Remember when you began vehemently swearing upon realizing that before you used your bank card to buy a $3 iced coffee, you were in the red already, making that a $37 iced coffee and overdrawing your account even more? That’ll change for Chase customers, as the bank announced its going to do its customers a solid by dropping overdraft fees for purchases under $5. [More]

jpmorgan chase

Shareholders Sue JPMorgan & CEO Jamie Dimon Over $2 Billion Loss

Late last night, two separate lawsuits were filed against JPMorgan Chase & Co and its Chief Operating Officer, Jamie Dimon, accusing the bank and its management of excessive risk that led to trading losses of at least $2 billion. [More]

JPMorgan CEO Jamie Dimon On $2 Billion Loss: "We Have Egg On Our Face"

JPMorgan Chase dropped a hefty financial bomb on everyone yesterday, admitting that it lost $2 billion in six weeks after some bad trading decisions. CEO Jamie Dimon revealed the news after trading closed last night, admitting that the company only has itself to blame. [More]

Federal Judge Signs Off On $25 Billion Mortgage Settlement With Top 5 Banks

It’s just like reality TV, but not at all — America, here are your top five big greedy banks, and here is the $25 billion mortgage settlement they’re all going home with, now that a federal judge has approved it. That’s their load to carry, after allegations of foreclosure abuses and misconduct in servicing home loans. [More]

Which Worst Company Contenders Force Customers Into Mandatory Arbitration?

As we sifted through the mountain of nominations for this year’s Worst Company In America tournament, we noticed a trend of readers who cited companies’ mandatory binding arbitration clauses as a reason for nominating. And while it’s businesses like AT&T and Sony that have made all the headlines for effectively banning class action lawsuits, there are a lot of other WCIA contenders who are forcing customers into signing away their rights. [More]

Worst Company In America Round One: Bank Of America Vs. Chase

It hasn’t been a banner year for either of these banking bruisers. But has12 months of settlements over fraudulent mortgages, along with all that planning/canceling/reinstating of fees, left these fighters exhausted, or has it hardened them into true WCIA warriors? [More]

Here It Is, Your Lineup For Worst Company In America 2012!

Welcome to Consumerist’s 7th Annual Worst Company In America tournament, where the businesses you nominated face off for a title that none of them will publicly admit to wanting — but which all of them try their hardest to earn. So it’s time to fill in the brackets and start another office pool. That is, unless you work at one of the 32 companies competing in the tournament. [More]

How Much Have The Big Banks Been Penalized Over Mortgage Mess And Where Is All That Cash Going?

The last few years have seen numerous settlements between the nation’s biggest mortgage lenders and various federal and state authorities. And while we hear numbers like “a total of $25 billion,” exactly which banks are responsible for the biggest chunks of these settlements? [More]

Feds To Stop Punishing Chase, Bank of America For Sucking At Mortgage Modifications

Since the Treasury Dept. began releasing quarterly report cards on big banks’ efforts to improve their mortgage modification processes, Bank of America and JPMorgan Chase have consistently received subpar marks, leading the feds to withhold a total of $171 million in incentives. That money is now set to be released to BofA and Chase — but not necessarily because they suck any less at mortgage mods. [More]

Chase Plans On Caring Even Less About Customers With Less Than $100K In The Bank

Are you a JPMorgan Chase customer with less than $100,000 dollars deposited? Then you are not making the bank enough money and it probably wants nothing to do with you going forward. [More]

Pair Of Positive Experiences Reminds Chase Customer That Good People Work For Bad Companies

JPMorgan Chase is a regular fixture in our annual Worst Company In America tournament, but like most of the businesses in the WCIA brackets, there are a lot of decent people who truly want to help their customers. [More]

$25 Billion Mortgage Settlement Is Just The First Step Toward Cleaning Up Mortgage Mess

There are a lot of good things about today’s $25 billion settlement between the five largest mortgage servicers, the Dept. of Justice and the attorneys general of 49 states. But in spite of the huge price tag on the deal — which could grow even larger if other lenders sign on — it’s only the beginning of cleaning up the aftermath of housing market collapse. [More]

DOJ, 49 States Reach $25 Billion Settlement With Five Largest Lenders Over Robosigning

More than a year after several of the nation’s largest mortgage lenders temporarily suspended foreclosures after it was revealed that they had been using untrained, unqualified “robosigners” to process foreclosure documents, the U.S. Justice Dept. and the attorneys general of 49 states have announced a $25 billion settlement that will result in mortgage reductions to some homeowners. [More]

Banks Realize Short Sales Are Better Than Foreclosure, Pay Homeowners To Sell Now

It’s been nearly a half decade since the housing market imploded like an old stadium packed with explosives and the ground is still rumbling from the impact. Realizing it’s better to recover some money now rather than trying to get all their cash back eventually, more banks are making it easier for homeowners to unload their houses for less than what is owed on the mortgage. [More]

Almost All States Sign On To Massive Mortgage Settlement

Last night was the deadline for the attorneys general of each state to sign onto a massive settlement with the nation’s five largest mortgage lenders, and more than 40 of the states opted to join in the pot-sharing. [More]

Big Banks Pinky-Swear To Overhaul Lending & Foreclosure Practices

Nearly a half-decade after the U.S. housing market collapsed like something that collapses really badly, the country’s five biggest mortgage providers — Bank of America, Chase, Wells Fargo, Citi and Ally — are oh-so-close to reaching a settlement with the states that could include overhauls to how they operate when it comes to the whole lending/servicing/foreclosing process. [More]

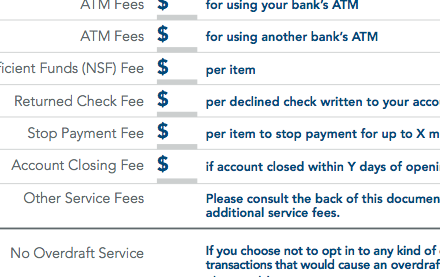

Chase To Cut Checking Account Fee Disclosures From 100+ Pages To One

When the charitable folks at the Pew Charitable Trusts first suggested that banks could condense their overly complicated fee schedules from over 100 pages to one simple page, it seemed unlikely that any major bank would follow suit. But this morning, JPMorgan Chase announced it would do just that. [More]