Seven Websites That Saved Me Money in the Last Week [The Simple Dollar] “Here are seven websites I used to directly save money over the last week, my exact purchases and savings, and how much cash they saved me.”

personal finance

S&P 500 Enters Bear Market

Since the Dow made it look so fun, the S&P today dipped into its first official bear market since 2002. A bear market is usually defined as a 20% drop in securities prices from their high (Not a hard feat when the financials were hyped up on imaginary money from worthless mortgages). Is it time to sell, sell, sell? Not unless you’re retiring tomorrow, tomorrow, tomorrow. Investopedia says the best thing to do when you see a bear in the market is the same as when you see one in the woods: “Tuck in your arms and play dead!” In other words, don’t go crazy selling stocks at a loss. In both cases, fighting back can leave you bleeding, although toughing it out won’t be a pleasant experience either. And if you have money leftover after filling up your car, it’s actually a buying opportunity. Which I guess is like playing dead in front of the momma bear while your buddy gathers up all the cubs while mamma is occupied and then later you and your buddy train them to harvest honeycombs for you.

Save Money by Taking a State Tax Holiday

In an effort to spur retail sales, many states offer sales-tax holidays each summer — periods of time where sales tax is temporarily suspended on certain products. This year the slumping economy has some states enhancing their efforts by extending the holiday dates and broadening the list of eligible products. Smart Money lists each state sponsoring a sales-tax holiday as well as the applicable dates and details of each offer. It also suggests a few helpful hints for making the most of a sales-tax holiday as follows:

Shame Yourself Into Spending Less With A Hello Kitty Debit Card

Reader MervinGleasner has Hello Kitty to thank for his unique method of curbing personal spending. In a comment on our “Succeed Through Self-Undermining!” post, he writes:

Personal Finance Roundup

8 ways to ruin your chances to retire [Bankrate] “You can stay shackled to a job until your last gasp if you follow these steps.”

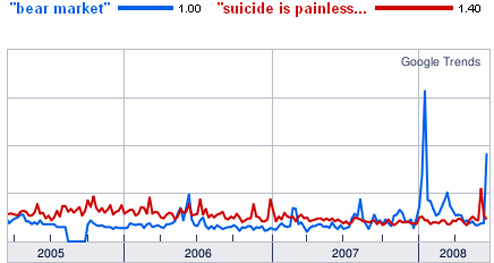

Dow Enters Bear Market

Finally having lost over 20% from its October high, the Dow has entered into a bear market. An unrelated story about an investor-fleecing hedge fund manager who tried to make his disappearance prior to his incarceration look like he took his own life provides context in a Google Trends graph.

Succeed Through Self-Undermining!

Our post on freezing your credit cards in a block of ice got me thinking. Anything that slows, stops, or impedes making transactions can be used as a technique for limiting your spending. Whatever it may be, cutting up your credit cards, locking up most of your money in an account it takes 3 days to transfer from, giving yourself an allowance, it will be a variation on a single principle: It’s easier to put a hard limit on the future then to make the right decision in the impulsive moment. Installing some kind of an automatic hiccup can help break you out of your desire-driven action and give you the breathing room to step back and make the right choice. So if you have trouble with overspending (or overeating or any kind of bad habit) and your sheer willpower is sometimes lacking, aka, you’re human, try brainstorming ways you can trip yourself up. The world is full of obstacles, it shouldn’t be too hard to find one.

IRS Increases Business Mileage Deductible From 50.5 To 58.5 Cents

To help ease the pain of higher gas costs, starting July 1st the IRS will increase the allowable business deductible for business vehicles from 50.5 to 58.5 cents per mile. The IRS is also going to raise the rate for calculating computing deductible medical or moving expenses from 19 cents to 27 cents a mile, also starting July 1st. The rate for charity services, requiring an act of law to change it, remains at 14 cents per mile. If you’ve been meaning to claim business mileage deductions, July 1st will be a great time to begin. Here’s info on how to get started.

Chase Shrinks Credit Due Dates Without Warning, Profiting Off Fees

Got a Chase credit card? Check your bill to see if the due date shrunk. For the past ten months, the due date on reader NDphoxylady’s four Chase credit card due date was the fifteenth. Then, without warning or notice, it became the tenth. NDphoxylady only noticed when she was charged a $39 late fee and a $20 finance charge. When she complained to Chase, they told her that simply changing the due date on the bill was adequate notice. Nu-uh

Use Your Credit Card At A Marriage Counselor, See Your Limit Get Reduced

The FTC claims that CompuCredit didn’t properly disclose that it monitored spending and cut credit lines if consumers used their cards at certain places. Among them: tire and retreading shops, massage parlors, bars, billiard halls, and marriage counseling offices. “What they didn’t say was that you could be punished for specific kinds of purchases.”

Personal Finance Roundup

9 big credit card myths [MSN Money] “What you don’t know could hurt you.”

Sneak Peek Of BillShrink.com's New Credit Card Comparison Tool

Billshrink.com is going to bring a never-before-seen level of transparency to consumers looking for the best credit card offer. Think of it as a turbocharged dashboard for navigating the credit card market. The site launched earlier this year as wireless plan comparison service, but with personal debt at record highs and personal savings rates at record lows, the credit card vector is potentially even more important and useful tool. I sat down with CEO Peter Pham yesterday as he showed me the actual website in action.

Five Sites That Will Help You Recession-Proof Your Life

Although we are not technically in a recession, it’s starting to feel like one. As gas prices and unemployment continue to rise, we’ve rounded up a collection of useful advice for the current period of economic austerity.

The Basics Of Insurance, Taxes, And 401(k)s For First-Time Employees

If you’re entering the work force for the first time (although this probably pertains to lots of older employees too), all the details of insurance, taxes, and 401(k)s can be daunting/boring/confusing. Ron Lieber at the New York Times has pared away the extraneous bits and created a “primer for young people starting their first job,” including helpful advice like why it’s important to get health insurance, how to fill out your W-4, and why it’s good to take advantage of the built-in “raise” that comes from a company-matching 401(k). Sure, this is all basic stuff, but that’s the point. Ya gotta start somewhere.

Stop Spending By Freezing Your Credit Card In Ice

If you have trouble controlling the amount and frequency of your credit card purchases, try putting your credit card in a glass of water and putting it in the freezer. This makes it so every time you want to use your credit card, you’ll have to wait for the credit card to melt. By the time the ice has thawed, your desire to impulsively purchase may have evaporated as well. I read about this in Predictably Irrational; Dan Ariely called it, “The Ice Glass Method.” Apparently, it doesn’t ruin the credit card, although it will if you try to microwave-defrost it. This method is probably only good for people who do their shopping sprees in-person. Online shopaholics would just look through the ice.