Regulators are trotting around Washington Mutual trying to get banks interested in buying it. It’s sort of like in the old days when the local beauty queen, last scion of the largest landowner in the county, would get maimed in a horrible combine accident and the town elders would trot her catatonic body around to arrange a marriage so all her fields wouldn’t turn fallow and destroy the local economy for years to come. Wasn’t that given treatment in Faulkner? As I Lay Hemmoraghing Equity?

personal finance

How Hard Is It To Get A Car Loan These Days?

Having trouble getting a car loan? You’re not alone. “Gas at $4 a gallon changed the type of vehicles people buy. The credit crunch, however, has changed their ability to buy,” says a car dealer. Higher interest rates, higher down payments, fewer loans, and high aversion to dings on your credit report, this Kicking Tires post has more from the front lines about banks’ new level of pickiness when it comes to putting you in your next jalopy.

WaMu's Stock Bumps Upwards

WaMu’s stock is up this morning after the new CEO said the S&P rating downgrade to junk was based on “market conditions” and not their financial condition, and an unsourced Daily Mail article said Chase was going to bid for the beleaguered thrift.

Chase to WaMu Customer: "God Bless Your Soul"

I went into a Brooklyn Chase today to see if, in the wake of the concerns about them going bust, Washington Mutual customers were switching over. I went up to the manager and said, “I’m a WaMu customer —” “—God bless your soul,” he interjected.

What Merrill, Lehman, And AIG Customers Need To Know

NYT’s Ron Leiber breaks down what you need to know and do if you are or were a customer of Merrill Lynch, Lehman, or AIG…

Don't Start Yanking Your WaMu Accounts

The scary headlines about WaMu’s stock slide have a few readers worrying if now is the time to pull their deposits. I’m a WaMu customer myself and I say no. For now, though I could be wrong, this just looks like more hot panic sweeping the market. First off, you’re FDIC-insured up to the first $100,000. You will get your money. Secondly…

Live Underground For Cheap

Forget the sub-prime meltdown and get with the subterranean housing craze. This book – linked in one of Chris’s posts but I just had to bring it to the front page – has everything you need to know about building a house underground. The most amazing thing is that there’s ways to do it to get light from all four sides. The penultimate amazing thing is not being buried alive while you sleep.

FTC: Protect Gift Card Holders When Companies Go Bankrupt

Consumers Union (CU) filed a petition with the FTC Thursday to protect consumer gift card holders more when retailers go bankrupt. For as long as the stores remain open, CU wants companies to have to hold gift card funds in a secure trust, unless bankruptcy courts say otherwise. Currently…

Ex-Countrywide Employee Sells Your Data, They Offer Credit Monitoring Service, Hang Up When You Ask For It

Re: Countrywide Sends Fraud Alert Letters: ‘Your Info May Have Been Sold,” Reader Esqdork writes, “Yesterday, I phoned Countrywide to get them to extend the credit monitoring service [that they offered in their apology letter] to my co-borrower and was promptly hung up on.” The only surprise here is that they even picked up in the first place.

Personal Finance Roundup

6 Ways to Save on Beer, Wine and Liquor [Smart Money] “Here are six ways to save on your favorite vintage, malt or brew.”

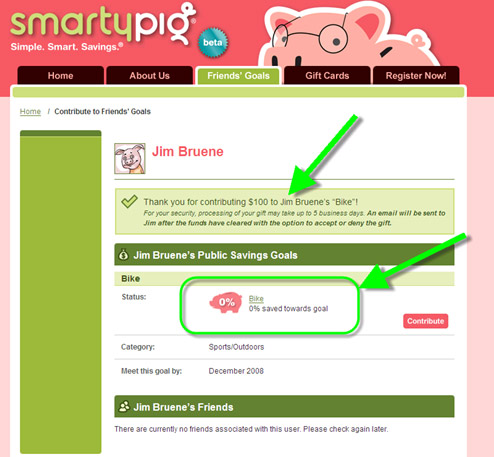

Save For Specific Goals With SmartyPig.com

“Saving up.” It’s nearly an alien concept in this “buy with debt” world, but into that breach steps SmartyPig. The site lets you set and save for specific goals in their online savings accounts at a competitive 3.9% APY savings rate. There’s all sorts of built-in graphs and widgets to track your progress, but then you can make it social, if you like, by making a page where your goals public and having friends and family or other random people on the net (export to Facebook, etc) track and root for your progress, or even contribute to your goal.

What Can You Do With $1,000?

It used to be that $1,000 was a good amount of money. Then again, it used to be 1980 once too.

Zombie Debt Collectors Find You At Grandma's

Palisades Collection is offering Jeremy a great deal: he can pay half off his debt of $237.64 and get the account settled! Small snag, though, Jeremy never ordered the Verizon service they’re trying to collect on, the debt has passed the statute of limitations, and he got it expunged from his credit report years ago. Still, Palisades persists in sending collection notices for him to his grandma’s house. What’s a boy to do? Read on and find out.

6 Horrible Investing Mistakes

It’s scary times for investors, so Bankrate has “6 Deadly Investing Mistakes” to avoid, most of which involve you not freaking out.

BoA's "Keep The Change" Program: Worth It?

What do you think of Bank of America’s “Keep The Change” program? How it works is every purchase you make with your BoA debit card you make gets rounded up to the next dollar. The difference between that and the actual price gets moved from your checking to your savings account. The idea is to help people save. Good idea, but there’s some potential downsides I can see:

Countrywide Sends Fraud Alert Letters: 'Your Info May Have Been Sold'

I received a letter from Countrywide today that says: