Maybe I won’t live long enough to retire. Life is so uncertain. Why should I miss out on the high life now when I might not even need to have money put aside for my old age? (If married, change pronouns in this reason to the plural.)

IRS

IRS Investigates Jackson Hewitt Further

The IRS investigation into Jackson Hewitt’s malpractices has deepened, NYT reports:

The lawsuits filed against the Sohail-owned or controlled franchises said that employees had been pushed to crank out returns in exchange for bribes, to accept scant or false documents, like W-2 forms, and to falsify taxpayer data to receive the earned-income tax credit, a federal assistance program.

And that’s why we like accountants. Not only will a good one help you find deductions, they also know enough to not do stupid stuff. It’s you, not the tax form preparer, on the hook if you file a fraudulent return. — BEN POPKEN

IRS Warns Taxpayers About New Email Phishing Scam

The IRS wants to warn you about a new email phishing scam that aims to trick you into opening an attachment that is secretly a Trojan Horse. the Trojen Horse that can give control of your computer over to the scammers. You, obviously, do not want this to happen.

Dude Busted For Running An Illegal Bank For Tax Evaders From His Suburban Home

An IRS investigator said Robert Arant had hundreds of customers, many of whom apparently used his bank, Olympic Business Systems LLC, to conceal assets for the purpose of evading taxes.

Post-Tax-Day Tips

Tax day is over but that doesn’t mean the party has to stop. WFMY has a roundup of tax tips for lingering tax issues, like setting up an installment payment plan, who to call if you have a major problem, and fixing errors.

Check On Your Tax Refund

Don’t have your tax refund yet? You can check on it! It’s easy just click here and fill out the form. Knowledge will be yours. —MEGHANN MARCO

Wait, Why Are We Paying Turbo Tax Again?

When a taxpayer files electronically through TurboTax, the information goes first to Intuit’s data center, where the file is batched with others and then sent to I.R.S. computers. The process is almost instantaneous, the company said — when everything goes right. “We are just the transmitter of the return,” said Julie Miller, a spokeswoman for the Intuit TurboTax unit. “In the middle there are no additional steps we are taking.”

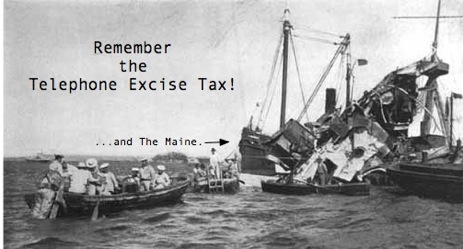

40 Million Taxpayers Forget To Collect The Telephone Excise Tax

Remember the telephone excise tax? For 40 million taxpayers, the answer is “no.” From Kiplingers:

Although nearly everyone who had a phone at any time between March 1, 2003, and July 31, 2006, deserved the credit, the IRS says that 30% of taxpayers failed to claim it. That means 40 million taxpayers missed the boat … and a chance to boost their refund (or cut their tax due) by $30, $40, $50 or $60.

You can still pry your money from the government by spending fifteen minutes with Form 1040X. X as in, remember the X-cise tax. Kiplinger’s has a step-by-step guide to claim the credit that is rightfully yours. — CAREY GREENBERG-BERGER

So, You *#$@%& Up Your Tax Return? Here's How To Fix It

We know you didn’t mean to do it. Now you’ve filed a totally incorrect tax return and you’re freaking out. “Why? Why did I tell the IRS I had a farm in Guam?”

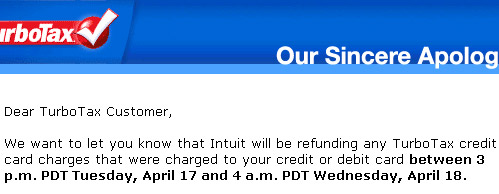

TurboTax Apologizes And Gives Refunds For Filing Slowdown

TurboTax sent an email this morning to customers saying sorry for the big server slowdown on April 17th, and pledging refunds to any one who tried to file that day.

IRS Won't Penalize Turbo Tax Late Filers

Tax procrastinators can stop biting their cuticles, the IRS says they won’t fine anyone who couldn’t file due to Turbo Tax server difficulties.

Overwhelmed Turbo Tax Servers Slow To Crawl For E-Filers

Yep, looks like Turbo Taxes servers were totally bunged up last night. Some people were sitting there for hours, waiting for a confirmation after hitting submit. Intuit, makers of Turbo Tax, contacted the IRS but there’s been no official word whether people unable to submit their taxes by the midnight deadline will get an extension. Some statement from the IRS should be out today.

Turbo Tax's Servers Down?

Reader Derek reports he can’t e-file taxes because Turbo Tax’s servers are down. Not sure if others are experiencing this, but he could still file by printing out his return and rushing to a local post office. There may indeed be one nearby open until midnight. — BEN POPKEN

IRS Offers Extension To Those Affected By The Virginia Tech Shooting

This relief applies to the victims, their families, emergency responders and university students and employees.

Post Offices Open Late For Last-Minute Tax Filers

If you’re scrambling to get your taxes mailed tonight in Manhattan, there’s a post office open until midnight at 31st st & 8th av.

If You're Getting A Refund, File Whenever You Feel Like It

Kiplinger’s says that if you’re getting a refund this year, you don’t need to stress about filing on-time.

Middle Class? Get Ready For Your Audit!

If you make from $25,000 to $100,000 dollars, the IRS is much more likely to audit you this year, and those caught cheating can expect to pay about $4,100 more in taxes.