We don’t want to admit it, but most of us have done it before. We’ve misjudged how much money was in our checking accounts, leading to a cascade of overdraft fees. It happened to Bob: he used his Bank of America debit card for each transaction during a night out and was hit with a total of $245 in fees. Sure, he could have taken the fees as an expensive lesson, but he chose to fight back instead. [More]

overdrafts

Banks That Market To & Serve Military Also Tacking On Huge Fees

One might assume that banks marketing to U.S. military servicemembers would not be out to nickel and dime these men and women with unnecessarily high fees on their accounts. But among those financial institutions levying the highest level of fees on its account-holders are several that not only market to the military but also have branches on military bases. [More]

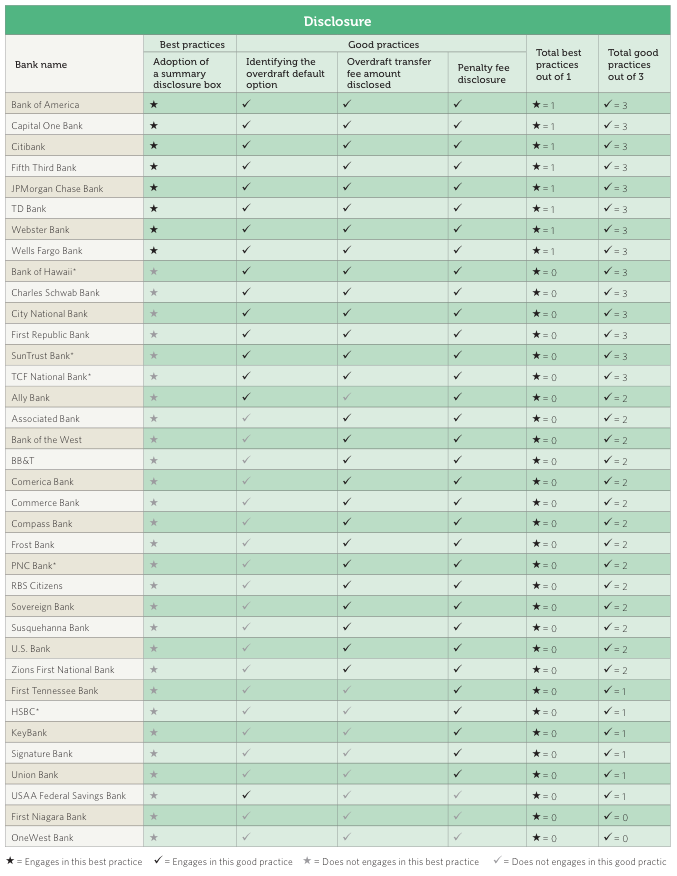

Consumer-Friendly Checking Account Practices Vary Wildly From Bank To Bank

Unless you’ve been hiding under a bed for the last six years, you probably know that the banking industry isn’t exactly beloved by many American consumers. As a reaction to public sentiment (and threats of regulation), a number of banks have begun phasing in some more consumer-friendly practices, but a new study shows these changes are not industry-wide and that several banks are still years behind. [More]

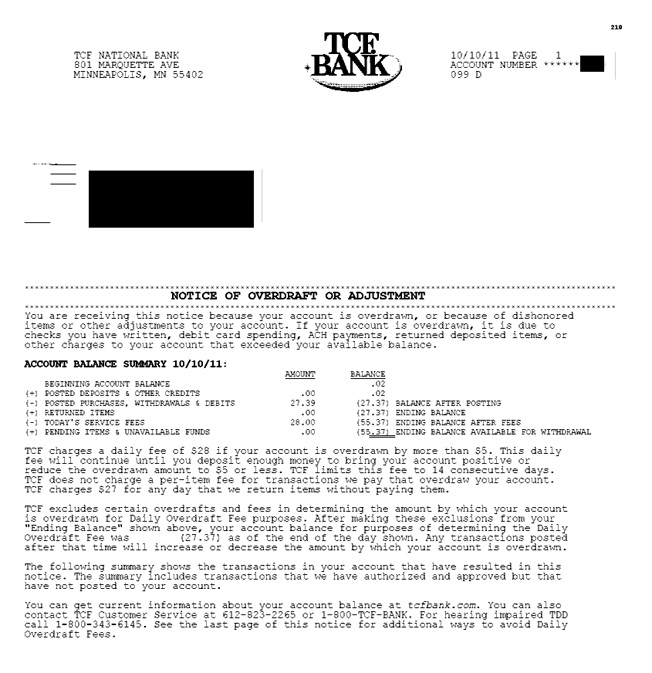

TCF Bank Adds New $28 Daily Overdrawn Balance Fee

Reader Jeff used to intentionally overdraw his bank account in order to have enough money to feed his family and gas the car. At $35 a pop, that’s a pretty cheap loan. But now that’s not going to be a viable option because TCF Bank has started to assess him a daily fee of $28 if his account is overdrawn by $5 or more. [More]

Citibank Pledges To Pay Small Checks First, Minimizing Overdraft Fees

Overdraft fees may be devious mechanisms that suck funds out of the customers who can least afford them, but their administration doesn’t have to be downright evil. [More]

Wachovia's Lame Attempt To Get You To Sign Up For Overdraft Fees

Wachovia sent out an eblast trying to get people to sign back up for overdraft protection, and the fees that “service” entails. [More]

Wells Fargo Hits Girl With Secret Fee Trifecta

Christina is broke as a joke. Wells Fargo doesn’t think this is funny and decides to shut down her account for having no money in it and no activity on it. No big whoop, she’ll just open another account. She does this twice. Then, whups! Those accounts were never closed! And we’re charging you fees because they were actually fee-based savings accounts! And you’re in collections! Good times, let them roll: [More]

Bank Screws Man For $900, He Tells Others, Ultimately Costing Bank $100,000 In Lost Business

Revenge is a dish best served cold, and when it comes to the bank who jacked him for $900, Justin is a master chef. [More]

At Chase, Depositing A $4,000 Check In An ATM Is "Unusual Activity"

Carol tells Consumerist that while in a financial pinch, she took out a title loan for $4,000, depositing it in her Chase bank account using an ATM. Instead of helping the situation, the deposit made her financial mess worse. Chase froze her out of her accounts and made her order a new debit card, but no one at her local branch or in the corporate “Risk Control” department has the power to tell her what the problem is. Her account remained locked after the check cleared. Bank staff also took the opportunity to attempt to sell her student loans and overdraft protection. Not a good time, Chase. [More]

HSBC Closes Bank Account Over 14 Cent Overdraft

“Don’t overdraw your bank account” is pretty sound advice. However, reader Phil advises that if you do happen to overdraw your HSBC account–even by a few cents–the bank will mercilessly close your bank account with no warning. That’s what happened to him. [More]

Remember: Checks Can Still Overdraft

Just remember, even though starting this week banks can’t charge you overdrafts unless you opted into their overdraft program, they can still authorize overdrafted checks, ATM withdrawals, and automatic bill payments at their discretion and charge you a fee for it. [More]

Wells Fargo Ordered To Pay $203 Million For Processing Transactions High To Low, Maximizing Overdraft Fees

A California judge ordered Wells Fargo to pay California customers $203 after finding that the bank had deliberately manipulated the way it processed transactions in a way that turned one overdraft fee into as many as 10, at $35 a pop. [More]

TD Bank Sells Overdraft Protection As A "Free" Service

Frank writes that he received a call from his bank, TD Bank, that insults the consumer savvy and the intelligence of their customers. TD kept calling him…unsurprisingly, to try to sell him on the idea of opting in to overdraft protection. Their sales pitch? Overdraft protection is a “FREE SERVICE.” Well, yeah, like many services, it’s free until you actually use it. [More]

Banks Told To Target Financially Unsavvy For Overdraft Reup

Consulting firms are telling banks to hone in on the financially precarious to sign back up for costly overdraft protection that will only further erode their bank account. Here are some quotes from their strategies: [More]

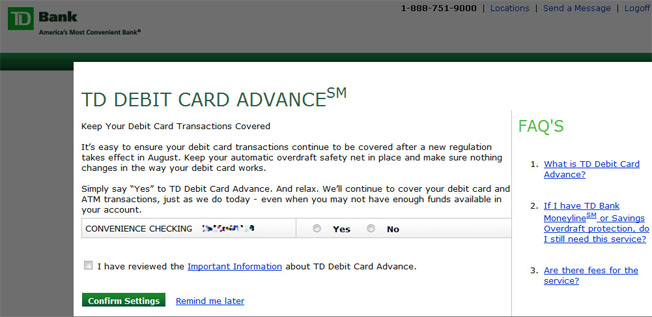

TD Ratchets Up Overdraft Opt-In Push With Pop-Up Scare Tactics

TD Bank is really stepping up its efforts to try to get customers to sign back up for “overdraft protection,” which really just protects their right to charge you $35 if you want to buy a $2.00 candy bar and only have a $1 in your account. Now they’re greeting customers accessing their accounts online with pop-up ads trying to scare them into agreeing to signing up for the service. [More]

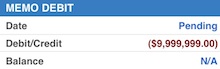

Chase Freezes Long-Time Customer's Accounts With $9.9 Million Overdraft Fee

Chase froze Micah’s checking accounts with a $9.9 million overdraft fee after he took the ultra-suspicious step of opening a joint checking account with his girlfriend. Rather than merely freeze the joint checking account, Chase decided to freeze all of Micah’s assets until they could verify that their customer of thirteen years was really whom he said he was. Not even a letter from the Social Security Administration, handed to the local Chase branch and sent to Chase’s fraud unit could stop Micah’s debit card from being canceled. Now Micah has no access to his cash, a $9.9 million charge to his name, and still no joint checking account with his girlfriend. [More]

Banks Luring You Into Signing Back Up For High Overdraft Fees

Banks are mad they can’t just automatically charge you a $35 overdraft anymore if you happen to try to buy a candy bar without enough cash in your account. Newly enacted legislation says they have to get you to opt-in to such overdraft programs. So, what they’re doing is renaming the overdraft programs something else, making them sound awesome, and then blitzing your mailbox and inbox with up-sells. Some banks are even calling people up! [More]