July 30, 1931. Magazines and newspapers are full of articles telling people to buy stocks, real estate etc. at present bargain prices. They say that times are sure to get better and that many big fortunes have been built this way. The trouble is that nobody has any money.

personal finance

The Great Depression Diaries

Personal Finance Roundup

5 Memberships Worth Signing Up For [Yahoo Finance] “There are some paid memberships that do pay for themselves — and quickly.”

How To Get A Raise When Times Are Tough

We’ve offered our suggestions for what to do in these uncertain financial times, but many of those ideas focused on hunkering down and riding out the storm. But what if you want to do more than that? How can you thrive in spite of the economy?

Consumerist Attends Robert Allen's Get Rich Quick In Real Estate Seminar

I wanted to find out what Robert Allen’s “get-rich-quick in real estate with no money down” promise was all about, so when I saw a full page ad in the Daily Post advertising one of his free seminars recently, I went and checked it out. I’ll give you a full run-down later, but here’s the quick and dirty, and what I can tell about how the darn thing seems to function.

Walmart: 6 "Disturbing Behaviors" Exhibited By Consumers

9 of 10 American families shop at Walmart at least once a year, says USAToday, which puts the retailer in an excellent position to tell us something about consumer behavior. So, what has Walmart been observing? “Disturbing behavior.”

Credit Cards Scammers Pretend To Be From BBB

Robo-scammers are ringing up consumers and pretending to the Better Business Bureau, saying, “We’re from BBB – Because of bailout, we can offer you a low-rate credit card.” In this iteration, we see several three common scam characteristics combined: *Unexpected communication * Automated communication * Mention of topical event * Use of recognizable institution’s name * Money-saving opportunity. Investigators were unable to tell the exact nature of the scam. It could be been to steal your account numbers, or it might have just been a marketing affiliate’s sleazy way of generating leads for a credit card company trying to get people to transfer their balances. Complaints have been received about the scam at a BBBs serving Washington, West Oregon and Northern Idaho, as well as Midland,Texas.

Despite Subprime Implosion, Robert Allen's Troops Still Pitch "Get Rich Quick In Real Estate With No Money Down"

Robert Allen promises to make you millions teaching you how to buy real estate with no money down. Unsurprisingly, Ripoffreport is littered with complaints about his company and those that use his name. Here’s the story they tell:

24% APR Crushes Reader To Death

I have a card with one bank (that I am trying my hardest to pay off ASAP) that is 24% APR. It is killing me. A week or two ago, you had an article about a woman who paid off all her credit card debt over the course of 20 months or so. Good for her and it was a good story. One thing about it had me wondering though. She said that she negotiated with her lenders to get lower interest rates on her cards. How do you suggest I do that?

AMEX Says You Closed Your Account While In Coma

According to the credit report, AMEX says Dan’s father-in-law closed a credit card he had with them while he was in a coma. Now Amex is using that to come after the mother-in-law for $15,000. Read the rest of the story, inside…

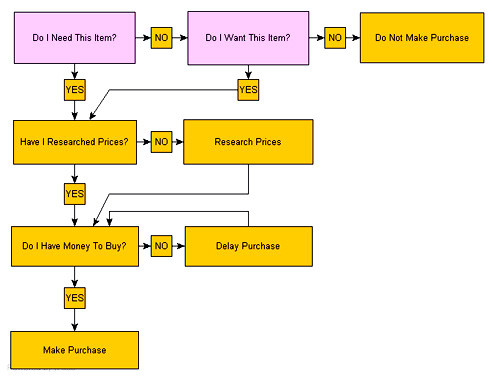

The Financial Decision Flowchart

During one insomnia-filled night, the blogger behind No Credit Needed decided to make this flowchart to illustrate how they make their financial decisions. Pretty neat. I think there should be an extra step before the Make Purchase that says, “Am I Sure I Still Need And/Or Want This Item?” Large version inside.

10 Things That Are Going Right For Consumers

Kiplinger’s is more optimistic than we are, so they had the cheerful idea to put together a list of 10 things that are going right for consumers — despite the financial apocalypse. Hooray!

Personal Finance Roundup

Beware these 5 insurance traps [MSN Money] “You might think your pets, your kids’ toys and your personal problems are your own darn business. But insurers watch these things — and they could cost you.”

Report From Finovate '08: Round 3

We spent yesterday at Finovate, a yearly roundup of new personal finance services available online. Here’s a recap of some of the afternoon presentations, including a mortgage comparison service that promises greater transparency, a new credit simulator feature from Credit Karma, and a site that uses reverse auctions to get banks to bid on your money.

../../../..//2008/10/15/wired-offers-money-saving-tips/

Wired offers money saving tips for “geeks.” Most of them involve buying and renting fewer dvds and/or canceling cable. [Wired]

Report From Finovate '08: Round 2

Round 2 of the Finovate presentations includes online financial planning, the “match.com” of stocks, and Facebook banking. Let’s dive in and find out what they’re all about:

Video: Credit Crisis As Antarctic Expedition

Antarctic explorers trudge across the icy wastelands, heavily laden with rucksacks, bound together with rope. This is a good metaphor for understanding the credit crisis, and Paddy Hirsch from American Public Media is going to lay it down on you. Oh no! There’s a crevasses. Yay! Here comes Henry Paulson to come save the banks in his helicopter. The money meltdown is definitely much more digestible, and fun, in stick-figure and whiteboard form. Full video inside.

Report From Finovate '08: The Latest Personal Finance Tools

I’ve been dispatched by our cigar-chomping editors to midtown NYC to check out the 14 new personal finance software apps getting demoed at Finovate 2008. I’ll be reporting here and letting you know about the latest tools from the frontlines of the personal finance revolution.

../../../..//2008/10/14/dow-ended-the-day-by/

Dow ended the day by shooting up 936.42 points, 11%, ending at 9387.61, it’s largest one-day point gain in history. [Newsday]