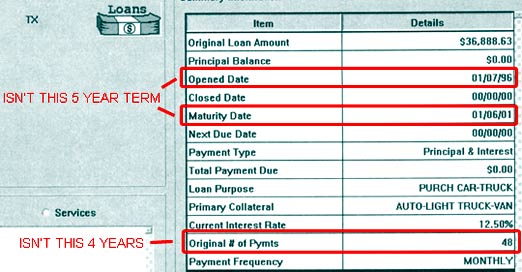

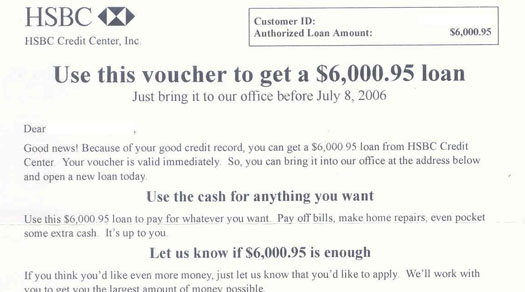

- Some of America’s most cash-strapped taxpayers – those from low- and moderate-income families – spent nearly $1 billion in the latest year recorded for what is almost always an unnecessary product: the so-called “refund anticipation loan” at income tax time. With another tax season gearing up, consumer advocates at the National Consumer Law Center (NCLC) and Consumer Federation of America (CFA) are warning taxpayers to steer clear of refund anticipation loans (RALs), one of the most avoidable tax-time expenses. New figures reveal that RALs drained about $960 million in loan fees, plus over $100 million in other fees, from the wallets of nearly 9.6 million American taxpayers in 2005. “Taxpayers can save themselves over a billion dollars by just saying ‘no’ to quick tax refund loans,” says NCLC staff attorney Chi Chi Wu. “These loans take a chunk out of your hard earned tax refund, and they expose you to the risk of unmanageable debt if your refund doesn’t arrive as expected.”

TRA’s are bad! Just say no.—MEGHANN MARCO