John got his account back in black after Wells Fargo had him paying for his rent twice and hit him with nine overdraft fees. He put a stop payment on his electronic check and wrote a paper one instead, but both went through and he was in the red. When he went to customer service, they would only refund some of the fees. Quivering with rage, he steeled himself and emailed the CEO and CFO. The next time he called back customer service, they reversed all the charges. Shazam! [More]

overdrafts

How Do You Keep Track Of Your Money?

Considering the number of stories we write about overdrafts, Consumerist reader Adam wanted to know if he was one of the few people left that still keep track of their cash with their checkbook. [More]

BoA Kills Overdraft Fees On Debit Purchases

Bank of America announced they will stop charging overdraft fees on debit card purchases. If you don’t have enough money to buy the item, the transaction will be declined. [More]

Citibank Closes Overdraft Protection Due To Lack Of Overdrafts

We all know that banks offer overdraft protection because it makes them money, not because they want to be kind to customers. Still, it seems weird–or maybe just brutally honest–that Citibank would cancel Corrie’s overdraft protection service simply because she’d managed to avoid any overdrafts since she opened her accounts. [More]

Citizens Bank Now Charging An Overdraft Protection Fee

Lynne writes, “Citizens Bank is now charging customers an annual overdraft protection fee. This is a charge for linking your savings account to your checking account. Customers can be removed from the program and can get the fee back.” We don’t know when this started—they just say there might be fees involved and call for details on their website—but if you’re a customer of the bank you might want to make sure you haven’t been enrolled without knowing it.

Banks Cling To Overdraft Fees Because They Need Them To Survive

Banks now make more on debit card overdraft fees than credit card penalties—they’ll rake in about $27 billion in 2009 alone, according to the New York Times. They obviously have zero incentive to curb the practice. In fact, one economist told the paper that “45 percent of the nation’s banks and credit unions collect more from overdraft services than they make in profits.”

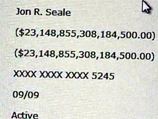

The Real Reason Behind The $23 Quadrillion Errors

The secret of the $23 quadrillion VISA debit errors looks like a specific and not uncommon programming error. Take the insanely large number, if you convert 2314885530818450000 to hexadecimal, you end up with 20 20 20 20 20 20 12 50. In programming, hex20 is a space. Where a binary zero should have been, there were spaces instead. What made this instance special is that it wasn’t caught in time. A Slashdot commenter identifying himself as working in the industry explains more about what very likely happened:

The $23 Quadrillion Meal

I hope he cleaned his plate. Jon Seale was another of several VISA customers who were charged $23 quadrillion for mundane purchases. This time it was his July 13th meal a Dallas restaurant, reports KXAS. VISA said a temporary programming error affecting prepaid accounts was responsible for the error . Jon spent the rest of the day calling between Wachovia and VISA to try to clear the $23,148,855,308,184,500 charge.

Banks To "Earn" $38.5 Billion From Overdrafts This Year

Consumers aren’t the only ones looking to save money and gain a little extra cash on the side. Banks are people too, you know! In the face of toxic assets and credit card delinquencies, they’ve come up with a plan to increase their revenue: New fees! Higher fees! Higher minimum balance requirements! Trickier overdrafts!

HP Overdrafts Your Checking Account After 4-Day-Old Laptop Breaks

The hard drive of Chris’s HP laptop failed within its warranty period. Technically, it was four days after he bought the brand-new computer, but who’s counting?

Stop Hungry Hungry Hippo Banks From Gobbling Your Bucks

Oh noes! The Hungry Hungry Hippo Banks are trying to gobble up your happy money fish! You only have 5 days left to get them to stop by writing the Fed and saying NO to banks default stuffing you into an overdraft fee programs. Send an email to regs.comments@federalreserve.gov with “Docket No. R-1343” in the subject line. Or you can use this online form.

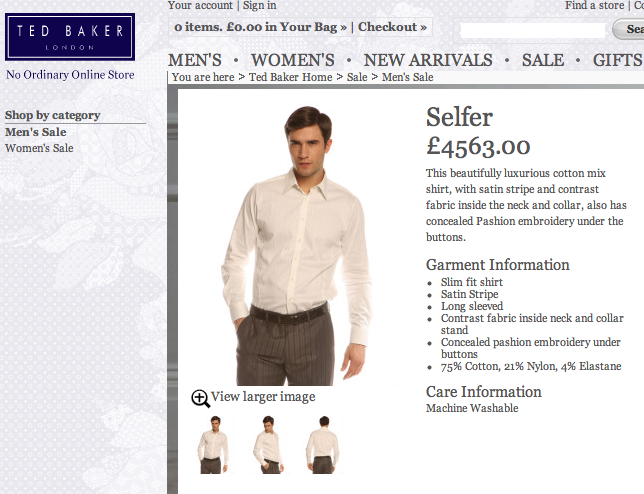

Tell The Feds You Want A Choice On Overdraft Fees

Tell the Feds that you don’t want your bank levying overdraft fees on you until you say, yes Mr Banky, I want to end up paying $28 for a Coke. The Feds are considering Regulation E: R-1343 and of critical concern is whether overdraft fees will be opt-out or opt-in. Obviously people shouldn’t overdraft, but what started out as a service for customers has, in some cases, turned into kicking a guy in the nuts while he’s down and taking his wallet.

Target Employee Incompetence Freezes Nearly $800 Of Customer's Money

Erica, who writes Philadelphia Weekly’s Style blog, went to Target this past Saturday to purchase some new tank tops. She and her boyfriend filled their cart with a lot of other stuff too—”Ready to stimulate the economy?” she joked to him on their way to the register—and they agreed to split the cost equally. Now when I worked retail, that was an infrequent but not impossible task. When you ask a Target cashier to do that, get ready to have your debit card debited twice for the full amount of the bill, and then told two days later that the voided transactions will take 72 hours to clear.

Claim Your Share ($78) Of The Bank Of America Overdraft Settlement

Bank of America has settled a class action lawsuit over its dirty overdraft tricks—things like approving transactions that generate overdraft fees, for example, or clearing transactions in high-to-low order to increase the number of overdrafts. If you’re a former customer of BoA, Fleet, LaSalle Bank or United Trust Company, you can claim your part of the settlement fund.