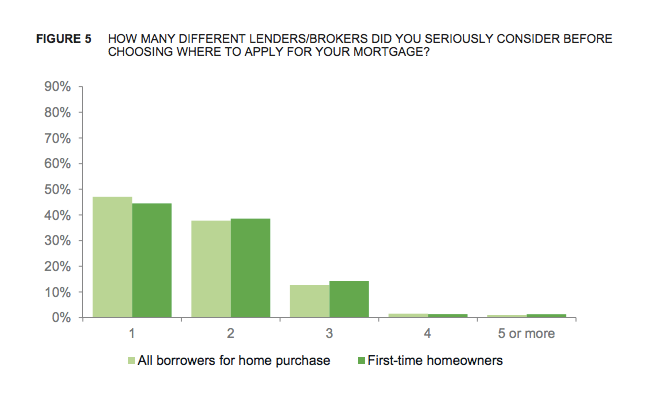

While a report earlier this year suggested that consumers don’t spend nearly enough time shopping for the right mortgage, that doesn’t mean lenders are off the hook for purposefully steering potential homeowners into costlier mortgages. Because doing so will land a company in hot water with federal regulators. Just ask RPM Mortgage and its top executive, who must now pay $20 million for their allegedly deceptive practices. [More]

mortgages

CFPB Fines Mortgage Company $20M For Pushing Customers Into Spending More Than They Had To

Wells Fargo Breached 2010 Mortgage Settlement, Must Work To Provide Homeowner Assistance

Some homeowners who were wrongly denied mortgage assistance from Wells Fargo will soon receive the help they needed years ago after a federal judge ruled this week that the bank’s denial of modifications were in breach of a 2010 settlement involving adjustable-payment mortgages. [More]

HSBC Finance Says Some Mortgage Customers’ Information May Have Been Compromised

Customers of HSBC’s U.S.-based finance division are the latest victims of a data breach, the bank confirmed this week in a letter to the New Hampshire Attorney General. [More]

![The CFPB's electronic version of its Know Before You Owe Mortgage Toolkit includes interactive forms to help consumer find the right mortgage for them. [Click to Enlarge]](../../../../consumermediallc.files.wordpress.com/2015/03/screen-shot-2015-03-31-at-2-08-15-pm.png?w=300&h=225&crop=1)

CFPB Releases Mortgage Toolkit Aimed At Making The Home Buying Process Easier

In January, the Consumer Financial Protection Bureau released a report suggesting that many homebuyers spend more time looking for a TV than shopping around for the right mortgage. In an attempt to make things a little less daunting for prospective borrowers, the Bureau today released the “Know Before You Owe” mortgage shopping toolkit. [More]

CFPB Returned $19.4M To 92,000 Consumers In The Last Half Of 2014

Each year the Consumer Financial Protection Bureau supervisory examiners hold hundreds of companies accountable for violations of fair lending and debt collection rules. During the last half of 2014, those actions resulted in the return of $19.4 million to more than 92,000 consumers, according to a new report from the agency. [More]

Woman Wants To Back Out Of Buying House Saddled With $400K Debt, Blaming Winning Bid On Diet Pills

Feeling like maybe you shouldn’t have splurged on that shirt when you’ve already got a bunch like it already in your closet is one thing, but deciding you’d rather not own a home you purchased is an entirely other category of buyer’s remorse. A Florida woman is blaming her winning bid on a home that comes with a $400,000 debt on it on diet pills, saying they caused her to become confused. [More]

Chase Hit With $50 Million Settlement Over Robosigned Mortgage Documents

The nation’s biggest banks have already been hit with billions of dollars in settlements over robosigning — the illegal process of signing and filing important mortgage documents without reviewing them for accuracy — so what’s a few million more? Today, the Justice Dept. announced a settlement with JPMorgan Chase that will require the bank to pay more than $50 million in cash, mortgage credits, and loan forgiveness, to over 25,000 currently and recently bankrupt homeowners. [More]

Morgan Stanley To Pay $2.6B To Settle Charges Of Selling Troubled Mortgages Leading Up To The Financial Crisis

The Department of Justice has struck a multi-billion dollar deal with Morgan Stanley in what is expected to be one of the last major steps in resolving investigations related to banks’ roles in the subprime mortgage crisis. [More]

CFPB Orders Mortgage Company To Pay $2M Penalty For Deceptive Advertising & Kickbacks

The Consumer Financial Protection Bureau continued its ongoing crackdown of companies deceptively marketing products to U.S. veterans by ordering NewDay Financial, LLC to pay $2 million and revamp its business practices. [More]

Wells Fargo, Chase To Pay $35.7M For Allowing Illegal Mortgage Kickbacks

Federal law prohibits giving or receiving kickbacks in exchange for a referral of business related to a real-estate-settlement service, but for four years a now-defunct title company in Maryland provide cash, marketing materials and consumer information in exchange for referrals. And now the banks have agreed to pay more than $35 million — including $11.1 million in redress to affected consumers — for their sins. [More]

HSBC To Customers: Merry Christmas, Pay Your Mortgage Or We’ll Take Your House

Holiday greetings generally contain salutations of thanks and wishes for a happy season. A note from HSBC hits all of those points, but then tacks on a quick threat you’d expect from Scrooge: pay us, or we’ll take your home. [More]

First-Time Homebuyers May Only Need 3% Down Payment, But It Won’t Be A Cakewalk

In October, the director of the Federal Housing Finance Agency announced that the regulator had reached a deal that would allow bailed-out mortgage-backers Fannie Mae and Freddie Mac to sign off on loans with down payments of less than 5%. Today, Fannie and Freddie revealed more details on what it would take for home buyers to be eligible for the reduced requirement, and getting one of these loans won’t be as easy as filling out a form. [More]

CFPB: Mortgage Lender Must Refund Consumers $730,000 for Steering Them Into Costlier Mortgages

Taking out an expensive loan is often the only option when it comes to financing a new home. And while most prospective home buyers might expect their mortgage lender to find them the best deal, that isn’t always the case. Take for example a California-based mortgage lender being ordered to provide $730,000 in consumer redress for an illegal compensation system that offered bonuses to employees for steering borrowers into higher interest loans. [More]

Indiana Woman Lived In A House For Eight Years Without Ever Having To Pay For It

The luxury of not having to pay rent or a mortgage payment every month might seem like some kind of fever dream, obtainable only by those scant few who make the rest of us uncomfortably jealous, but one woman in Indiana managed to pull it off not just for a few months or even a year — but for eight years. [More]

3 Things That Won’t (Or At Least Shouldn’t) Affect Your Mortgage Pre-Approval

Anyone who has ever filled out a mortgage application with a bank or broker knows that there are a lot of questions you have to answer about your current assets, income, etc. There are a few things that seem like they might factor in — negatively or positively — to the approval process, but which can’t be used in determining whether or not you’re eligible for a loan. [More]

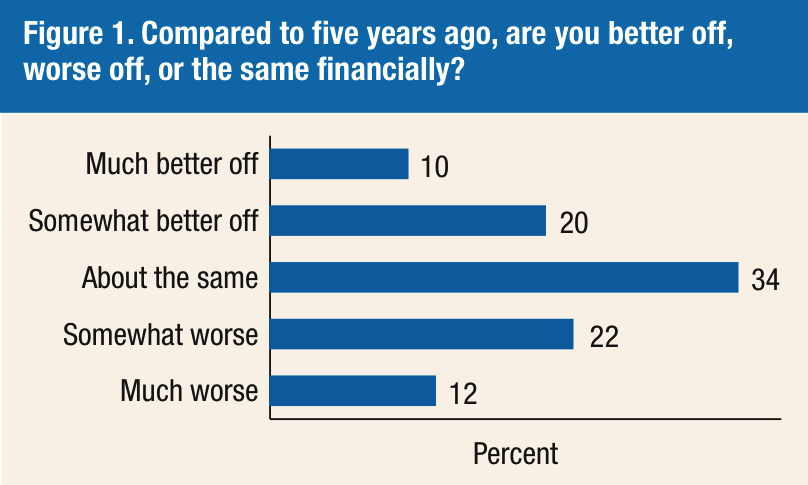

1-In-3 Americans Still Feeling The Sting Of Recession

While many Americans are now doing better than they were during the Great Recession, those dark days took such a toll on many consumers’ savings that some people who are currently doing well enough to pay the bills and enjoy a decent living aren’t able to make necessary longterm investments, like buying a new home or saving for retirement. [More]

Feds File 9 Lawsuits Against Alleged Mortgage Relief Scammers That Took Millions From Consumers

If the thought of losing one’s home wasn’t bad enough, finding out that you’ve been ripped off by the companies promising to help must be even worse. Today, the Consumer Financial Protection Bureau, along with the Federal Trade Commission and 15 states announced a string of lawsuits and other actions against such deceptive companies. [More]