With the stock market so scary right now, investors are looking for a sure thing, especially those approaching or in retirement. Enter the equity index annuity, which promises you’ll never lose money but if the index it’s tracked to, like the S&P 500, gains, you’ll get some of that. Though your maximum upside is capped and you have to agree to keep your money in there for a fixed term or suffer stiff early-withdrawal penalties. Annuities are infamous for being extremely complicated and festooned with bizarre fees, but, that aside, NYT Your Money reporter Ron Lieber analyzed a typical equity index annuity and found it was a bad bet. Here’s how the numbers played out…

investing

Stocks Are Still Sad

Monday’s brief hope of a better week for stocks was exactly that as the market continued its downward spiral through Friday and international indexes suffered body blows. [WSJ]

The Great Depression Diaries

July 30, 1931. Magazines and newspapers are full of articles telling people to buy stocks, real estate etc. at present bargain prices. They say that times are sure to get better and that many big fortunes have been built this way. The trouble is that nobody has any money.

How Short Selling Works

A lot of people and pundits have been blaming short-selling for the recent stock market plummets, and even the SEC temporary banned it at one point recently. But what is short selling? Marketplace’s Patty Hirsch is back with another video and his whiteboard to give you the low-down.

10 Things That Are Going Right For Consumers

Kiplinger’s is more optimistic than we are, so they had the cheerful idea to put together a list of 10 things that are going right for consumers — despite the financial apocalypse. Hooray!

../../../..//2008/10/14/dow-ended-the-day-by/

Dow ended the day by shooting up 936.42 points, 11%, ending at 9387.61, it’s largest one-day point gain in history. [Newsday]

Getting Married, What Do I Do With My Money For Now?

WooHoo! I got a job! Right out of college and everything. With an awesome sign-on bonus! Now what am I supposed to do with all this money? I know I have options. Stock Market (HA!), bank, and under my pillow. I would put it in the bank but I have a wedding coming up in less then a year to pay for and I want to know my options for making good quick investments. Please help!

3 Ways 2008 Isn't 1929

With the Dow currently below 8600, stocks are continuing their downward spiral this week, the but the WSJ tells us 3 ways why it’s totally different from 1929:

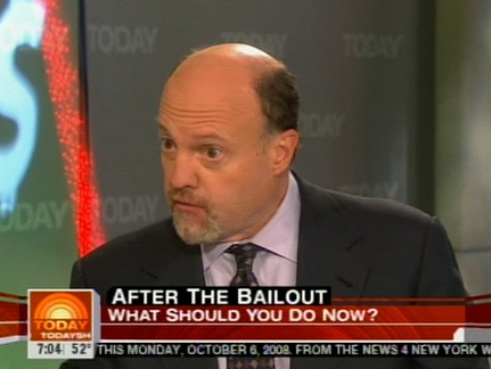

Jim Cramer Did Not Actually Say What He Said Yesterday… Or Something

Yesterday, Jim Cramer annoyed Ann Curry by saying the following words on her little television program, which is known as The Today Show: “Ok, whatever money you may need for the next five years, please, take it out of the stock market. Right now. This week. I do not believe that you should risk those assets in the stock market.”

The Economist Sums Up Financial Crisis: "Oh Fuck!"

If you feel at a loss for words to describe the now global financial cover, this spoof cover floating around the internet for September’s Economist says it all: “Oh fuck!” Download the large version, suitable for framing or desktop wallpaper, inside…

../../../..//2008/10/06/after-falling-800-points-in/

After falling 800 points in a single trading session, the Dow pulled back to finish down just 369.88. [NYT]

Jim Cramer Tells America To Get Out Of The Stock Market

Jim Cramer, host of CNBC’s “Mad Money” and dedicated yelling enthusiast is apparently no longer content to behave strangely on his own television program, so he’s taking the crazy to the Today Show.

A Blacker Monday

The Dow is down over 800 points, and the day isn’t even over. This beats last week’s all-time record of 777 points. A global credit crisis is in full swing, with versions of what just decimated Wall Street repeating itself across Europe as governments swoop in with bailouts of high-profile banks. Verily, blood is in the streets. Hm, what’s that old saw? Oh. Right. Buy when there’s blood in the streets.

Why Did Everyone Buy This Stupid Toxic Debt? No One Understood It

Marketplace has the answer to one of the most troubling questions of our time. Why did people who are supposed to be smart buy all this stupid toxic risky debt? Apparently, it’s because they weren’t that smart, and they didn’t understand what they were buying or selling.

E*Trade Sells Your Stock To Pay Inactivity Fee

If you’ve bought stocks through E*Trade, make sure you log into your account at least once a quarter. That way you can see if there’s any alerts on the account, like the one telling you about the “inactivity fee” for not executing at least one trade per quarter, the fee that they’ll sell some of your stocks to pay for. This happened to reader Brody, who writes:

10 Things To Expect From The New Post-Apocalyptic Economy

Kiplinger’s has put together a list of 10 things that you, fair consumer, can expect from our new post-wall-street-apocalypse economy. Should you be scared? Maybe.

Understanding The Money Meltdown In 10 Easy Links

After reading these 10 links, the I Will Teach You To Be Rich blog believes they will make you smarter than 99% of other people about the financial crisis, what it means, and what to do about it. [I Will Teach You To Be Rich]