When it comes to spending on munching and swigging, how do you think your city stacks up? Bundle crunched the numbers and turned it into a plump and juicy infographic, served up piping hot inside… [More]

money

Wait Until You're Dead To Pay For Your Funeral

You’re gonna die. Why make your family suffer even more by burdening them with the cost of your funeral? That’s the pitch made by companies that try to get you to pay for your funeral years in advance. But, in most cases, you’re better off putting your money into normal savings accounts or life insurance instead.

FTC Shuts Down Bogus Credit Card Robocallers

Three companies that made claims that they could help consumers reduce their credit card interest rates — and then charged fees of up to $1,590 — have been shut down by the Federal Trade Commission. “The last thing debt-ridden consumers need is to be deluged by illegal robocalls – especially when all the calls are offering is a scam,” said FTC Chairman Jon Leibowitz. [More]

Credit Card Limits Going Lower, Rates Staying High

A FICO survey of risk officers at various financial companies found that they overwhelmingly agree that credit cards are going to get even crappier for consumers in the coming months. 83% said that card limits are going to go lower. 95% said that interest rates could go higher or stay at the currently high levels. Just two more reasons to cut the plastic. [More]

What Should I Do With My Stacks Of Chinese Currency?

Greg has a question for the world travelers and expats who are part of the Consumerist hive mind. He writes that he has about $2,000 worth of Chinese yuan, in cash, from his first year as a teacher in China. He’s back visiting the US for a few weeks, and can’t figure out what to do with his giant pile o’yuan. [More]

What's In The Financial Reform Bill?

Now that the Senate has passed the financial reform bill, it’s off to non-smoke-filled rooms, where it will go into a Blendtec with the version passed by the House last year. CNNMoney.com sifted through all 1,600 pages of the bill and came up with a handy cheat sheet explaining what’s actually likely to change when this thing becomes a law. [More]

Financial Reform Bill Heading To Final Vote

Despite opposition from most Republicans and a couple of liberal Democrats, the Senate today reached the 60 votes needed to block a filibuster threat, clearing the way to bring the financial reform bill to a final vote. In the 60-to-40 vote, Democrats were joined by three Republicans, including freshman Senator Scott Brown of Massachusetts. [More]

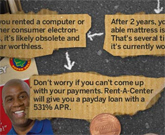

Rent-A-Center Responds To Predatory Lending Infographic

Sonia, Rent-a-Center’s Public & Community Affairs person, saw our popular post, “How Predatory Lending Works, From Payday Loans To Rent-To-Own” and has a rebuttal that shows how they do math. I showed it to Jess, the creator of the infographic, and he has a rebuttal to the rebuttal. Let the chips fall where they may: [More]

Personal Finance Roundup

The Ten Worst Money Mistakes Anyone Can Make [Free Money Finance] “You must avoid the financial pitfalls that can significantly derail your finances. Here they are along with some suggestions for avoiding them.”

5 Questions Couples Should Ask in the Money Talk [Wise Bread] “If you are thinking about living with someone or getting married, sit down as a couple early on and ask yourselves the following questions.”

71 Ways to Save on Taxes Now [Kiplinger] “Don’t wait until you file your return to find ways to lower your tax bill. These moves will help you save throughout the year.”

Solve your health care challenges [CNN Money] “Try these strategies to cure what ails you when it comes to getting and paying for medical care.”

A Toolkit for Women Seeking a Raise [NY Times] “A new study concludes that women need to take a different approach than men.”

Some Homeowners Worse After Getting Rushed Into Gov't Loan Mod Program

Despite fulfilling every obligation under trial government-sponsored loan modification programs, some homeowners can end up far worse off than if they had never joined up at all, Propublica reports. That’s because if they’re denied a permanent modification, they have to pay the entire amount that was being discounted, often within a very short period of time. This pushes already strapped families past the breaking point. [More]

Senate Bill To Curb Credit Card Swipe Fees Passes

The bill to curb credit card fees that was being floated last night ended up passing. Credit card industry stocks fell Friday on the news. [More]

Gold-Dispensing ATM Converts Pesky Cash To 24K Bars

Next time you’re in Abu Dhabi and have to get some gold in a hurry (and we’ve all been in that situation, right?), you can just drop in to the Emirates Palace hotel, pop a few bills into the ATM and walk out with gold bars. The machine, Gold To Go, monitors gold prices and automatically updates its pricing every 10 minutes. [More]

Personal Finance Roundup

How to find a car’s ‘real’ price [MSN Money] “Actual dealer cost is elusive, and the ‘invoice price’ is just one clue. But you can get an idea of dealer cost, and that will help in negotiating the price you pay.”

Seven Easy Steps to Your Dream Job [The Simple Dollar] “Pretty good advice for any “dream job” a person might have.”

We’re flunking personal finance [Washington Post] “The financial teaching grade is in for teachers — and it’s not good.”

Social Security: Get to know your options [Vanguard] “Your personal circumstances—such as whether you have other savings or sources of income—can affect the path you’ll take.”

How to Appraise Home Appraisers [Wall Street Journal] “A low appraisal is one of the more common reasons that transactions fall apart these days.”

CR Index: You're Buying More, Less Worried

Consumer Reports is out with the latest edition of its economic-health tracker, the CR Index, and the news is generally positive, with gains in jobs and consumer spending, and declines in stress. But that doesn’t mean it’s time to break out the bubbly: “We are seeing modest improvements across our indices since April, which demonstrate that consumers are starting the long slog out of this historic recession,” said Ed Farrell, a director of the Consumer Reports National Research Center. “But a full recovery will require a substantial period of growth for consumer confidence to fully take hold.” [More]

How Predatory Lending Works, From Payday Loans To Rent-To-Own

You’re a savvy, savvy consumer. You pay your credit card bills in full every month, auto-deduct a generous portion of your paycheck into savings, invest in index funds, and always make sure you’re getting the best deal from your cable and wireless providers. Unfortunately, some of your brethren do not read Consumerist and can get caught up in the jaws of predatory lenders, wasting limited cash on things like payday loans, bad credit cards, and using rent-to-own stores. So let’s take a walk down the wild side and see how each of these bad choices work, in a giant infographic, courtesy of Mint and WallStats, after the jump. [More]

How Consumerists Are Saving Money With Consumerist

Consumerist readers are saving money left and right using tips and techniques they learned about here from posts and from other commenters. Here’s just a few a few of the ways they’re able to hold onto more of their hard-earned cash: [More]