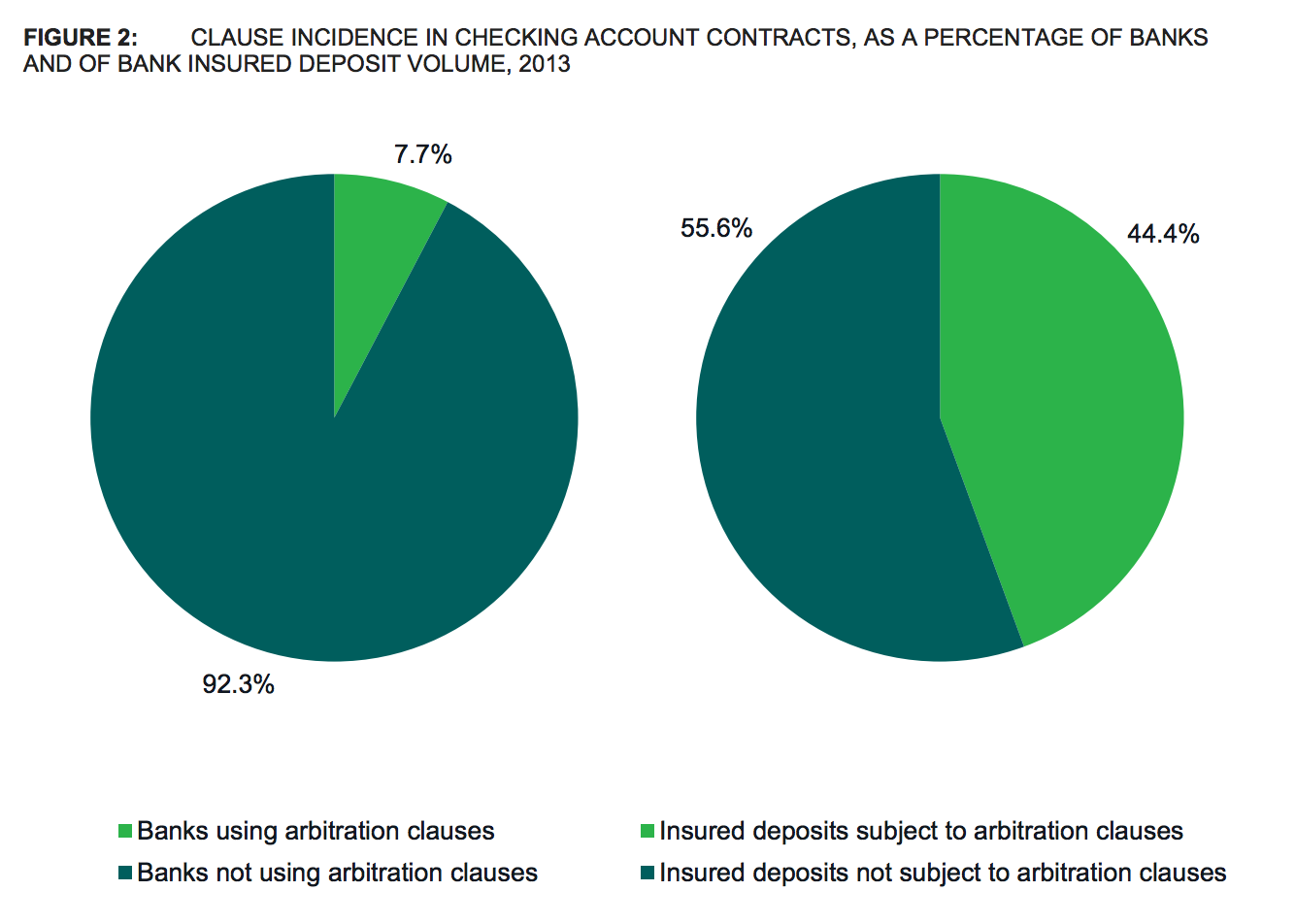

The lengthy, often complicated terms of use for more than half of all credit cards — and nearly half of all federally insured bank deposits — include clauses that force customers into arbitration, taking away their right to sue these companies in a court of law and usually blocking them from joining together in a class action. Critics argue that these forced-arbitration clauses allow banks and other businesses to break the law with impunity. Heeding the call of lawmakers and consumer advocates, the federal Consumer Financial Protection Bureau has decided to consider rules that would ban this practice among financial institutions. [More]

mandatory binding arbitration

Dish Taking Away Users’ Right To Sue Company In Court. Here’s How To Opt Out

Over the weekend, a number of Consumerist readers wrote to us with the bad news that, like a growing number of companies, Dish Network is updating its terms of use to strip customers of their right to dispute legal claims in a court of law. There is a way for Dish subscribers to opt out of this restriction — but only if they do it right away. [More]

FTC Affirms Consumers’ Right To Go To Court Over Warranty Disputes

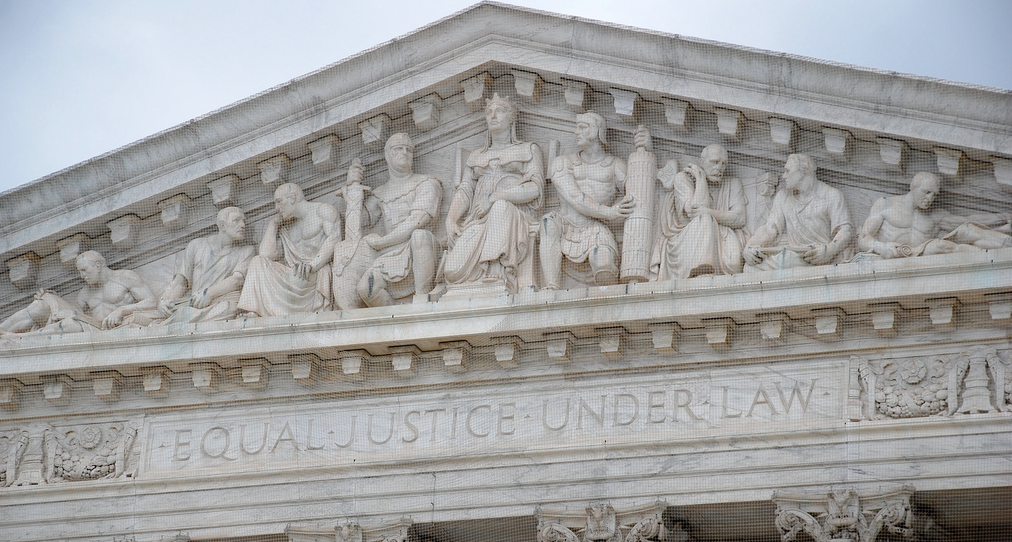

In just the last four years, the U.S. Supreme Court has twice ruled against consumers’ rights and in favor of companies that use fine print in their contracts to block wronged customers from suing in court and from joining together as a class action. In spite of these rulings, the Federal Trade Commission recently upheld rules that give warranty buyers the right to a day in court, even if they have to go through arbitration first. [More]

In Wake Of Arbitration Report, Consumer Advocates Ask CFPB To Revoke Banks’ “License To Steal”

This morning, the Consumer Financial Protection Bureau released its final report on forced arbitration, showing how banks and credit card companies use contractual clauses to short-circuit class-action lawsuits from their customers. Now that the Bureau has done its research, consumer advocates are calling on regulators to use their authority to end the practice. [More]

Banks & Credit Card Companies Saving Millions By Taking Away Your Right To Sue

Tens of millions of American consumers have clauses in their credit card, checking account, student loan, and wireless phone contracts that take away their rights to sue those companies in a court of law, and more than 93% of these people have no idea they’ve had this right taken away from them. The companies involved are presumably quite happy about this lack of awareness, as it results in millions of dollars in savings that aren’t being passed on to you. [More]

Marching Band Delivers Petition To Citi Asking Banks To “Revoke License To Steal”

In a handful of recent decisions, the U.S. Supreme Court has affirmed the right of businesses to effectively break the law by putting a few carefully worded sentences into their contracts and user agreements. But just because you can add these clauses doesn’t mean you have to do so, which is why pro-consumer advocacy groups gathered more than 100,000 signatures on a petition that was delivered, with a little bit of music, to Citigroup HQ in Manhattan this morning. [More]

Petition Demands Big Banks Give Consumers Back Our Right To Sue

Since 2011, when the U.S. Supreme Court affirmed that it was perfectly okay for companies to take away a consumer’s right to sue — and their ability to join other wronged consumers in a class action — by inserting a paragraph or two of text deep in lengthy, unchangeable contracts, the rush has been on for almost every major retailer, wireless provider, cable company, and financial institution to slap these mandatory binding arbitration clauses into their customer agreements. Now one petition is gathering signatures, calling on the nation’s largest banks to put an end to the practice. [More]

Why These 5 Pro-Consumer Bills Won’t Become Law In 2014

Back in January, at the dawn of the year, we gazed into our not-quite-crystal ball and took a look at some pieces of pending legislation that could help consumers this year. Now, in July, we’re at the halfway point of the year, and so it’s a good time to take a look at those bills and see how the wheels of government have turned in 2014. [More]

General Mills Thinks You’re Stupid, But Decides To Not Take Customers’ Legal Rights Away After All

While all sorts of big-name financial, tech, e-commerce, and telecom companies have been trying to take away consumers’ right to sue by inserting forced-arbitration clauses in their contracts and terms of service, it seemed ridiculous to think that the makers of cereal would resort to such deviousness, or how they would even be able to do it. But last week, General Mills tried, adding language to its website that stripped certain customers of their access to legal redress against the company. Realizing that maybe this might tick off an awful lot of people, the company has backed off this policy change. [More]

9 Federal Laws That Companies Can Skirt By Using Forced Arbitration

There are numerous federal laws that explicitly give wronged consumers the right to file a lawsuit against the company that harmed them, but all those statutory rights are being taken away by companies that insert arbitration clauses into their terms of service. [More]

Why You Should Opt Out Of Forced Arbitration, In 3 Sentences

While more and more companies are adding “forced arbitration” clauses to their terms of service, only a handful of these businesses are offering customers the choice to opt out of this part of the contract. Here are the reasons why you should take advantage of that option whenever possible. [More]

DropBox Jumps On Forced Arbitration Bandwagon, But Offers Online Opt-Out

Another company is taking the coward’s way out of resolving legal disputes with its customers by tweaking its Terms of Service to take away users’ rights to take the company to court and to prevent multiple users from having their complaints heard as a group. This time, it’s online storage service Dropbox, which is currently notifying users of the bad news. [More]

Your Guide To Proposed Laws & Regulation That Could Help Consumers In 2014

2013 is gone, a collection of memories never to be dealt with again. Next week, the 113th Congress returns for its second session, ideally to enact legislation throughout 2014, some of which could help consumers if they were to become law. [More]

Watch Al Franken Shred A Pro-Arbitration Professor For Trying To Gloss Over The Problem

Earlier this week, the Senate Judiciary Committee held a hearing on mandatory binding arbitration clauses, those fun bits of contractual language that take away your right to sue a company and force you into a resolution process that is heavily weighted in the company’s favor. The hearing was chaired by Senator Al Franken of Minnesota, who earlier this year introduced the proposed Arbitration Fairness Act, and so he obviously has a thing or two to say on the topic. [More]

CFPB Report Confirms That Banks & Credit Card Companies Are Taking Away Your Right To Sue

In 2011, the Supreme Court held that it was A-OK to not only hide a complicated forced-arbitration clause in a novel-length contract for a consumer product or service, but that it was also just peachy that such a clause stripped the consumer of his/her right to bind together with other affected customers in a class action. Since then, sellers of everything from cellphone service to video games have added these complicated clauses in an attempt to keep complaining consumers out of court and into the unfair arena of arbitration. Today, the Consumer Financial Protection Bureau issued its first report on forced arbitration, and the results are, sadly, not shocking. [More]

Comcast Lawsuit Shows Why Mandatory Binding Arbitration Is Just Plain Evil

I know, I know… lots of you hear a phrase like “mandatory binding arbitration” and your eyes gloss over and your mind drifts off like it did when your high school history teacher tried to teach you about the Monroe Doctrine or the Teapot Dome scandal. And that’s exactly how companies like Comcast — and AT&T, Time Warner Cable, American Express, Sony, Microsoft, eBay, and many, many others want you to react. But here’s a decent example of why you should give a hoot about having your rights taken away by a few words in a contract you can’t possibly alter. [More]

TiVo Adds Mandatory Binding Arbitration For Customers: Here’s How To Opt Out

We at Consumerist have crusaded against the evils of mandatory binding arbitration for most of the last decade. Companies love it, though, because it means we can’t sue them. TiVo is only the latest company to insert language requiring customers to use arbitration and give up their right to sue. You can opt out of that provision, though, if you want to. [More]