Plans are in the works to dismantle Fannie Mae and Freddie Mac, and that could mean that what many Americans had assumed came fourth after “life, liberty and the pursuit of happiness,” the 30-year mortgage, could be on the outs. [More]

mortgage

Woman Fights Foreclosure For 25 Years

This lady has been successfully fighting off foreclosure for twenty-five years, pulling out every trick in the book along the way. But her winning streak may be drawing to a close. [More]

Like Being Single? That'll Be $388,059, Please

According to a British price comparison website, the cost of being single from 22-75 (in the UK) is £254,082 or $388,059. The extra expense comes from having to carry mortgage, holiday costs, insurance premiums and utility bills alone — do they not have roommates in the UK? [More]

Should You Have a Mortgage in Retirement?

A growing personal finance debate centers around whether or not individuals should have a mortgage when they retire. A surprising number of retirees maintain a mortgage — 4 in 10 in 2007 — but is this good financial management?

Why You Should Pay Off That Mortgage Before You Retire

If you planned on retiring soon you’ve probably had to readjust your expectations. But even if you’re still on target to take it easy soon, you should reconsider until you’ve paid off your mortgage.

Let's Perma-Ban Consumer Predators

Regulating consumer predators is a bit like Whac-a-Mole. No matter how many times you put the bad guys out of business, they keep popping up again and again. Maybe it is time to consider a lifetime ban from financial services for the worst offenders. The Consumer Financial Protection Agency proposed by the President may be just the right watchdog for the job of handing out such banishments.

Renter Forced To Move Out Of Foreclosed House, Can't Get Security Deposit Back

Silpa had the bad fortune of renting a house from a deadbeat owner who let the property go into foreclosure. Now that $2,200 security deposit could be lost forever amid the turmoil. Silpa’s story:

Wells Fargo Will Let You Refinance For No Closing Costs Online

If you’re saddled with a Wells Fargo mortgage, now would be a good time to slash your rate and payment through little effort by hitting up the bank’s streamlined refinancing program, which under certain circumstances lets you refi without being gouged for closing costs.

What's This "Public-Private Partnership" Mean?

So the latest solution to the problem of these toxic assets on the banks’ books is a “public-private partnership” between the government and the private sector…yawn what is he going on about, I wish I had a pancake…oh wait! Here’s Paddy Hirsch from marketplace drawing stick figures on a whiteboard and explaining it all. Now we’re talking.

Faces Of Foreclosure: The Nonagenarian (He's 92.)

Our sister publication, Consumer Reports, put together some video interviews with people who, for one reason or another, are facing foreclosure. They are the human side of this financial meltdown.

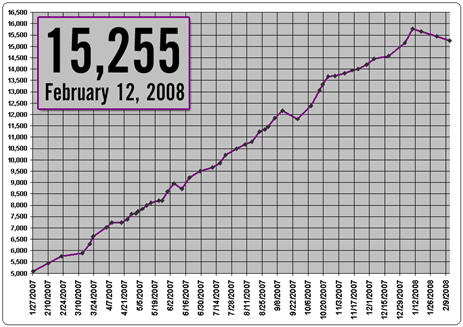

Countrywide Home Loans Has Over 15,000 Repossessed Properties For Sale

The Countrywide Foreclosures Blog keeps a running tally of the amount of repossessed or REO (Real Estate Owned) properties Countrywide has for sale on their website.

86,000 Mortgage Related Jobs Cut In 2007

A new study says that 86,000 mortgage related jobs were cut due to the weakening housing market, says CNNMoney. Diabolical mustache-twirling evidence-forging lender Countrywide unburdened itself of the most workers, cutting 11,665.

../../../..//2007/12/17/fewer-borrowers-will-qualify-for/

Fewer borrowers will qualify for mortgage insurance, due to tightened restrictions following the subprime…

Use Online Real Estate Broker, Get Back 2/3 Of The Sales Commission

A contributor to Kevin Kelly’s “Cool Tools” site writes that they saved $15,000 on a recent home purchase in California by using Redfin, an online real estate broker that lets you do most of the grunt work of finding a new house, then steps in to help with the paperwork at the end for a greatly reduced fee. We’ve discussed Redfin before, but thought it was interesting to read a user’s personal experience with it.

Interactive Map Of Global Credit Crisis

Now you can follow the subprime meltdown around the world with this handy interactive graphic from Financial Times. It’s grimly amusing to click the “show all” radio button and then drag the slider back and forth from “Pre-Jun 25” to “Week of Aug 6”.

What To Do If Your Mortgage Lender Goes Bankrupt

Panic! Burn down your house! Ha ha, just kidding. Actually, you shouldn’t let your mortgage lender’s death pangs interfere with your payments, says Gerri Willis of CNNMoney, because your loan will just be sold to another lender. However, make sure you review the details of your mortgage agreement; the terms should remain the same no matter who buys your loan, and you have a 60 day grace period to get your payments to your new mortgage lender.