As a self-employed certified tax cat, I make sure to take advantage of every opportunity possible to reduce my taxable income. The health insurance premiums I pay for me and my litter have always worked to bring that number down, but they never did anything to reduce the amount I had to pay in Medicare and Social Security taxes. Until now. [More]

IRS

IRS Offers Amnesty To Tax-Evaders With Offshore Accounts

If you are, or if you know, a person who is avoiding paying their taxes by stashing their cash in an offshore account, the IRS has announced a new amnesty program for just that sort of rich d-bag. [More]

Deduct The Costs Of Your Job Search

It’s hard to get a break when you’re out of work, but there are a few tax breaks you do qualify for. Did you know that you can deduct travel expenses for job interviews? The fees you pay to an outplacement firm? And the cost of printing your resume on ostrich ebony paper? A survey of 1,000 adults found that only 1% of them did. While you’re trying to snag a job, might as well catch a few tax breaks along the way. [More]

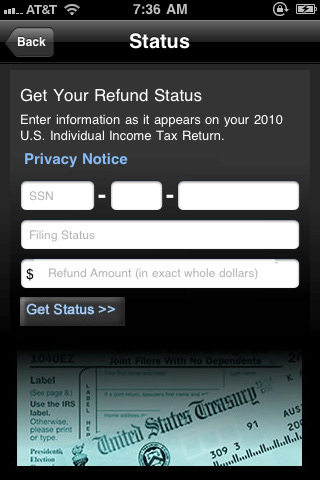

Track Your Tax Return Status With IRS2Go App

The IRS has an official app called “IRS2Go” for iOS and Android that lets you keep track of your tax return’s status after you’ve filed it. [More]

How To Get Free Tax-Prep Help

What many taxpayers don’t know when they step into H&R Block, Jackson Hewitt or go to some tax-preparation site is that there are several thousand IRS-approved volunteers out there willing to do the job for free if you qualify. [More]

Your 1099s May Be Tardy This Year

Some of your 1099s may be delayed this year because recent changes in the tax law require them to be corrected. They’re supposed to be mailed out by Jan 31 but this year they may not even show up until after the April 18th filing deadline. So what do you do? [More]

Avoid The Dread Eye Of The IRS Auditor

After The Reaper, second in the line of “those to fear” is the IRS tax auditor. What with his scales and poison fangs and all. But you can dodge his fell gaze if you know the red flags he’s looking for. [More]

8 Tips For Picking The Right Tax Preparer

You know that I love you all and would just love to prepare every last one of your 1040s this year. But between my existing clients and that centipede I can’t seem to catch, I’m booked solid through tax day. [More]

IRS Goes After Executive Whose Pay Is Too Low

Targeting executives who pay themselves too little in order to shield some of the money they make from taxes, the IRS is focusing its sunshine-concentrating magnifying glass on potential offenders. [More]

8 Ways Your 1040 Is Different This Year

Once January hits it’s a good time to start getting ready for your taxes. To help you prepare, here’s 8 ways your 1040 is going to be different this year: [More]

Bigwig Tax Cheats Next On WikiLeaks Hitlist

An ex-Swiss banking exec has given Wikileaks data on what he says are over 2,000 high-level people and companies involved in tax evasion and other potential crimes. At a news conference where he passed the discs to Julian Assange in front of reporters, the man refused to name names, but said that roughly 40 politicians and “pillars of society” were on there. Assange said that Wikileaks would vet the information and publish it, along with names, in just two weeks. [More]

What The New Tax Deal Means For You

Besides the Bush tax cuts getting stretched another two years, the proposed new Obama-GOP tax deal has other goodies in the bag for you. [More]

Why Does American Express Need A Copy Of My Wife's Tax Return?

Evan writes that he recently got married, and the newlyweds make more money than they did at this time last year. American Express suspects something, and has suspended their credit card, demanding a copy of his wife’s tax return from last year. What’s going on? [More]

Deduct Costs Of Stinky Chinese Drywall From Your Taxes

You can get some money if your home was ruined by defective Chinese drywall that emitted nasty-ass sulfuric fumes. The IRS yesterday said that homeowners could treat the damages to both their homes and appliances as a casualty loss and deduct it from their taxes. [More]

Tax Lady Roni Deutch Sued For $34 Million By California AG

Last week, when we asked for nominations for really horrible TV ads, self-described “Tax Lady” Roni Deutch’s name was mentioned more than a couple times. Adding insult to injury, Roni is now being sued for over $34 million by the California Attorney General over allegations that her heavily advertised tax relief service doesn’t actually live up to its promises. [More]

1,300 Prison Inmates Received $9 Million In Home Buyer Tax Credit

As always happens when the government puts tons of cash up for grabs, scam-happy people will line up to take advantage of it. And a new report says that nearly 10% of the 15,000 folks caught scamming the government for the recent home buyer tax credit were doing it from behind bars. [More]

High-Volume Sellers On eBay, Craigslist Can Look Forward To New Tax Form For 2011

If you tend to move a lot of merchandise on eBay or Craigslist, you should know that the IRS wants a share of those earnings. If in 2011 you sell more than $20,000 worth of goods and have more than 200 transactions, then come early 2012 you’ll receive a shiny new flavor of 1099 form called a 1099-K, and you’ll have to pay up. If you’re an infrequent seller, where your eBay or Craigslist transactions more closely resemble a garage sale than a virtual storefront (and especially if you sell items at a loss), you probably don’t have to worry. [More]

Actually, You're Paying The Lowest Amount Of Taxes In 60 Years

It may not feel like it, but it turns out that you are paying really low taxes right now, the lowest in 60 years, in fact, according to a new analysis of Federal data. [More]