When AT&T recently convinced the Supreme Court that a mandatory binding arbitration clause hidden deep in a customer’s terms of service contract was enough to keep said customer from joining a class-action lawsuit against the company, many of us predicted that a number of large companies would follow AT&T’s example, adding arbitration clauses to avoid expensive class actions. And it looks like Sony has opted to go that route. [More]

mandatory binding arbitration

AT&T: Mandatory Binding Arbitration Actually Benefits The Consumer

Earlier today, the Supreme Court ruled that it’s okay for companies to effectively preempt class-action lawsuits by putting mandatory binding arbitration clauses into their contracts with consumers. To most of us, that looks like a slap in the face to the American consumer, but the folks at AT&T want us all to know that the Supreme Court decision is actually going to benefit us all. [More]

Supreme Court Rules That Companies Can Block Customers' Class-Action Suits

In a huge blow to peeved consumers, the Supreme Court ruled earlier today that companies can block customers from joining together in a class-action suit by forcing each complaint into arbitration.

Mandatory Binding Arbitration Is Almost Dead

A provision buried deep within the recently passed Wall Street reform bill has the power to finally kill off mandatory binding arbitration, one of the more dangerous anti-consumer practices still sanctioned by law. While the bill includes a limited provision banishing arbitration agreements from mortgages and home equity loans, it also gives broad powers to the Securities and Exchange Commission and the new Consumer Financial Protection Bureau to kill off arbitration in all other consumer financial products. [More]

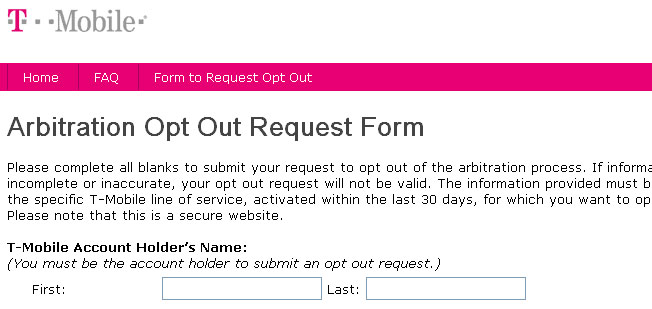

T-Mobile Fixes Broken Arbitration Opt-Out Site Our Reader Spotted

A little over two weeks ago, tipped by reader Chan, we told you about how buried in T-Mobile’s online terms and conditions is a way to opt-out of their mandatory binding arbitration clause, but unfortunately the website where you were supposed to do it was down. We gave their PR guy a heads up and now the site, www.t-mobiledisputeresolution.com, is online. [More]

You Could Opt Out Of T-Mobile's Arbitration Clause… If Their Site Wasn't Broken

Consumerist is no fan of mandatory binding arbitration, a clause in many consumer contracts that forces you to give up your right to sue in small claims court and have all disputes resolved by a professional arbitration firm that gets paid directly by the companies. So when I saw that there was an way to opt-out of T-Mobile’s arbitration clause online, I was stoked. Then I tried to go there, and the site was broken. Fail phone! UPDATE: T-Mobile Fixes Broken Arbitration Opt-Out Site [More]

JP Morgan Chase Yanks Mandatory Binding Arbitration Clause From Credit Card Contracts

In response to legal and political pressure, JP Morgan Chase is removing the mandatory binding arbitration clause from its credit card contracts. Customers will receive a new member agreement reflecting the change first quarter 2010.

Senate Protects Employee Rights With Forced Arbitration Ban

Yesterday, the Senate adopted an amendment that will prevent federal funding from going to any contractor that requires its employees to use mandatory binding arbitration, instead of court, for sexual assault and civil rights claims against the company.

No Arbitration For Halliburton Sexual Assault Case, Court Holds

A woman who was allegedly raped while working for Halliburton/Kellogg Brown & Root in Iraq will have her civil claims heard in court, not by a company-selected arbitrator, thanks to a ruling by the Fifth Circuit Court of Appeals.

USAA: Opt-Out Of Mandatory Binding Arbitration By Closing Your Account

The “credit union on steroids” has gone to mandatory binding arbitration for all disputes, removing customers’ ability to successfully sue them if things go wrong. Previously, USAA had arbitration as an option, but allowed members to opt out. Now, if you want to opt out of arbitration, you’ll have to close your accounts.

Credit Card Arbitration Cabal Implodes

The arbitration rollback continues apace! Last Thursday, JPMorgan Chase announced it won’t send disputes to arbitration and is rethinking putting the clauses in its consumer contracts. Coming on the heels of news that NAF and AAA will stop arbitrating consumer credit card disputes, Creditcards.com wrote, “Two more supporting beams have crumbled and now, with astonishing speed, the entire edifice of the mandatory credit card arbitration system is collapsing.”

Another Arbitration Firm Pulls Out Of Credit Card Arbitration

Just days after the National Arbitration Forum agreed to stop arbitrating consumer credit card disputes, the American Arbitration Association has decided to do the same. This is good, but passage of the Arbitration Fairness Act is still necessary.

Minnesota Attorney General Punches National Arbitration Forum In The Face

Minnesota has filed a lawsuit against the National Arbitration Forum, alleging fraud, false advertising, and deceptive trade practices.

Arbitration Fairness Act On "All Things Considered"

The perils of forced arbitration and the need for the Arbitration Fairness Act were recently featured on an NPR piece. The story discusses the case of Jamie Leigh Jones, the former Halliburton employee who was gang raped in Iraq by her coworkers, then was sent to arbitration when she tried to sue her employer.

../../../..//2009/05/05/the-house-subcommittee-on-commercial/

The House Subcommittee on Commercial and Administrative Law is currently holding a hearing on forced arbitration and credit cards, appropriately titled “Federal Arbitration Act: Is the Credit Card Industry Using It To Quash Legal Claims?” Our friends at Public Citizen will be testifying. You can view (or at least listen to) the Real Player stream here.

Forced Arbitration: You Can't Sue Us For Discrimination

Besides banning forced arbitration in consumer and franchise contracts, the Arbitration Fairness Act bans mandatory binding arbitration clauses in employment contracts. John’s story illustrates why this is necessary, inside.

"We Build In Middle Class Neighborhoods Because You Can't Afford To Fight Us"

Meet Michelle. We met Michelle at Arbitration Fairness Day and she told us about being forced into arbitration when she tried to get her poorly constructed home repaired. Now she’d like to share her story with you.

Forced Arbitration: You Lose, Now Pay For Our Lunch

Mandatory binding arbitration, which corporations use to dodge accountability for their discrimination, negligence, or harassment, is a caricature of justice that offers no protection to consumers or employees. It’s also terrible for small business owners, as one couple found out.