../../../..//2008/03/19/the-new-york-times-ponders/

The New York Times ponders: How could irresponsible mortgage lending “take out take out the whole global financial system?” [NYT]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2008/03/19/the-new-york-times-ponders/

The New York Times ponders: How could irresponsible mortgage lending “take out take out the whole global financial system?” [NYT]

[via Boing Boing]

../../../..//2008/03/18/some-of-the-same-strategies/

Some of the same strategies that landed sub-prime borrowers in trouble are becoming increasingly popular among the rich as wealth-management tools. [NYT]

Bear Stearns, facing a grave liquidity crisis, reached out to JPMorgan on Friday for a short-term financial lifeline and now faces the prospect of the end of its 85-year run as an independent investment bank.

The FBI has opened an investigation into Countrywide for suspected securities fraud, reports the New York Times. The Justice Department and FBI “are looking at whether officials at Countrywide, the nation’s largest mortgage lender, misrepresented its financial condition and the soundness of its loans in security filings.” So far everything is unofficial because nobody has been authorized to discuss the case, and a Countrywide spokeswoman says, “”We are not aware of any such investigation.”

The Mortgage Bankers Association says that foreclosures have hit an all-time high as more and more borrowers with adjustable rate mortgages walk away from their homes before their payments increase.

“Pay-option mortgages” are loans in which homeowners can choose to pay the interest or even just part of the interest on their mortgage each month. If they do this, the unpaid interest is added to the principal resulting in a mortgage that actually grows over time.

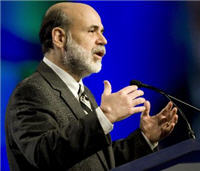

Fed Chairman Ben Bernanke is urging lenders to “forgive portions of mortgage debt held by homeowners at risk of defaulting,” says Bloomberg.

We’ve talked about this issue a few times here on Consumerist and now the New York Times has gotten into the act with an article about people who’ve chosen use the new service “You Walk Away” to let the bank take over their mortgages after their homes turned out to be bad investments.

If, despite the news telling you every day, you still don’t understand how the subprime meltdown happened, perhaps this stick-figure slideshow will help. If even flatlanders can’t see through these scams, what hope is there for the rest of us? Warning, uses naughty words.

A new survey from Reuters and the University of Michigan found that a third of homeowners felt their homes lost value in February, compared to 16% a year ago.

Tax Cat knows that it’s a hard subject, but if your home has been foreclosed there’s something you should know about changes to the tax laws.

Keith writes:

My adjustable rate mortgage with Verity Credit Union is due to reset next month. As part of the note there is an option to convert to a fixed rate. The calculation of this fixed rate is clearly defined as equal to Fannie Mae’s required net yield for a 30 year fixed rate covered by an applicable 60-day mandatory delivery commitment plus five-eighths of one percentage point, rounded to the nearest five-eighths of one percentage point. So take the Fannie Mae 30 year 60 day rate add 5/8ths and round to the nearest eighth. The note said the note holder got to decide the day of the rate but Verity was nice enough to let me pick which day I wanted as long as I gave them 15 days notice before the reset date. I patiently watched the rates every day and fortunately right before I was to give them notice rates were steadily declining…

../../../..//2008/02/15/smaller-cities-that-missed-the/

Smaller cities that missed the housing bubble have also missed its burst, and people are actually making money off the sale of their homes. [NYT]

Is Countrywide telling you your Loan-to-Value (LTV) ratio needs to have reached 75%, not 80%, in order to get the private mortgage insurance (PMI) removed? Throw the book at them: tell them they’re in violation of the Homeowners Protection Act of 1998. The law clearly states that PMI is to be removed after 80%:

Cancellation date.–The term “cancellation date” means…the date on which the principal balance of the mortgage…is first scheduled to reach 80 percent of the original value of the property securing the loan.

One reader (different from the guy we posted about before) says he was having trouble getting Countrywide to remove the PMI. They twice told him in writing that he needed a LTV of 75%. Then on the phone with them he mentioned the Homeowner’s Protection Act and then all of a sudden they were magically able to remove the PMI.

3. PMI [Ed. A type of insurance a borrower pays to the lender to protect the lender in case the borrower defaults. It is typically required when putting down less than 20%]. Because this was our first home loan, and it was considered a “jumbo” (I hate that term), they required us to have PMI (despite having put down 20%). During the summer of 2005, we were nearing the magic 80/20 Loan-to-Value ratio, which I believed to be sufficient to have them remove our PMI…

The New York Times says that the mortgage meltdown isn’t just a subprime problem anymore, but has spread into the prime market where consumers with good credit are now struggling to pay their bills.

../../../..//2008/02/11/if-youre-late-on-your/

If you’re late on your mortgage payments, Countrywide may have a new workout program for you. You don’t need to have a ARM. Call them! [MarketWatch]

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.