../../../..//2007/06/27/6-regular-people-share-their/

6 regular people share their tricks for staying on within their spending limits.

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2007/06/27/6-regular-people-share-their/

6 regular people share their tricks for staying on within their spending limits.

If you’re trying to get your spending under control, try taking Bankrate’s 7-day budget challenge.

The rebate has mated with the gift card to produce a super-strain of super-sucky rebates. By adopting the gift card’s”dormancy fee,” your rebate’s value now shrinks over time. In many cases it’s only a few months before it starts to lose value, reports The Red Tape Chronicles. Some cards will even ding you for an activation fee, or charge you for checking your balance.

One time we had this huge credit card debt that we just let sliiiiiiiiiiide. When we finally owned up to it, the debt collector told us that the credit card company said we could just pay 85% of it if we paid it all at once.

Lately, thanks to our girlfriend’s initiative, we’ve been picking up extra cash whenever we go out of town by renting out our apartment.

Zen Habits has posted a simple guide to setting and achieving life goals, and we think it’s great. A lot of life goals have a personal finance aspect, and this guide can help you get yourself organized so that you’re not just dreaming of a the day where you have the things you want, you’re actively working towards that future.

“Credit Card Arbitrage” is when you take out a 0% balance transfer check from your credit card use it to make money. Here’s the basic gist of how to do it, and some of its dangers.

WSJ round up seven mind games people play that can have them short-changing their personal finances.

Why give the IRS an interest-free loan throughout the year? Instead, boost your monthly earnings by changing the amount of withholdings you claim. Kiplinger offers an easy 3-question calculator to help you figure out the right number.

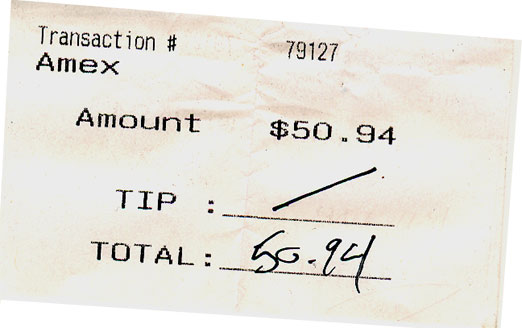

We do this little thing to protect against someone charging us more when we swipe with a card for a good or service that doesn’t require tip.

Reader and security researcher Nweaver has blogged the precautions he takes when managing his personal finances, from credit cards to debit to his brokerage account.

Our tip box is organized by complaint category. In the “banks” section, email after email starts roughly the same way, “I overdrafted my account and then a series of horrible events ensued.”

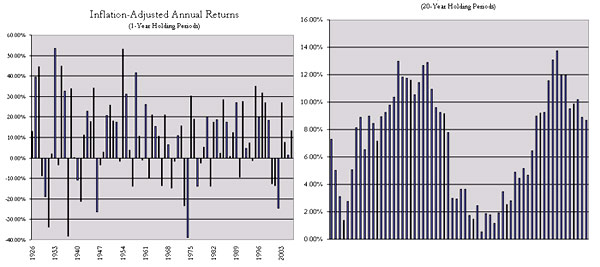

The longer you hold stocks, the better your inflation adjusted returns are, AllFinancialMatters demonstrates. For instance, compare the S&P 500 Annual Real Returns from 1926-2006 with a 1-year holding period vs a 20-year in the picture above.

Losing your wallet is a major drag but if you act quickly you can mitigate the fallout, writes The Mint Blog:

Social finance sites are evolving from utilities that track spending into resources that can provide useful, personalized advice. The sites allow anyone to anonymously upload and tag banking records and credit card statements and receive advice tailored to their particular financial situation.

Some of the sites, such as Wesabe.com and Geezeo.com, include many of the same features offered by popular software programs such as Intuit Inc.’s Quicken and Microsoft Corp.’s Money, such as the ability to track spending in different categories and from different sources in one place. But they also allow users to get feedback from peers that is tailored to their specific circumstances. Some allow users to rate the quality of other members’ tips or provide feedback on various products or services they’ve used.

Have you found the advice from social finance sites useful? Share your experiences in the comments. — CAREY GREENBERG-BERGER

Retire at 40: Here’s how [MSN Money] “Take 20% of your gross income every month, invest it in a balanced index fund and leave it there, then retire 20 years later with enough for a lifetime.”

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.