire. [More]

Credit Card Companies Begin Flirting With Subprime Borrowers Again

After getting all hot and heavy leading up to the recession, then turning completely cold shoulder, credit card companies are once again starting to selectively flirt with subprime borrowers. [More]

Why You Should Thank BofA For The $5 Debit Card Fee

Bank of America’s new $5 monthly fee for having a debit card is getting painted as a public enemy, but columnist Michael Hiltzik for the Los Angeles Times says we should be giving it a great big hug. [More]

Stuff You Can Do To Save Money Today

If you find yourself in tight financial times, your instinct will probably be to hunt around for ways to cut spending. While it’s tough to make sweeping changes that will result in major savings, you can feel better about yourself by culling together little ways to save here and there. [More]

Large-Scale Expenditures That People Use To Judge You

You tell people a lot about yourself by the way you spend your money. And the larger the expenditure, the more analysis from others the purchase tends to draw. [More]

ATM Council Sues Visa And Mastercard For Forcing Them To Charge Consumers Set Fees

Visa and Mastercard have been accused of price fixing in a lawsuit filed Wednesday by the the National ATM Council. The suit alleges that nonbank ATM operators could charge customers lower ATM fees when they use other, cheaper payment networks, but are prevented from this by the set access fees Visa and MasterCard charge. [More]

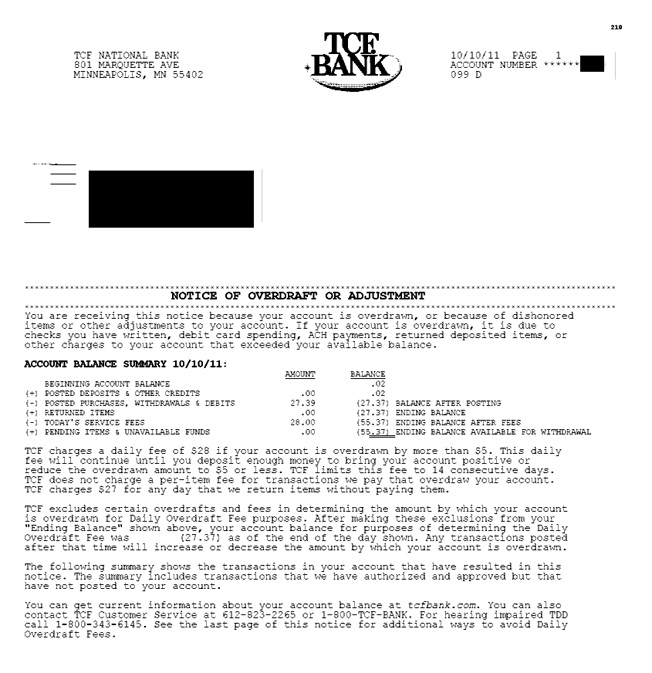

TCF Bank Adds New $28 Daily Overdrawn Balance Fee

Reader Jeff used to intentionally overdraw his bank account in order to have enough money to feed his family and gas the car. At $35 a pop, that’s a pretty cheap loan. But now that’s not going to be a viable option because TCF Bank has started to assess him a daily fee of $28 if his account is overdrawn by $5 or more. [More]