A reader who works in the chargeback section of a major credit card company has just about had enough with people tossing around “chargeback! chargeback!” as the solution to every customer service problem. While it is a great tool, you gotta make sure you use it right. To help you do that, here’s our credit card company insider’s guide to the top 10 reasons why your chargeback will get rejected.

personal finance

Got Debt So Bad It's Defaulted? 3 Ways To Deal

Getting into debt is easy. Winding up in default is easier yet; all you have to do is not pay your bills for several months! So how do you deal when the lender doesn’t want to wait around for you any longer and has moved on to more drastic action? Here’s three ways, only two of which are advisable.

Would You Like To Get Charged For A Bill You Already Paid?

Definition: Double-cycle billing or two-cycle billing: When the credit card company calculates finance charges not just for the past cycle (month), but the past two.

Five Money Lessons For New Grads That Everyone Should Follow

New graduates are about to walk smack into the Great Recession, and they need every bit of financial advice they can get. The Wall Street Journal has five excellent money tips that should apply not just to new graduates, but to everyone.

Not Everyone Is Having a Financial Meltdown

For all the financial news of doom and gloom, the Money Crashers blog reminds us that not everyone is hit hard. In fact, they say that for every person struggling right now, there are a majority of people who are doing just fine in this economic climate (note: no data is presented for this claim, but it does sound at least directionally correct). As such, they list five money-related tips for those out there who are not struggling in this recession as follows:

Never Get A Chase Over-The-Limit Fee Again

Stop the presses! You know how most banks are glad to let you charge more than your credit limit and then charge you fees for the “courtesy?” CreditMattersBlog reports it turns out Chase will let you block these “over-the-limit” purchases. You just gotta call and ask for it, 1-800-432-3117. If you’re a Chase credit card customer and sometimes find yourself going over your credit limit and incurring fees, putting an over-the-limit block on your account could be just the thing.

Spread It Around: A Low Balance On Each Card Is Better

When the little trolls with the green visors determine your credit score, a big factor in their abacus-shuffling is how much percent of your credit limit you’re using. However, it’s not just your total credit utilization, all of your credit limits added together and divided by how much of that you’ve tapped, but also how much of each credit line you’re using, the individual credit utilization. Say what?

Would You Use A Government-Issued Credit Card?

With President Obama and Congress threatening to tag-spank credit card issuers, Slate is left wondering why the government doesn’t just issue its own credit card. Before you scream “SOCIALISM!,” consider the government’s heavy involvement in the banking sector, not just through the recent bailouts, but through long-standing institutions like Fannie and Sallie Mae, and Freddie Mac. Credit-worthy borrowers in Germany, France, and India all have access to low-interest, no-fee credit cards issued by their central banks. Would you ever be interested in an Obama-backed credit card?

What Are You Going To Use Your Tax Refund For This Year? 28% Say "To Pay Off Debt"

The comparison shopping website PriceGrabber.com just completed its “what are you going to do with your tax refund?” survey for the second year in a row, and not surprisingly there are some notable differences between last April and now. The biggest change is among those who plan to spend the money: it was 44.0% in 2008, but only 29.2% this year.

Personal Finance Roundup

Dollar stores: Where the deals are [MSN Money] “When it comes to stretching your money, these discounters deliver. But be careful: Some of the stores’ products are no bargains.”

— FREE MONEY FINANCE (Photo: donbuciak)

Do You Haggle?

Asking for a discount. Negotiating for a better price. Haggling. No matter what you call it, the concept is the same: working to get a seller to let you pay a lower price for a good or service than what was initially offered. The Digerati Life encourages shoppers to negotiate on price and offers the following tips (including a story about getting a discount at Home Depot) to make the most of the process:

Bills: Spend Less, Get More

Getting slayed by your bills? Gizmodo has a good roundup of how to save money by ditching your landline and tv, and renegotiating your monthly service rates. It’s recap and refresher for expert Consumerist readers, but a nice compendium of tactics that can get you started saving money today.

Personal Finance Columnist's Financial Advisor Accused Of Fraud

Last week, New York Times personal finance columnist Ron Lieber discovered that his family’s financial planner was being investigated for fraud, because millions of dollars had been transferred out of clients’ accounts without authorization. What’s funny is Lieber found the financial planner while writing a column on how to comparison shop for one.

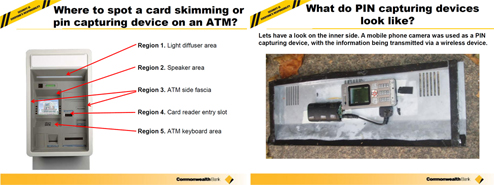

ID An ATM Skimmer

Here’s a 24-page PDF of a powerpoint on ATM skimmers that’s making the rounds in Australia. If you’ve been reading every ATM skimming post, most of this is review, but it contains several more examples of what skimmers can look like and what to watch out for. Though it’s from an Australian bank, most of the information is general enough to apply to any ATM. A handy document to pass around to friends and family to warn them about ATM skimming dangers.

Video: How An ATM Skimmer Scam Works

How do ATM skimmers work? This clip from UK show “The Real Hustle” shows you, from start to finish, how scammers steal your card info and take out money themselves. (Thanks to bonanzaone!)

Check Your Bills, WaMu Cardholders, Due Dates May Be Changed

If you’re a former WaMu credit card customer and now with Chase, check your bill due dates. They may have changed, according to reports CreditMattersBlog is getting from its readers. Seems WaMu had a 25-day grace period, while Chase has one of “at least” 20.