GOP Moving Forward With Plan To Block New Legal Protections For Bank, Credit Card Customers Image courtesy of inajeep

The Consumer Financial Protection Bureau recently finalized new rules that prevent banks and other financial institutions from stripping customers of their constitutional right to a day in court. As expected, bank-backed lawmakers in both the House and Senate are now planning to pass fast-track legislation that would undo these protections and make sure banks retain their “get out of jail free” card.

The new CFPB rule applies to the use of “forced arbitration” clauses in consumer contracts. These little bits of legalese, often buried very deep in fine-print agreements that the customer has no authority to change, generally do two things: First, they prevent the customer from filing a lawsuit against the company. Instead, all disputes must be settled through a private — frequently confidential — arbitration process outside of the legal system.

Second, many arbitration clauses include a ban on class action claims, even through arbitration. So even if there are thousands — or in cases like the Wells Fargo’s fake account fiasco, potentially millions — of customers who have all been wronged in a similar way, they are barred from joining their complaint into one case. Instead, each of those customers must go through arbitration on his or her own, and since arbitration results set no legal precedent (and the decisions may be confidential), it’s possible that some customers could have different arbitration outcomes despite having the exact same claim.

The CFPB rule does not outlaw the use of arbitration clauses. Rather, it prevents affected financial operations from using these clauses to prevent class actions. Thus, individual cases could still be resolved through arbitration, but banks under CFPB’s oversight would not be able to block multiple wronged customers from combining their cases.

Now, two heavily bank-backed lawmakers are expected to introduce legislation to roll back the CFPB rule. Rep. Jeb Hensarling (TX) and Sen. Mike Crapo (ID) will attempt to use the Congressional Review Act (CRA) — a law that allows lawmakers to voice their disapproval of new federal regulations — to stop the arbitration rule.

Under the CRA, lawmakers in each chamber of Congress vote on resolutions of disapproval. If a simple majority in each chamber approves the resolution, it goes to the White House. Given President Trump’s zeal for deregulation, and his ongoing opposition to CFPB Director Richard Cordray, we don’t see a world in which this CRA resolution would not be signed.

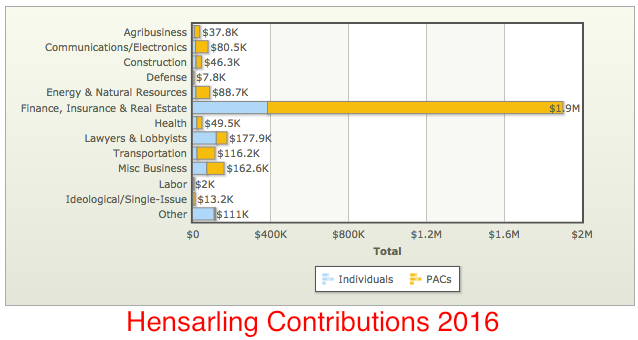

Rep. Hensarling, Chair of the House Financial Services Committee, has received millions of dollars from banks and other businesses with a direct interest in shutting down the CFPB rule. According to the Center for Responsive Politics, the Texas Republican’s campaign took in $1.9 million from the financial services industry in 2016 alone, more than 10 times the amount received from any other industry:

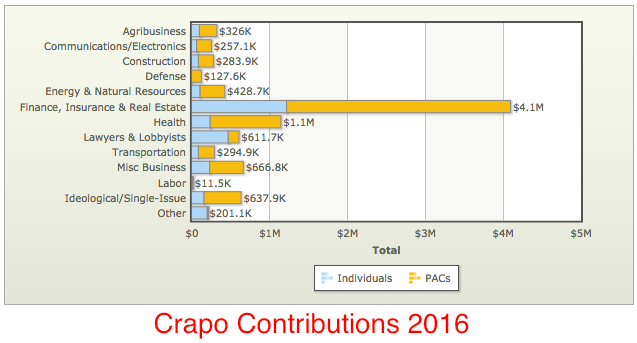

Similarly, Crapo’s campaign took in more than $4 million from the financial sector last year, nearly four times the total from any other industry:

Until the Trump administration, the CRA had been used successfully only once in its two decades of existence. Since February, it’s been used around a dozen times to overturn regulations put in place during the final months of the Obama White House, most notably the FCC’s new rules regulating online privacy.

Most CRA votes have thus far been along strict party lines, though 15 Republicans did vote against their party’s effort to overturn the privacy rule.

Supporters of the CFPB rule will likely be putting significant pressure on moderate GOP senators. As was demonstrated earlier this week, only three “no” votes are needed in that chamber to stop fast-tracked legislation.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.