We’ve heard it before: A debt collection company engaged in a “phantom” debt scheme in which they try to entice unsuspecting individuals into paying debts they don’t actually owe. While federal regulators have cracked down on these unscrupulous organizations in the past, they are now turning their attention to the companies providing information on these supposed debts. To that end, the Federal Trade Commission today ordered one such data company to pay $4.1 million. [More]

payday loans

Financial Protection Bureau Finalizes New Rules To Curb Predatory Lending, But Will Congress Let It Happen?

In an effort to rein in short-term, high-cost loans that often take advantage of Americans who need the most help with their finances, the Consumer Financial Protection Bureau has finalized its new rule intended to make these heavily criticized financing operations to be more responsible about the loans they offer. But will bank-backed lawmakers in Congress use their authority to once again try to shut down a pro-consumer regulation? [More]

Debt Collector Accused Of Taking Money From People Who Didn’t Owe Anything

As part of its ongoing efforts to crack down on unscrupulous debt collectors, the Federal Trade Commission has accused a North Carolina company of running a “phantom” debt collection scheme that went after people for money that they did not actually owe. [More]

Feds Sue Four Online Payday Lenders For Collecting On Void Debts

Last year, federal regulators released a report that found online payday lenders — despite their clean, professional websites — could be just as bad, if not worse, than their storefront counterparts. Today, the Consumer Financial Protection Bureau provided yet another example of how these companies can wreak havoc on consumers’ finances by skirting the law. [More]

Most Americans Favor Payday Loan Reforms

Despite claims from the payday loan industry that Americans don’t want reforms intended to prevent borrowers of these short-term loans from falling into a revolving debt trap, two new reports show that most people do think it’s time to rein in payday lending and provide more affordable loan options for borrowers in need. [More]

Future Looks Dim For Consumer Financial Protection Bureau Under Trump Presidency

On the campaign trail, President-elect Donald Trump made his disdain for the 2010 Dodd-Frank financial reforms clear, leaving many to wonder what a Trump White House would mean for the Consumer Financial Protection Bureau — the financial services regulator created by the 2010 legislation. Now that pieces are beginning to fall into place for the Trump transition plan, the outlook for the CFPB does not appear very bright. [More]

South Dakotans Vote To Cap Payday, Auto-Title Loan Interest Rates At 36%

More than a dozen states and the District of Columbia currently prohibit payday lenders and other short-term loan companies from charging exorbitant interest rates on their financial products. Last night, the residents of South Dakota added their state to that list, voting to cap interest rates on short-term loans at 36%. [More]

Operators Of Scammy Payday Lender Ordered To Pay $1.26 Billion

Four years after federal regulators sued the operators behind what might have been the scammiest payday loan Consumerist had ever seen, a federal judge has ordered Scott Tucker and his businesses to pay $1.26 billion to the Federal Trade Commission to resolve allegations of running online payday lending operations that exploited more than 5 million consumers. [More]

Online Payday Lender Can’t Hide Behind Western Sky’s Tribal Affiliation

While operating a business on tribal lands may protect you from certain federal laws, an online payday lender can’t just prop up a storefront on tribal lands in order to offer high-interest loans that are illegal in many states. [More]

DNC Chair Walks Back Her Opposition To Payday Lending Reform

Only three months ago, Florida Congresswoman and chair of the Democratic National Committee Debbie Wasserman-Schultz was actively lobbying her fellow lawmakers in opposition to pending reforms for the payday loan industry, finding nothing wrong with lenders who charge interest rates in the range of 300% to people in dire need of cash. Now that the actual rules have been announced, the legislator has had a sudden change of heart. [More]

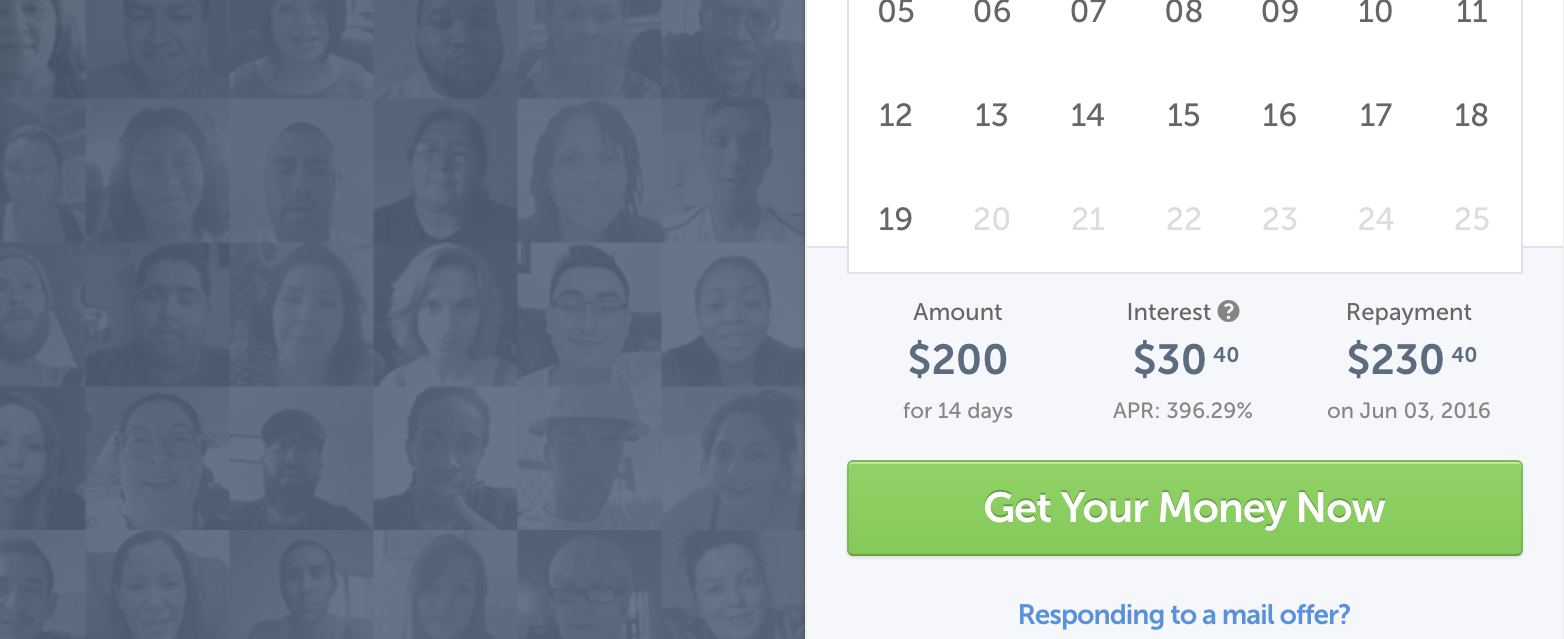

New Rules Aim To Rein In Predatory Payday Lending, But Will They Work?

After nearly four years of studying the issue of high-cost, short-term financial products like payday loans, and auto-title loans, the Consumer Financial Protection Bureau has finally released its proposed rules intended to prevent borrowers from falling into the costly revolving debt trap that can leave people worse off than if they hadn’t borrowed money in the first place. [More]

Google Invests In Payday Lender While Banning Ads For Payday Loans

Last week, Google announced it would no longer include ads for payday lenders — financial services, outlawed in many states, that offer short-term, small-dollar loans, often with triple-digit interest rates — to protect “users from deceptive or harmful financial products.” All the while, Google’s parent company is investing in a startup that offers loans with annual percentage rates as high as 600%. [More]

Payday Loan, Check Cashing Operation Trained Employees To “Never Tell Customer The Fee”

All American Check Cashing collects approximately $1 million in check-cashing fees each year. But according to federal regulators, the company, which also provides payday loans, obtains those fees through deceptive means, including refusing to tell customers what they will be charged and lying to prevent consumers from backing out of transactions. [More]

Google Bans Payday Loan Ads In Search Results

Google can’t stop you from searching for “payday loans,” and the company’s search engine will continue to turn up results for people inquiring about these short-term, high-interest loans, but it can choose to stop running ads for payday lenders. [More]

Survey: 9-in-10 Christian Consumers Think Payday Loans Hurt Borrowers

Expensive. Harmful. Predatory. Those are just a few of the words that members of faith-based groups used to describe payday and auto-title loans in a recent report that asked congregants in 30 states to detail their experience with the short-term, high-cost loans and similar financial products. [More]

Operation That Illegally Debited Consumers’ Bank Accounts Must Repay $43M

Months after federal regulators ordered a data broker to pay $7.1 million for selling consumers’ sensitive information to scammers, a court ordered one of those alleged scammers and its subsidiaries and operators to provide $43 million in relief to victims. [More]

Are The Comments Opposing Payday Loan Rules Legitimate?

Last summer, the Consumer Financial Protection Bureau released proposed rules intended to prevent borrowers from falling into the costly revolving debt trap that can leave people worse off than if they hadn’t borrowed money in the first place. Since then, those in the payday lending industry have ramped up their efforts to ensure the proposal isn’t finalized. [More]