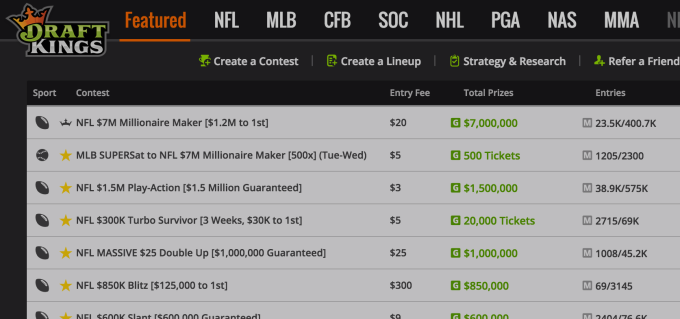

Daily fantasy sports companies DraftKings and FanDuel each agreed to pay $6 million to resolve New York’s claims that the companies engaged in false advertising. [More]

Paying Up

FanDuel, DraftKings To Pay $12M To Resolve False Advertising Allegations In New York

Navy Federal Credit Union Ordered To Pay $28.5M Over Bad Debt Collection Practices

Navy Federal Credit Union offers customers — current and former military servicemembers and their families — a wide range of financial products and services, including loans that must be repaid. But when those customers fell behind on those payments, federal regulators allege that NFCU illegally threatened borrowers and restricted access to their accounts. To resolve these allegations, the company must now pay $28.5 million in refunds and penalties. [More]

Wells Fargo CEO John Stumpf To Forfeit $41M, Forgo Salary To Answer For Scandal

Following the revelation that Wells Fargo employees created more than two million unauthorized accounts in customers’ names to meet the bank’s high-pressure sales goals, the bank’s board has decided to claw back $41 million from CEO John Stumpf’s compensation package, and $19 million from Carrie Tolstedt, the former head of retail banking who failed to stop the chicanery. [More]

For-Profit College Operator Bridgepoint Agrees To Forgive $23.5M In Student Loans

Two months after Bridgepoint Education, the operator of for-profit colleges Ashford University and the University of the Rockies, revealed it was being investigated by the Department of Justice over its federal student aid funding, another federal agency has ordered the company to forgive $23 million in student loans and pay an $8 million penalty over allegedly illegal student lending practices. [More]

Santander Bank To Pay $10M Fine Over Alleged Illegal Overdraft Practices

Santander Bank has agreed to pay $10 million to settle federal regulatory allegations that it illegally charged overdraft fees to customers who didn’t affirmatively opt in to the bank’s overdraft policies.

[More]

Wells Fargo To Pay $8M To Settle West Virginia Lawsuit Against Company It Acquired in 2001

Eleven years ago, West Virginia accused an insurance broker called Acordia of improperly pocketing millions of dollars in commissions. Acordia is now doing business under the Wells Fargo banner, and the big bank has agreed to pay $8 million to settle this decade-old lawsuit. [More]

British Airways, Lufthansa & Air France Fined For Treatment Of Disabled Passengers

Four months after the U.S. Department of Transportation fined United Airlines $2 million for violating rules protecting air travelers with disabilities, the agency is continuing to police the skies when it comes to disabled passengers. This time, levying fines against Lufthansa, British Airways, and Air France. [More]

Walmart Stops Contesting $7,000 Fine For Worker Killed By Black Friday Shoppers In 2008

After six years and millions of dollars, Walmart plans to stop fighting a $7,000 fine imposed by the U.S. Occupational Safety and Health Administration related to the death of an employee during Black Friday. [More]

U.S. Bank Ordered To Refund Customers $48M For Deceptive Add-Ons

Promising consumers a service and then never delivering on that promise is not a good way to do business. When those services are meant to protect consumers’ bank accounts, then you’re likely going to be in trouble with the Consumer Financial Protection Bureau. Such was the case today when the CFPB ordered U.S. Bank to pay more than $57 million in refunds and penalties for allegedly deceptive banking practices. [More]

Regulators: SunTrust Mortgage Must Provide $540M In Relief To Consumers Wronged By Shady Practices

Homeowners underwater with their mortgages and those who lost their homes to foreclosure could be seeing a bit of relief now that several federal agencies and state attorneys generals have filed an order requiring SunTrust Mortgage, Inc. to provide restitution for servicing wrongs. [More]