Georgia narrowly rejected a bid Tuesday to repeal their ban on payday loans.

payday loans

More Payday Lenders In Arizona Than McDonald's And Starbucks Combined

“According to data supplied by the Children’s Action Alliance, there are now more payday loan facilities in Arizona than there are Starbucks and McDonalds combined,” she says.

AFFIL: A Day Late and a Dollar Short?

The message from the Americans for Fairness in Lending (AFFIL) is clear: Your home, your family, and your life are all in the crosshairs of predatory lenders across the nation. One look at their marketing material leaves no doubt in your mind that the consequences are dire unless we take action. Now AFFIL, along with a number of partner organizations including the Center for Responsible Lending, the NAACP, and the Consumers Union, have unveiled a new publicity awareness campaign designed to bring their message into your living rooms.

Why Don't Banks Offer Padayesque Loans, Just With Lower Interest?

Credit Slips digests a recent article in the Journal of Economic Perspectives on Payday Loans. The article’s answer to why banks don’t offer low-cost, short-term, unsecured loans is that banks find fees, like from bounced checks, more profitable. Bob Lawless disagrees, offering this alternative explanation:

PayDay Loans' New Ad About How Payday Loans Are For Upstanding Citizens

“Please borrow only what you feel comfortable paying back when it’s due,” says Darrin Andersen, president of the Community Financial Services Assn. A new emblem will tell borrowers which lenders meet his trade group’s requirements, Andersen says in the ad.

PayDay Loans Are Awesome

We tripped up over this little gem dropped in the payday loan industry’s press conference held on Wed Feb 21st – which attended by remote telephone (neat!).

How Much Is That Payday Loan In The Window?

If people knew the true cost of a payday loan, perhaps the industry wouldn’t be growing like cancer. AllFinancialMatters breaks down the math.

Payday Lenders Are on the Defensive

• Introduce an extended payment plan that may be used once a year for those who can’t pay their bills on time.

For those of you not familiar with payday loans, they are essentially short-term loans. Let’s say things are tight and you need $100 to pay the electric bill. You go to a payday loan company and write them a check for $115 (they usually charge $15 per $100 loan). You walk out with $100. They won’t cash your check for a certain period of time (usually two weeks). If at the end of the two weeks, you don’t have enough money to cover the check, the lender will be more than happy to roll you over into a new loan (with another $15 or more fee). This is how most people get into trouble. According to the WSJ article, the typical client of a payday lender takes out seven loans per year.

Virginia House Passes Payday Loan Bill Without Interest Rate Cap

Gov. Timothy M. Kaine’s (pictured, putting out fire) is the last man standing between a bill hand-written by the PayDay loan industry and Virginia consumers.

Payday Lender Structures Loan Dates So They Fall Outside The Law

An Illinois PayDay lender revealed sets the dates on their loans so they’re not governed under state payday law, a Credit Slips blog student discovered after interviewing the company.

Payday Lenders Target Poor New Mexicans

NPR’s got a nice little story on payday loans in New Mexico.

Virginia Payday Lenders To Charge Infinity Interest

An aggressive campaign by the payday loan industry has paid off in Virginia. The House of Delegates approved a bill removing all caps from interest rates charged on payday loans.

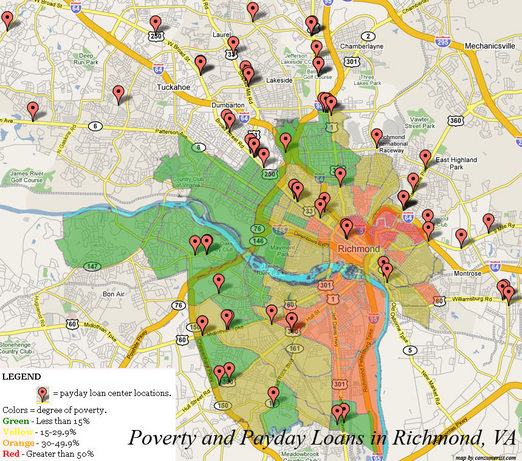

Do PayDay Loan Centers Target The Poor?

According to Virginia Delegate Jennifer L. McClellan, “There are over two payday lending stores for every McDonalds in Virginia and three for every Starbucks.”

Payday Lenders Are Just A Symptom

Payday lenders receive buckets of bane for preying upon low-income, under informed borrowers, as ruminated upon in a recent NYT piece:

Payday Lenders Come Under Fire

“States should do more to restrict payday lenders, who pocketed $4.2 billion in fees from borrowers last year, according to a report released Thursday by the Center for Responsible Lending.”

Payday Loanshark’s Waters Drain

A proposed cap on payday loan percentages charged to members of the military is nearing final approval. The bill aims to limit the vigorish to 36%, down from the usual 350%. Great, how about the rest of us?