../../../..//2009/01/22/to-fix-the-economy-the/

To fix the economy, the Fed needs to lower interest rates below zero. Trouble is, that’s impossible. [Business Week]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2009/01/22/to-fix-the-economy-the/

To fix the economy, the Fed needs to lower interest rates below zero. Trouble is, that’s impossible. [Business Week]

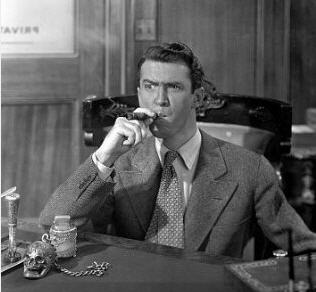

Merrill Lynch CEO John Thain spent over $1.22 million to renovate his office in early 2008, just as his firm was getting ready to slash thousands of jobs, cut back on spending and dump businesses. Here’s this douchebag’s big-ticket tally of personal aggrandizement in the midst of financial crisis:

People are cutting back from outsourced services and opting to do things themselves, like cleaning the house, walking the dog, making their own coffee, cutting their hair, or packing their lunch. Those who do say it saves money and gives a feeling of self-reliance. What have you started doing yourself lately that you used to pay people to do?

Vikram Pandit, CEO of Citigroup, announced today that the company would be split after reporting a net loss for 2008 of $18.72 billion. He also promised to put the money from the $700 bailout to work by extending credit to consumers and businesses… responsibly.

Marketplace’s Paddy “Sexycakes” Hirsch whips out the whiteboard to explain the how and why of the latest gimmick the Fed is deploying to ease the financial crisis. Now they’re making “bad banks” which will go buy the toxic assets from the banks so they can clean up their books. Hopefully over time these assets will mature past their heavily discounted value and the taxpayers can make money on the deal. But if the situation deteriorates and too many of the assets go to zero, as some indeed may, then we’ll be sitting on a big fat goose egg, again. Video inside.

If you thought oil speculators as the reason behind the historic gas prices spikes of this summer was debunked, think again. From ’07 to when the price of oil collapsed, supply increased and demand dropped. According to basic economic theory, this should’ve meant the price went down. But all of a sudden an influx of capital, an infusion that brought the total at play from $13 billion to $300 billion, brought to market by large investment bankers, exploiting de-regulation and trading in black box private exchanges made possible by Enron, drove the price of oil from $69 to almost $150. A new 60 Minutes report explores the issue. Video inside.

Against a a backdrop of cheery balloons, and exclamatory soap opera digest headlines, the signs at this Austin supermarket checkout lines read, “All job fairs have been cancelled until further notice.” Sign of the times, perchance?

Adolf Merckle, the 94th richest man in the world, committed suicide this week. Stock speculation is hazardous to your health. [NYT]

Gripped by “catatonic fear,” banks still aren’t thawing credit markets, “leaving taxpayers propping up an industry that won’t lend to them.” [Bloomberg] (Photo: The Joy of the Mundane)

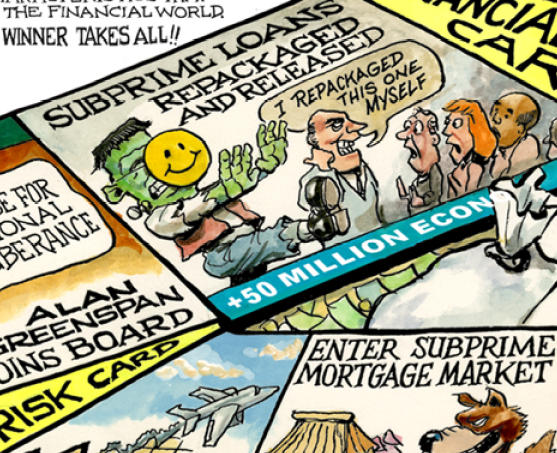

We think the idea of “Credit Crunch,” a print-it-yourself board game in this week’s issue of The Economist, is great. We’re not convinced it’s exactly cost-effective to print the board, cards, and money with your own equipment, though—as someone suggests in their comments section, maybe a web-savvy reader should create an online version.

The AP says that while last-minute shoppers are still out there looking for bargains — the holiday season was over long ago for retailers.

Even though real incomes are dropping and people are worrying about their jobs — a drop in gas prices has lead to a push in retail spending, says the New York Times.

It’s A Wonderful Life is a heartwarming classic film — but it now seems to have wrecked our economy. Whoops!

A study by the Associated Press says that executives at bailed out banks got $1.6 billion in salaries, bonuses, and other benefits — including cars, personal use of company jets, and country club memberships.

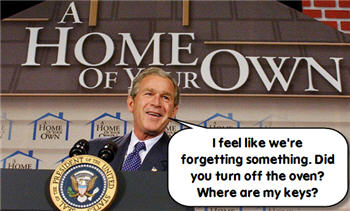

Former Treasury Secretary John W. Snow has told the New York Times that he, along with the entire Bush Administration, simply “forgot” that people had to be able to “afford their house.”

One of the conditions of the auto bailout is the elimination of private corporate jets. Guess they probably shouldn’t have flown them to Washington to ask for a tax payer bailout. Whoopsie!

President Bush has approved a $17.4 billion auto bailout, with $13.4 billion in emergency loans to prevent the collapse of GM and Chrysler and another $4 billion to be handed out in February.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.