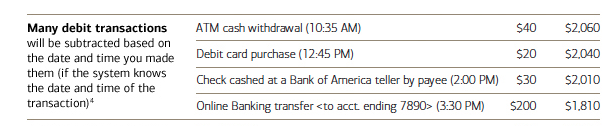

As we’ve noted multiple times over the years, some banks love to lump all transactions made by a customer during a day or weekend together and then process them not in the order they were received, but from largest to smallest. For customers on the brink of overdrafting, this can result in numerous fees that may have been avoided if the charges had been processed chronologically. In a rare bit of positive Bank of America news, the bank has decided to stop this high-to-low transaction processing (for many debit purchases). [More]

overdraft

Judge Tries, Again, To Slap Wells Fargo With $203 Million For Overdraft Policy

It’s been nearly three years since a U.S. District Court first ordered Wells Fargo to pay out $203 milllion in refunds to settle a class-action suit involving the bank’s overdraft policies. Since then, the bank got a U.S. Circuit Court of Appeals to set aside that mountain of cash, saying California law can not override federal banking laws. Now the original District Court judge is once again ordering the bank to fork over the $203 million. [More]

Wells Fargo Closes My Overdrawn Account 28 Days Before It Says It Would

Sean’s Wells Fargo checking account dipped into the negatives on charges he disputed. He says Wells Fargo said he’d have nearly a month to sort out the issue, but it turned out that by “30 days” the bank meant “48 hours,” because two days later the account was as incapacitated as the 49ers’ offense. [More]

Best Buy Register/Bank Error Leaves You Overdrafted And Cameraless

Reader Jeff is now in a situation that we find all too familiar, but most people have never even heard of: Electronic Funds Transfer Error Hell. You see, Jeff bought a camera at Best Buy and something went wrong — causing his debit card to be charged twice. This in turn caused him to overdraft. Now he’s shocked to learn that the process for reversing the charge isn’t as simple as it would be with a credit card. [More]

CitiFinancial Auto Keeps Deducting Payment On Zero Balance Loan, Triggers Overdraft Fees

Marc’s monthly budget just exploded into a mess of overdraft fees thanks to CitiFinancial Auto’s negligence, and now he’s not sure how to get them to actually do anything to fix it. [More]

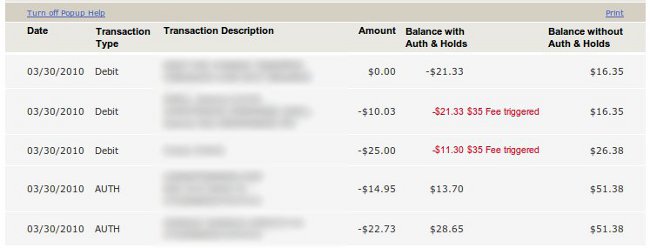

Remember, Authorizations May Cause You To Overdraft

Consumerist reader Patrick wrote in to express his dismay with Bank of America. He had purchased two items online that wouldn’t be shipping until a later date, but the authorizations placed on both items by the vendors caused him to overdraft (and be charged $35 overdraft fees) for his subsequent purchases. [More]

Should Banks Be Forced To Ask Permission Before Overdrafting Your Account?

Sen. Chris Dodd plans to introduce legislation that would require banks to get permission before allowing fee-generating overdrafts. Banks are on track to earn $38.5 billion in overdraft fees this year and, according to a study by the Federal Deposit Insurance Corp, most banks offer the “service” automatically. Common “features” of the programs include not notifying customers when an overdraft is about to occur, not offering them a chance to cancel the transaction, and processing the transactions in ways designed to increase the number of fees.

Chase's Vague, Off-Putting Debit Overdraft Threat

Chase bought Washington Mutual to seize market share by expanding its customer base, but its execs seem to have forgotten to take into account that there was probably a reason customers weren’t using them in the first place.

Should Banks Be Required To Ask Permission For Overdrafts?

When you sign up for a checking account, most banks automatically enroll you in a “courtesy overdraft protection” program. This program means that the bank will approve overdrafts from your ATM or debit card — and charge you a $35 fee for each transaction, etc. But what if you don’t want the service? Well, the Federal Reserve has proposed a new regulation that will require banks to ask your permission before they sign you up.

Help! The Gas Station Froze $100 For $12 Of Gas And My Rent Check Bounced!

Reader WW is upset because a gas station froze $100 on a debit card transaction for $12 worth of gas. This caused his rent check to bounce. Now he’s got overdraft fees and he’s wondering why gas stations are doing this.

Polite Letter Gets Bank Of America To Refund Overdraft Fees

Jenn’s checking account with Bank of America recently had a policy change designed to increase overdraft fees, and it worked: sometime between Friday night and Saturday morning she was hit with 6 NSF charges going back the previous 48 hours, because she was about 15 minutes late transferring funds into her account the day before. Technically she had broken the new policy, but Jenn hadn’t realized or remembered that there was a policy change and she was taken by surprise. She decided to try to reason with BoA’s corporate office about the fees, and explain why she thought they were unfair.

Bank Of America Refunds $325 In Overdraft Fees To Customer Who Was On Cruise

Don’t say we never printed anything nice about you, BoA. One of your customers just had an experience with you that—despite still having an overdraft fee of $20 to pay—has left her feeling pretty good about you.

Dear Sprint: "Die In A Fire"

Sprint. Hilary’s boyfriend wanted one phone. You signed him up for, like, a bazillon and took all of his money, plus an extra $400 from his bank account.

36 Confessions Of A WaMu Banker

– About the WaMu Free Checking, yes it is a different “free” checking account. We just came out with the “WaMu” part about a couple of years ago, so if you have any “free” checking account older than that I suggest you change it to the newer one.

Dreamhost Busy Cleaning Up The Great Billing Apocalypse Of 2008

Dreamhost is busy cleaning up the mess after accidentally overcharging their customers by $7.5 million dollars due to a typo. The process is not going smoothly and we’ve been receiving a mix of complaints and praise.