In an unprecedented move, the SEC warned S&P that it might be suing it over its rating of a mortgage-backed bond. It’s the first warning a credit rating firm has gotten over its behavior leading up to the financial crisis. [More]

mortgage meltdown

Freddie Mac Tells Bargain Hunters To Buzz Off

Just because Freddie Mac has a glut of properties on its hands, buyers can’t expect Costco prices. Most of the buyers approaching Freddie have been looking to buy at 40-60% off of market price, like the final weeks of a Borders liquidation sale. Instead, Freddie is sending them back this letter which says sorry, we’re only taking less than 10% off. [More]

With Only $37,000 Left On Mortgage, House Gets Foreclosed

They only had $37,000 left to go on their mortgage they’d been paying off for 25 years, but now a California family’s house is going into foreclosure. [More]

Investigation: Banks Took $6 Billion In Home Insurance Kickbacks

According to a HUD investigation, big banks raked in over $6 billion in a decades-long insurance kickback scheme that violated RESPA. [More]

"Foreclosure Factory" Draws Critics

It’s a one-stop foreclosure shop. Under one roof is a law office, title company, and auction house. They act as their own notaries and can foreclose. Its owner and several of his top attorneys are even VPs at the Mortgage Electronic Registration Systems Inc (MERS) which gives them the ability to transfer mortgages from owner to the other. The Boston Globe profiles a local law firm that has attracted criticism from homeowners and consumer advocates for its vertically integrated approach to foreclosure that can speedily ride over homeowners who thought they were in the middle of working out a deal with the bank. [More]

Bank Tries To Foreclose On Gas Station Owner For Being One Day Late With Mortgage Payment

A gas station owner in Florida’s monthly mortgage payment bounced on October 12th. The next day he put the money required into the bank account. In November and December he tried to make his mortgage payments as normal, but BB&T wouldn’t take his money. 10 months later, they still won’t take it. Instead, they want to foreclose on his gas station. All for being one day late. [More]

BofA Bulldozing Foreclosed Homes

Now here’s one to reduce the oversupply in the housing market. As the reluctant owners of vast amounts of foreclosed and abandoned houses it can’t sell, Bank of America is going to start bulldozing patches of them. [More]

Four Charged In Alleged $2.5 Million Reverse Mortgage Racket

For their victims, the phone call sounded like salvation. Seniors, living on a fixed income and having trouble with the bills, they were glad to hear someone offering them a reverse mortgage that would allow them to turn the equity in their house into cash. But the four mortgage professionals charged with perpetrating a $2.5 million reverse mortgage fraud scheme are anything but angels. Their aftermath has left those who signed up with them impoverished and close to foreclosure. [More]

Retiree Loses Everything After Bank Mistakes His House For Foreclosure

An eighty-two year old Tampa Bay man has lost everything he owns, including pictures of his dead wife, after a clean-out crew hired by Bank of America mistook his house for the foreclosure next door. [More]

Will Take NY 62 Years to Get Through All The Foreclosures

At their current pace, it will take New York State lenders 62 years to repossess all the houses currently in foreclosure or severe default, NYT reports. That’s good news for some homeowners looking to get a break while they try to get out from behind the eight-ball with their debts. Some of them could even be dead by the time the house repo man comes to collect. [More]

Court Threatens BofA Bank Manager With Jail Over Foreclosure

A Bank of America bank manager could end up in jail if the bank doesn’t demolish a fire-damaged eyesore, a Georgia court has warned. [More]

Class Action Suit Against BofA For Deceptive Loan Mods Goes National

Olly, olly, oxen, free. A class action lawsuit against Bank of America claiming they were less than above board with their loan modification practices has been certified for national participation. [More]

Dumping 2nd Mortgage Through Bankruptcy Is No Cake Walk

For anyone considering getting rid of their second mortgage in the manner described in yesterday’s post, bear in mind that it is by no means a painless process. One of our readers is a staff attorney for a Chapter 13 bankruptcy trustee, and he writes in with more details about what this process entails. [More]

Homeowners Exploiting Bankruptcy Loophole To Dump 2nd Mortgages

Some homeowners are taking advantage of a little-known loophole in the bankruptcy law to get rid of their second mortgage and also avoid the pain of foreclosure, reports the San Jose Mercury News. Here’s how it works: [More]

Regulators Hatch Plan To Pay Back Victims Of Bad And Illegal Foreclosures

It’s no secret that foreclosures in America have been a royal mess. Missing paperwork, faked documents, turbo-charged courts that just rubberstamp foreclosure orders, robosigners, the list goes on. Along the way, a number of homeowners have gotten foreclosed on improperly and, in some cases, even illegally. So regulators are putting together a plan for grand-scale recompense. They’ve laid down decrees that servicers have to start following the law, for really reals this time, banks need to hire outside firms to review their foreclosure actions between 2009 and 2010, and then pay back their victims. [More]

Bank Gives Failed Flipper Foreclosed House For Free

A guy who deserves no breaks at all, a speculator who jumped onto the house-flipping craze just before the music stopped, just got a huge one. Instead of making the final stroke to finish foreclosing on his house, the bank decided to write off the loan and just give it to him for free instead. [More]

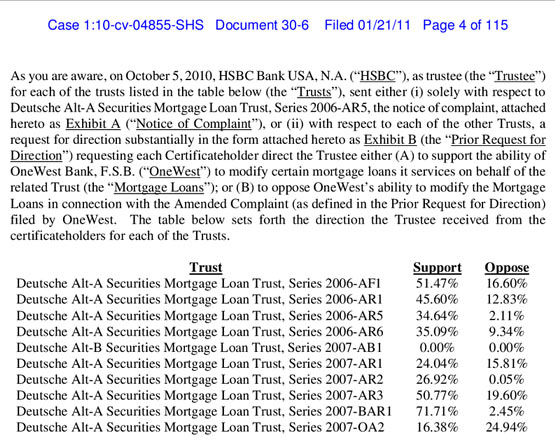

Middlemen Blocking Mortgage Mods

Homeowners trying to get loan mods often run into resistance by banks who say they’re powerless because they need to protect the interests of investors. But ProPublica reports a recent lawsuit uncovered a document where, when HSBC polled investors, a majority of those responding say they favored letting the loans being modified. [More]

17.45% Of Florida Homes Are Vacant

The latest Census Bureau results show that 17.45% of homes in Florida are vacant. That’s 1.558 million houses sitting there soaking up the sun. Florida’s housing bubble was one of the hottest and now their vacancy rate is the highest. [More]