Taking a private loan from friends or family can be a win-win proposition, not necessarily a shame-filled dish with a side order of failure. Private loans are an ideal way to reduce the amount you need to borrow from a bank—instead of paying loan application fees, processing fees and higher rates, you can save money while offering attractive yields to your friends and family.

mortgages

Easily Compare Wholesale Mortgage Rates Online

Mortgage Professor has a great no-frills online tool for tracking the wholesale mortgage rates. Just go here, Select your geographic area, and time period to look at. Choose whether you want your data in chart or table format (I suggest table, as the chart data isn’t as up to date), and what kind of mortgage you want to look at. You can further sort the results by FICO, loan purpose, loan size, type of documentation, or size of down payment. The data comes from Amerisave. A great way to check out mortgage rates, and how strong you have to be to get them. Plus, you can use it to compare how much of a markup your broker is charging.

Mortgage Broker Confessions

“When I have a client I really don’t like — he’s a pain in the ass — that’s when I charge as much as I can get out of them,” one mortgage broker told the Joe Consumer blog. That’s right, a lot of mortgage broker fees are bullshit. It’s important to get a good faith estimate and shop around for things like your title and escrow.

Mortgage Brokers Demand Higher Down Payments From Borrowers In Risky Zip Codes

Prospective home buyers may need to pony up more cash up front to secure a mortgage if they are looking to buy in one of hundreds of zip codes that lenders now consider “soft markets.” Countrywide and GMAC recently ranked over 1,000 zip codes on a risk scale of 1-5. Lenders to moderate risk zip codes, ranked 1-3, may require borrowers to pay an additional 5% down payment. Unlucky buyers in high risk zip codes, ranked 4 or 5, are now automatically required to put down the extra 5%.

FBI Starts Investigating The Entire Mortgage Industry

The New York Times says that the FBI has begun an investigation that includes almost the entire mortgage industry—from the lenders to the brokers to the Wall Street banks who packaged the loans as securities. They’re cooperating with the SEC and wouldn’t name which firms they’re targeting, but the Times said that it includes 14 companies.

Exciting New Service Helps You Walk Away From Your Mortgage!

You will immediately know the exact amount of days you have to live in your house payment free. We stay on top of your walk away plan and keep you up to date with weekly progress emails. We also will notify you if the lender is taking longer than expected subsequently giving you more time in your home payment free.

It’s like a spoof, except real!

../../../..//2008/01/30/how-to-use-the-drop/

How to use the drop in interest rates to refinance your home mortgage and get a better deal. [Kiplinger]

Record Decline In U.S. Home Prices, Foreclosure Filings Up

The already troubled housing market is just getting worse says the latest report from S&P Case/Shiller. The 10-City Composite’s annual decline of 8.4% is a new record low for the index, which started recording home prices in 1987.

Appraiser Says Washington Mutual Blacklisted Her For Not Inflating Property Values

A Californian real-estate appraiser is suing Washington Mutual, saying she was blackballed after refusing to to give artificially inflated property value estimates.

…last May, according to the suit, a WaMu manager upbraided her for describing local property values as “declining” in an appraisal. The manager insisted that Wertz “change her report to indicate ‘stable’ conditions so that the loan could be approved.”

../../../..//2008/01/28/countrywides-ceo-is-eschewing-a/

Countrywide’s CEO is eschewing a $37.5 million severance package as he leaves the company that profited torrid billions during the housing bubble, sometimes through duplicity and reams of questionable fees. After all, there’s only so many gold-plated Rolls Royces one can drive. [Reuters]

When A House Is A Bad Investment, Is It OK To Just Walk Away?

Here’s one that’s sure to start some intense debate: If you’ve made a bad investment and your house isn’t worth what you thought it was going to be, is it OK to just walk away?

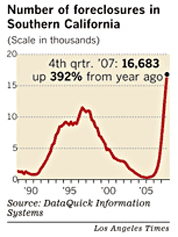

California Foreclosures Hit New Quarterly Record: 16,683

The number of homeowners losing their house to foreclosure shot to a new record of 31,676 in the last quarter of 2007, Los Angeles Times reports. Research firm DataQuick says that 41% of homeowners currently in default can keep their homes if they bring their payments current, refinance, or sell their home, down from 71% the year prior. Hey, at least it’s sunny.

Buyers Sue Agent For Inflating Real Estate Appraisal

The New York Times has an interesting article about a couple in California who are suing their real estate agent (who is conveniently also a mortgage broker) for allegedly artificially inflating the appraisal on their home by $100,000. A few days after moving in to their new home, says the NYT, “they got a flier on their door from another realty agent. It showed a house up the street had just sold for $105,000 less than theirs, even though it was the same size.”

World Economy Feels The Mortgage Meltdown

On a day when United States markets were closed in observance of Martin Luther King’s Birthday, the world’s eyes were trained nervously on the United States. Investors reacted with what many analysts described as panic to the multiplying signs of weakness in the American economy.

../../../..//2008/01/15/citigroup-writes-down-181-billion/

Citigroup writes down $18.1 billion due to investments related to subprime debt. Observers and analysts unanimously agree that that is a lot of billions. [Reuters]

BREAKING: Bank Of America Buys Countrywide, CEO Gets Up To $115 Million Parachute

Hey there, sports fans: Bank of America will buy everyone’s favorite evidence-forging subprime lender, Countrywide for a cool $4 billion dollars.