Next Saturday, 250 IRS Taxpayer Assistance Centers staffed with IRS agents will open their doors to anyone making $42,000 or less. With money tight for everyone this year, if you qualify, take the government up on its generous offer and let the IRS agents fill out your tax forms.

IRS

Scrizzle: New Homeowners Can Get Up To $8000

First-time home buyers can get a tax credit of up to $8,000 thanks to the stimulus bill Obama signed back in February. You qualify if you bought between April 9, 2008, and November 30, 2009. To get the credit, use IRS Form 5405, “First-Time Homebuyer Credit.” Since house prices are going down, the credit isn’t anything to go and sign for a new crib this afternoon. But if you already got a home or were planning to, it’s extra jingle in your coin-purse.

IRS Fires Private Debt Collectors, Plans To Pursue Deadbeats On Its Own

The IRS has ended a controversial program that allowed private debt collectors to pursue individual debts owed to the government. The private debt collectors, described as “bounty hunters who collect taxes from vulnerable people for profit,” were allowed to keep 25% of any collected debts for themselves. Before we celebrate, let’s all take a moment to join Senator Charles Grassley of Iowa in thinking about those poor private debt collectors who no longer have jobs harassing and abusing people…

Beat An IRS Audit

Like a worst-case-scenario guide for taxes, tax attorney Fred Daly‘s Stand Up To The IRS helps you prepare for an IRS audit. Best of all, he’s released all the chapters online for free.

Illinois Couple Swindles Best Buy Out Of $31 Million

The Chicago Tribune says that Russell Cole calls his $2.75 million Deerfield, IL home “the house that Best Buy built,” but now investigators are claiming that the Best Buy money was obtained through fraud.

UBS Will Release Names Of Americans Hiding Money From IRS

Swiss bank UBS, which has “admitted conspiring to defraud the Internal Revenue Service and agreed to pay $780 million to settle a sweeping federal investigation into its activities,” has agreed to release the names of Americans who have been secreting away cash in UBS’ fabled Swiss bank accounts. The U.S. Justice Department has been investigating about 19,000 accounts, but the New York Times says the bank may only release a couple hundred names. Update: Now the IRS has asked a judge to demand that UBS turn over the names of around 52,000 clients. UBS says it will “vigorously challenge” the new request.

Get $4800 With The Earned Income Tax Credit

You could qualify for a maximum tax credit of $4,800 if you made less than $42,000 in 2008. Even if your salary was around $61,000 but you lost your job last year, you could still qualify. It’s called the “Earned Income Tax Credit” and you can find out if you can claim it by taking the IRS’ online EITC quiz. Your tax preparer, be they human or software, can you help determine if you’re worthy (One big one: you must be over 25 but under 65 at the end of the year).

Embezzling Fry's VP Once Gambled Away $8 Million In ONE DAY

The LA Times is reporting that former Fry’s executive and accused embezzler, Omar Siddiqui, once gambled away $8 million in a single day. According to the IRS, Mr. Siddiqui financed his gambling by taking at least $65.6 million in kickbacks from Fry’s suppliers. He’s been charged with money laundering and fraud, and if convicted, he faces 140 years in prison.

10 Tax Incentives For You From Bush's Bailout Bill

Remember that guy Bush? Well back in October he signed one of those fancy bailout bills and it had a bunch of tax incentives for you. Here are the highlights of The Emergency Economic Stabilization Act of 2008 relevant to your tax return:

10 Tax Deductions For Freelancers

Freelance Switch has 10 deductions freelancers can take. For instance, if you have a cellphone as a second line and primarily use it for business, deduct it. Work from home? There’s the complex but worth it home-office deduction. The “research” category is very useful, especially for journalists and writers. Just about any piece of entertainment can go in there. Hey, you got to keep in touch with the zeitgeist, right?’

Survey: Politicians Pretty Much Suck At Paying Taxes

Following up on the multiple Obama nominees who’ve had tax troubles, Politico asked the 99 members of the Senate whether they’ve ever had mistakes on their tax returns or filed back taxes. Yes and yes.

2008 1099-Composites Mailed By Feb 17 Not Jan 31

One thing you probably didn’t hear about the bailout is that it extended the required mailing date for 2008 1099-Composites from Jan 31 to Feb 17. So don’t get freaked out and run down to the dirt road to the mailbox to keep checking for it. Just sit back on the porch and wait for your little post-Valentine’s tax present to arrive. (Thanks to Chris!) (Photo: booleansplit)

Everyone Can Now File Their Taxes Electronically For Free

This year the IRS is letting each and every one of us file our taxes electronically free of charge. Didn’t the IRS already let all of us eFile our taxes for free, you ask? No. The IRS has a program called Free File, which provides free commercial tax help to anyone making less than $56,000 per year. This program, enticingly known as Free File Fillable Tax Forms, is different…

Tax Cat's 8 Tips For Choosing A Tax Preparer

Tax Cat here. It’s that time of year again when our thoughts turn from the lovely holiday season to the pile of receipts and other crap that we don’t want to deal with — taxes. If you’re thinking of hiring someone to prepare your taxes this year — the IRS has some tips that will help you choose a qualified professional.

9 Ways The IRS Can Help You Save On Taxes This Year

Taxes aren’t that far off, and the IRS is here to help you give them less money, or take longer in giving it to them! Here’s 9 ways they can make your tax life easier.

5 Last-Minute Ways To Reduce Your 2008 Taxes

USAA Mag has 5 good ideas for getting in good shape for tax season before the closing bell rings on 2008:

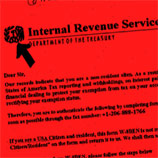

Fake IRS Fax Demands Your Bank Account And Passport

Nick has written in to warn us about a fake IRS scam that lately has been targeting nonresident aliens (e.g. teachers and researchers) working in the U.S., as well as American citizens working abroad. In the scam, which has been going on since at least 2002 (pdf), the target receives a faxed request from the IRS to provide his name, SSN, and pretty much every other bit of data you’d need to take over a person’s financial identity.

Senator Recommends That UBS Be Shut Down For Helping Thousands Of U.S. Citizens Cheat On Their Taxes

Another update to the disgruntled computer technician story: Sen. Carl Levin told ABC News that Swiss banking giant UBS’s banking license should be revoked until the bank “cleans up its act.” The bank is accused of arranging “undeclared” accounts for an estimated 19,000 US citizens, effectively “hiding” $18 billion from the IRS.