At first, this woman thought her used car, financed through Wells Fargo, had been jacked from the front of her house. She reported the car as stolen and filed a claim. It was a bummer because she had been only two years away from paying off the five year loan. Then she got a call from Chase Auto Finance who said they had repo’d the car because the previous owner didn’t finish his payments. Whoops! Chase had taken the car without securing a lien on the title! [More]

loans

Class Action Suit Against BofA For Deceptive Loan Mods Goes National

Olly, olly, oxen, free. A class action lawsuit against Bank of America claiming they were less than above board with their loan modification practices has been certified for national participation. [More]

4 Magical Words Debt Collectors Use To Open Your Pockets

Debt collection is all about mind games. NotSoDeepSouth blogged about the four magical words that he used to use as a debt collector that acted like a crowbar on people’s wallets, getting formerly relcacitrant people to empty out their pockets. [More]

Smooth The Buying Process By Getting Pre-Approved For A Loan

Make enough major purchases and you’ll eventually learn that it’s always wise to enter a transaction with your own financing in place. [More]

Call Every Time To Make Sure Extra Payments Go To Paying Down Principal

People trying to get ahead on their car and house payments are sometimes shocked to discover the default way that banks handle their extra payments. Instead of paying down the existing principal, they apply it to the future interest. Not only that, but you can’t just call them up one time and ask for them to change how they handle your payments. You need to call them every month you make a payment. Here’s a tale from reader Katherine: [More]

Bank Of America Posts 36% Drop In Profits

Perhaps hoping to garner sympathy votes in our Worst Company in America contest, Bank of America today reported a 36% drop in profits for the first quarter. One of the big drags on business continues to be the toxic landfill of mortgages the bank gobbled up when it bought Countrywide Home Loans. Never trust a man who is completely orange, I always say. [More]

Get A Bad Deal On Your Loan? Now You'll Know Why

If you applied for a loan and got denied or received a higher interest rate than other borrowers with better credit scores, starting July 21st, the lender has to send you a free copy of your credit score. [More]

Goldman Actually Borrowed From Fed Discount Window 5 Times, Contradicting Bank Claims

Looks like Goldman has been a more frequent visitor to the Federal trough than they’ve been letting on. Despite testifying before Congress that they had only accessed the Federal Reserve’s discount window, which lets banks borrow cash from the government quickly and on favorable terms, just once, Bloomberg reports that recently released data shows they actually took at least five overnight loans from the Fed between September 2008 and 2010. [More]

Homeowner Turns SUV Into Anti-BofA Collage

A homeowner has affixed their SUV with a creative anti-Bank of America collage and slogans on posterboard and parked it outside a BofA branch in Austin, Texas. Reader Jeff is at the SXSW festival and sent in this picture he snapped of the scene. The driver of the car apparently has a loan with Bank of America and is accusing them of “fraud” though I can’t decipher from the medley of images what kind they had in mind. Nice pirate flag, though. [More]

Make Interest Work For You Instead Of Against You

Interest, which us cool cats call “juice,” is always flowing. It pours into the lives of those who know how to find it, while draining resources from those who buy stuff with money they don’t have. It’s much easier to build wealth when the juice is flowing toward you rather than away, but the trick is discovering just how to make that happen. [More]

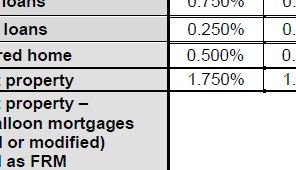

What Risk Factors Will Make My Mortgage More Expensive?

When you’re in the market to buy a new home or investment property, it’s one thing to get a pre-qualification over the phone and a completely different thing when you later sit down and actually apply for a loan. So before you get too far into the process, you should know which factors could end up inflating the interest rate on your mortgage. [More]

Chase Makes It Just A Little Harder To Pay Down Your Car Loan Principal

If you want to pay down the principal on your Chase car loan by adding a little extra to your payment when you pay online…well, don’t bother. Sean discovered that paying a little extra on your auto loan isn’t so simple. Any extra money you might send is considered an early payment for next month…not applied to the principal. Sneaky. [More]

FDIC Seizes 4 More Banks

The FDIC seized four more banks on Friday. That brings the total number for 2010 to 143, the most in a year since the S&L fiasco back in the 80’s. Here’s who went down: [More]

Debt Collectors Have Been Using Robo-Signers For Years

For all the attention being paid robo-signing foreclosure mills, you’d think people would be more interested in the guys who basically invented the business of mass-production affidavits: debt collectors. [More]

Old-School Personal Loans Make A Comeback

Out of the soil of the post-apocalyptic credit graveyard shoots the skeletal hand of a forgotten lending practice. Banks are once again busting out “personal loans” to help finance what might otherwise be just out of reach for consumers. Here’s how they work: [More]

JPMorgan Chase Suspends 56,000 Foreclosures

JPMorgan became the second major lender after GMAC/Ally Bank to halt pending foreclosures, halting proceedings on 56,000 homes. This follows revelations that “robo-signer” “foreclosure mills” were filing paperwork that would be gracious to call “sloppy,” at the rate of 10,000 a day. [More]

Collectors, Stop Harrassing Me About Mom's Debt

Michele keeps getting nasty letters and phone calls from debt collectors trying to get her to pay for her mother’s debt. One of them told her the local police had said she “should be arrested” and another pretended to be from the U.S. Department of Education. How does she get them to stop? [More]