It may not feel like it, but it turns out that you are paying really low taxes right now, the lowest in 60 years, in fact, according to a new analysis of Federal data. [More]

money

Dow Jumps 400 On Euro Stimulus Loan News

Got whiplash? US and global indexes jumped on Monday, responding to news of a $1trillion European loan package to staunch their debt crisis. The rally reinstated the gains erased by a panicked sell-off driven by concerns that Greece’s debt crisis would infect other markets. [More]

BoA Sued For Taking TARP $ But Not Helping Foreclosures

A class action lawsuit has been filed against Bank of America for taking $25 billion in federal TARP bailout money but intentionally failing to live up to its part of the bargain. The deal was that banks were supposed to use use the money to allow struggling homeowners to reduce their payments to affordable levels. “Bank of America came up with every excuse to defer the Kahlo family from a home loan modification, from stating they ‘lost’ their paperwork to saying they never approved the new terms of the mortgage agreement,” said the plaintiff’s attorney. “And we know from our investigation this isn’t an isolated incident.” Bank of America declined to comment.

Washington homeowners file class action against Bank of America [Seattle PI]

Top 7 Legalized Ripoffs

We busted the trusts! Oil! Rail! Coal! Kapow! You just got Tafted! Yeah, but that was a century ago. Industries have had more than enough time to mutate and adapt, especially when it comes to technology, and figure out new anti-consumer ways to develop and maintain hegemony. You get higher prices, lower product quality, and fewer rights. They get more yachts to waterski behind. In no particular order, here are some of the top 7 legalized ripoffs consumers face today: [More]

Test Your Credit Card IQ

So you think you’re pretty smart with your credit know-how? Got a good credit score and line of credit? Well here’s another number to watch, your credit card I.Q. Take this 10 question test and see how you stack up. Even I got a few of these wrong. For instance, “The typical American carries a balance of about $5,500 in credit card debt. If you make no more charges and pay only the minimum payment each month, how long will it take to pay that debt off at 19 percent interest?”

10 questions to test your credit card I.Q. [Philly.com via LowCards.com]

VIDEO: VISA Is A Monster That Feeds On Human Wealth, And VISA Is Hungry

“Go. Get it. Run. Use your VISA card right now. It doesn’t matter what you use your VISA card to buy. It doesn’t matter what you use your VISA to buy. All that matters is that VISA is a monster that feeds on human wealth. And VISA is hungry.” The credit card companies’ rapacious desire for your debt is laid bare in this commercial parody video. I guess you would call what we’re going through now the purging stage? NSFW due to naughty words and suggestive simulating gestures. [More]

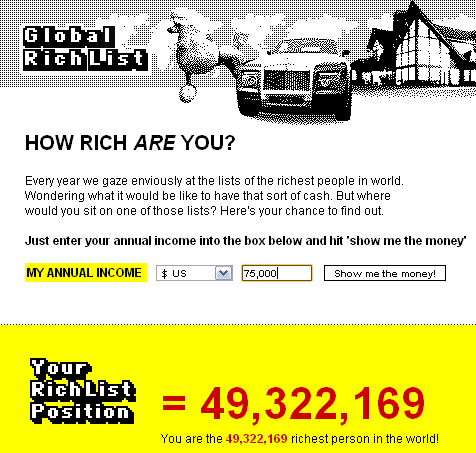

How Rich Are You, Really?

It’s not enough just to have money. You need to know how your money stacks up against others’. Are you making a lot or a little compared to most people? How many people are ahead of you, and how many behind? A free fun little online tool called the Global Rich List is here to help. Just type in your salary and it will tell you your rank in the entire world. For instance, a salary of $75,000 and you are the 49,322,169th richest person in the world. Not bad, eh? Sure, but the guy who is the 49,322,168th has it so much better.

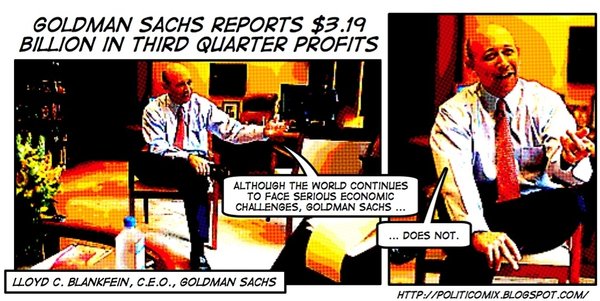

Goldman Riskier Than Citigroup

Bond markets slammed Goldman Sach this week, making the firm pay more for cashizzle then even the bailed-out Citigroup. Goldman’s yield rose to 2.79 percentage points over Citigroups’ 2.29. At the end of March, before the legal and regulatory headaches began, Citigrouop’s spread was wider than Goldman’s by .45 percentage points. Higher yields on debt usually indicate a higher risk of default or other negative credit events. Concerns continue to mount over how long and how deep the firm will be tainted by the SEC’s civil lawsuit and the investigation by federal prosecutors, and what other skeletons the scrutiny might shake out.

Blankfein’s Bonds Are Riskier Bet Than Pandit’s: Credit Markets [Bloomberg]

Banks Gone Amok, Unlawfully Foreclosing

“Darnit, where was that mortgage modification paper? I knew I put it somewhere. Oh well, let’s just foreclose on these people’s house. STAMP! Whoo, that was tough. Time to treat myself to a Diet Coke.” That’s an imaginative reenactment at what’s going on inside the mortgage departments of the biggest banks in America: total disorganization, the right hand not knowing what the left is doing, a bureaucratic and document-strewn nightmare that can swallow up people’s homes right from under them. [More]

Personal Finance Roundup

The Best Time to Buy Guide for 75 Products and Services [Go Frugal Blog] “Before you make another major purchase, check with this guide to know when the best time to buy is.”

5 Savings Tips for Soon-to-Be Retirees [Smart Money] “Here are five ways to boost your retirement savings — even later in life.”

Simplify Your Financial Life [Kiplinger] “Now is the perfect time to do some financial spring cleaning, from tossing old papers to digitizing important documents.”

How Much to Donate? God Knows [NY Times] “Of the $229 billion that Americans donated in 2009, about half went to religious institutions.”

Cash Provides a Cushion [Wall Street Journal] “People who lose their jobs often think about using a severance package to pay off debts. Instead they should focus on conserving cash.”

Death And Taxes 2011: Gobsmacking Visual Of Where All Your Tax Dollars Go

Death and Taxes 2011 is here! Jess Bachman is famed for his annual poster where he spends two months researching and creating a visual representation of where your taxes go. The result is a stunning six-foot poster that boggles the mind. Now in it’s 4th year, the poster has over 500 departments, agencies, programs, and whatever else the government can spend money on. “It is still the single most open and accessable record of government spending ever created,” says its creator. After the jump, here is this year’s version in full! [More]

We're Finally Saving The Economy By Spending Too Much

Back in the early days of the recession, circa 2008, people were nervous about the future, and decided to start saving more of their money instead of just spending it. That brought personal savings rates up to over 5% by last year. But after hearing for months that the recession is over, consumers are apparently starting to believe it — especially when numbers show the economy growing by 3.2%. Savings rates are down to about 2.7%, and consumer spending is up by 0.6% as of March. Unfortunately, incomes are only up 0.3%, so plenty of people may be helping the economy grow by spending more than they earn. Thanks, guys! [More]

BoA Debt Collector Tells You How Not To Be A Deadbeat

A shadowy figure emerges from even darker shadows to reveal the umber-colored world that is the Bank of America Collection department. It is a place so fell that it cannot be even spoken of directly and is instead referred to as “Customer Assistance.” A cruel joke? Perhaps. “I never expected to be working for such an evil company. but they were the only ones hiring,” says our tipster who has some tough-love advice for all you deadbeats out there so he doesn’t have to call you up and demand your money. Because he will find you, and he will get you. [More]

Join The 24 Hour Fitness Class Action Lawsuit

If 24-Hour Fitness kept charging even after you cancelled, you might be eligible to join a class action lawsuit against them. You can join if you were debited between Oct 2, 2002 and Feb 28, 2010. You could get $20 back, or, in a perhaps ironic twist, a three month gift certificate to 24-Hour Fitnesss.

Friedman, et al. v. 24 Hour Fitness USA [via Top Class Actions]

Feds Said To Be Opening Criminal Investigation Of Goldman

As if Goldman Sachs didn’t already have enough problems with the SEC’s civil probe of the firm and senators screaming at execs about the “shitty deals” offered to clients, word is out now that federal prosecutors are investigating the company. According to reports out this morning, the investigation is just starting up, and no charges have been made against the company.

10 Coolest Secret Safes

Safes are handy for safekeeping stuff you don’t want other people to get, like money. The only problem is most look so “safey.” Given enough time, any of them can be broken open. The best solution is if the robbers can never find it in the first place. No, that fake-bottomed can of Campbell’s Soup in your closet isn’t going to fool anyone. To this end, Budgets Are $exy has rounded up “The 10 Awesomest Safes I’ve Ever Seen.” They have a surge protector safe, bread safe, and dirty underwear safe, but my favorite is the iceberg lettuce safe. [More]

Personal Finance Roundup

How to Ask for a Raise [Free Money Finance] “Here are some steps to take when asking for a raise.”

How to appeal your tax assessment [MSN Money] “Now that home prices are sinking, your tax bill should be shrinking, too. If it hasn’t, take action.”

5 Cost-Saving Tips for Moving Time [Kiplinger] “Decamp mid month and other ways to save without schlepping it yourself.”

Penny-Pinching Is Fine, but It Won’t Save the Profligate [NY Times] “Perhaps, despite common wisdom, the small ways to save don’t really help us. They can even hurt us by fooling us into believing we are making genuine financial changes when we’re not.”

20 ways to save green by going green [Smart Spending] “Retailers offer discounts for eco-friendly practices, but savings can be slim.”