Over 80% of credit reports have errors on them, errors which could be lowering your credit score and keeping you from getting credit or paying more for it than you should. Here’s how to fix them: [More]

money

Book On Tuesdays, Fly On Wednesdays

Looking to save money on airfare for that fun summer getaway? The best time to buy an airline ticket is Tuesday around 3pm, and the best time to fly is a Wednesday. Why? [More]

Personal Finance Roundup

10 Things 401(k) Providers Won’t Tell You [Smart Money] “#1. We’re making money on your 401(k) — even if you’re not.”

10 common car-buying mistakes [MSN Money] “Before you step foot in a dealership, arm yourself with these tips. If you don’t, you could be taken for a ride.”

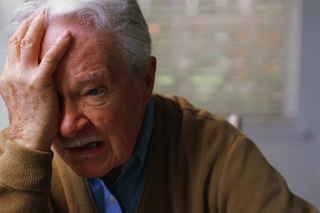

One in five older Americans a victim of financial fraud: survey [MarketWatch] “More than 7.3 million older Americans — one out of every five citizens over the age of 65 — already have been victimized by a financial swindle.”

How Not to Buy Too Much [Wise Bread] “You need to learn financial balance — spending wisely most of the time and treating yourself to the occasional Ferrari.”

Your Vacation-Home Checklist [Kiplinger] “These nine tips can help buyers keep expenses under control.”

Hunt Down Your Credit Card Contract Online

Hey, you can now look up your credit card contract online. There’s a searchable database over at the Federal Reserve that lets you check them out in both text and PDF form. [More]

10 Things To Know Before Buying A Condo

Before you jump into buying a condo, there’s 10 questions you should know the answer to: [More]

25 Inspirational Money, Career Blogs

Man vs. Debt, itself one of the finer personal finance blogs I’ve come across, has put together a list of 25 money and career-obsessed sites that aim to drive you toward financial and workplace bliss. [More]

Five Questions That Could Reveal Elder Fraud

Scam artists steal $2.6 billion from the pockets of unsuspecting seniors every year. To make sure your parents and grandparents aren’t one of the victims, ask these five quick questions. [More]

POLL: How Much Debt Do You Have?

Let’s play a fun game. I’ll show you mine if you show me yours. Debt, that is! [More]

Banks Luring You Into Signing Back Up For High Overdraft Fees

Banks are mad they can’t just automatically charge you a $35 overdraft anymore if you happen to try to buy a candy bar without enough cash in your account. Newly enacted legislation says they have to get you to opt-in to such overdraft programs. So, what they’re doing is renaming the overdraft programs something else, making them sound awesome, and then blitzing your mailbox and inbox with up-sells. Some banks are even calling people up! [More]

Unpublished Phone Number For Bank of America Online Banking Support

If you need to reach phone-based support for your Bank of America online account, it might be hard. You won’t find the number listed anywhere on their site. But we’ve got the unpublished number: [More]

Credit Cards Limits Reduced Based On What You Bought, Where You Bought It

New insight into how the credit card companies have been secretly judging us all has emerged in a new Federal Reserve report. From Nov ’06-Nov ’09, some credit card companies admit to using more than just the usual income, credit and repayment history to evaluate if they should reduce your line of credit or raise rates. Yep, they’re looking at where you shop. [More]

Personal Finance Roundup

10 Unusual Ways to Save Money Now [US News] “Here are my suggestions to take savings to the next level.”

The costly secrets in your 401k [MSN Money] “Paying as little as 1% extra in fees can mean thousands less for retirement. So why is figuring out what you’re paying for your plan almost impossible?”

Five Big Ways You Need to Think About Christmas … Now! [The Simple Dollar] “Just a little bit of forethought right now can save you a ton of time, effort, cost, and heartache this December.”

15 most hated fees [CNN Money] “Stand up to the pesky charges — from checked-bag costs to retirement plan expenses — that bug you the most.”

4 Things That Are More Expensive Than You Think [Yahoo Finance] “The true cost of an item can often go unnoticed and consumers end up paying much more than they bargained for.”

How Card Issuers Sneak Around New Laws

Crafty credit card issuers aren’t going to let a little thing like the law get in the way of their profits. Nope, they’re finding creative ways to get around the pro-consumer CARD act and maintain their grip on your pocketbook. [More]

Obama Orders Govt To Pay You Via Direct Deposit

Now you can sit hitting refresh all day instead of looking out the window every 5 minutes to see if the red flag on the mailbox is down: the White House has ordered the government to switch to direct deposits for all payments to consumers. [More]

What's The Sickest Thing You've Ever Done To Save Money?

These twenty-somethings saved money by using paper towels as coffee filters, and, at one point, when there was only old spaghetti in the house, ate a spaghetti omelete every morning. What’s the weirdest, grossest, or sketchiest thing you’ve ever done in an attempt to squeeze a nickel out of a penny? [NYT] [More]

New Rules About Getting Paid When Airlines Bump You

Airlines routinely overbook passengers, resulting in passengers getting bumped and having their travel plans disrupted. Currently, you can get the full ticket price if you are bumped, or 2x the ticket if you’re not provided alternative transportation within a certain time frame to the next stop, up to a certain cap level. Newly proposed regulations would increase the amount passengers could get, but it’s not as simple as that. Airline expert Elliott has delved into the report to find out what’s being proposed: [More]

Why Can't I Ever Save Any Money?

So you got that bank account, you even were smart and made sure to get an online savings account, so you get that higher rate of return, but gosh darnit, it just never seems to get any bigger! [More]

Debtors Increasingly Thrown In Jail. Wait, What?

Did you know you can get thrown in jail for not paying your debts? Yes, in America, in the 21st century, debt collectors are effectively deputizing local police forces to collect on debts, manipulating the system and using your tax dollars to do their dirty work. [More]