Dollar stores: Where the deals are [MSN Money] “When it comes to stretching your money, these discounters deliver. But be careful: Some of the stores’ products are no bargains.”

— FREE MONEY FINANCE (Photo: donbuciak)

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

Dollar stores: Where the deals are [MSN Money] “When it comes to stretching your money, these discounters deliver. But be careful: Some of the stores’ products are no bargains.”

— FREE MONEY FINANCE (Photo: donbuciak)

Asking for a discount. Negotiating for a better price. Haggling. No matter what you call it, the concept is the same: working to get a seller to let you pay a lower price for a good or service than what was initially offered. The Digerati Life encourages shoppers to negotiate on price and offers the following tips (including a story about getting a discount at Home Depot) to make the most of the process:

302-255-3704 – Rick Roberts direct dial

Getting slayed by your bills? Gizmodo has a good roundup of how to save money by ditching your landline and tv, and renegotiating your monthly service rates. It’s recap and refresher for expert Consumerist readers, but a nice compendium of tactics that can get you started saving money today.

Last week, New York Times personal finance columnist Ron Lieber discovered that his family’s financial planner was being investigated for fraud, because millions of dollars had been transferred out of clients’ accounts without authorization. What’s funny is Lieber found the financial planner while writing a column on how to comparison shop for one.

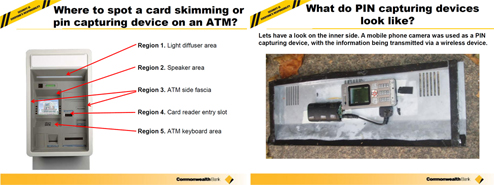

Here’s a 24-page PDF of a powerpoint on ATM skimmers that’s making the rounds in Australia. If you’ve been reading every ATM skimming post, most of this is review, but it contains several more examples of what skimmers can look like and what to watch out for. Though it’s from an Australian bank, most of the information is general enough to apply to any ATM. A handy document to pass around to friends and family to warn them about ATM skimming dangers.

How do ATM skimmers work? This clip from UK show “The Real Hustle” shows you, from start to finish, how scammers steal your card info and take out money themselves. (Thanks to bonanzaone!)

Did you have a few brews and decide it’d be funny to light cigars by burning $100 bills? If you have at least half of it left, you can get it replaced. Here’s how.

Having a baby soon? Congrats! Now you can begin the 18-year process of saving for college (not to mention the even more costly option of paying for their upbringing.) Luckily for you, the New York Times has a simple formula that makes the saving process as painless as possible, requiring only small sacrifices (over a long period of time). They dub the approach “20-20-20” and it goes like this:

This is the format for email addresses at Capital One: firstname.lastname@capitalone.com. Cheers.

What if you don’t have enough money to pay your taxes right away? There are several options. For starters, you can request a payment extension of up to 120 days after filing to pay in full without penalty. By June, if you haven’t paid yet, the IRS will send you a bill and assess a small penalty and start charging interest. For $105. you can also set up an installment plan and pay a little bit each month with each paycheck. Set that up online here. Just don’t blow it off entirely, the IRS are a lot more tenacious than BMG.

They say the only two certainties in life are death and taxes. Only one of these can be cheated, and that’s the one they’ll dress you up in horizontal stripes for. Some scammers promote schemes that they say you can use to get out of that one, but they’re just as legit as the Floridian Fountain of Youth. So, don’t be a Ponce (de Lion), and watch out for what the IRS calls the “Dirty Dozen” tax scams:

Bwahhhh! The Tax Man cometh! Here are 16 red flags to watch out for. If you wave them, it will be like if you called up the IRS and said, “Hello? IRS? I’d like you to come audit my sorry ass six ways from Sunday. Here’s my address.”

If you’re not done with your taxes, don’t worry, just get an extension. Just send in IRS Form 4868 and you’ll get 6-months to send in your paperwork. However, you still need to send in 90% of your total tax due otherwise you’ll get fines. If you’re getting a refund, then no sweat, just send in your extension. Don’t feel too bad about not having it together in time, either; according to the IRS website, form 4868 is their most requested document.

From what I’ve seen online, if I take it to a bank, they might take it, but of course I won’t be compensated. Should I turn it into the police? What should I do with it? I don’t really want to just pass it along.

You guys are some thrifty freakazoids. We asked you to submit your money-saving secrets and you dumped like 35 elephants on our heads in comments and emails. We’ve trimmed that down to 112 . Here they are! Enjoy your savings.

It’s no surprise that a popular purveyor of work-suitable vestments suck lowered a reader’s friend’s store credit-card limit, but to go from $1000 to $100, that’s cold, Banana Republic. Danielle writes:

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.