Adolf Merckle, the 94th richest man in the world, committed suicide this week. Stock speculation is hazardous to your health. [NYT]

investing

What's The Difference Between Money Market Accounts And Money Market Funds?

This year, many investors learned the hard way the difference between a money market account and a money market fund. Do you know the difference?

Suicide: Hedge Fund Manager Who Invested $1.4 Billion In Madoff Scheme Found Dead

A hedge fund manager, Rene-Thierry Magon de la Villehuchet, who invested $1.4 billion in Madoff’s $50billion Ponzi scheme was found dead by apparent, movie-style, suicide.

Jim Cramer's Advice Slightly Worse Than A Coin Toss?

In a not-so-shocking analysis of one of the most-watched TV investment advisers, author Eric Tyson argues that Jim Cramer’s actual stock-picking performance doesn’t match the strength of his bellowing.

Top 9 Good Habits For A Deep Recession

For many of us, this is the first recession where we are responsible for our own financial well-being. How should we react? What habits are important during a long, deep recession?

SEC Ignored Warnings On $50 Billion Ponzi Scheme Since 1999

SEC’s chief announced they had repeatedly received since 1999″credible and specific allegations” about Madoff’s $50 billion pyramid scheme…

New Enron Stock Settlement

If you bought individual Enron stock, you might get a piece of a new settlement against all the companies who supported Enron along the way and knew, or should have known, what was up. [TopClassActions]

$50 Billion Ponzi Scheme Could Just Be For Starters

Madoff’s $50 billion scam came unwound when too many investors tried to pull their money at the same time, which means we’re likely to more big swindles get exposed in the coming months…

$50 Billion Ponzi Scheme Busted

Famous broker Bernard Madoff was arrested yesterday for running what was really a $50 billion pyramid scheme. Slate’s The Big Money has insight on how investors can spot an operator like Madoff:

Swap Your Crappy Stock For A Day At The Beach

If you’re feeling pessimistic, you can swap your depressed stock for a week at the beach. [NYT] (Thanks, handsatlanta!)

Top 5 "Financial Meltdown" Themed Scams To Avoid

Kiplinger’s has an article that lists a few “financial meltdown” themed scams that are out there taking advantage of people lately.

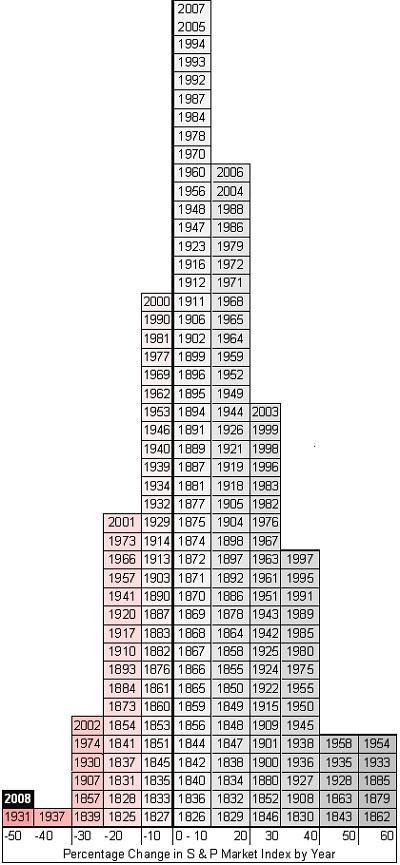

Sexy Graph Demonstrates S&P's Historic Dismalness This Year

Here is a sexy graph breaking down the S&P’s performance from 1825 to present, fitting each year into a column based on that year’s annual returns, from -50% to +60%.

Investors Willing To Pay The Treasury To Borrow Their Money

Here’s a sad bit of news, investors are so shaken that they’re willing to put their money into Treasury bills — even if it means losing money.

This Year's Best Stocking Stuffer: Stocks

If you have some extra cash right now, there’s a big sale going on right now you should know about. It’s called the stock market.

Goldman Furious Over Our Posting Insider's Confession About Ripping Off Non-Profits

Goldman-Sachs read my post, “Goldman Rips Off Non-Profits, Endowments, Foundations, And Charities” about a conversation I had with a Goldman-Sachs trader where he boasted about ripping off charitable organizations with excessive fees, and they’re hopping mad. Here is the lovenote sent by Melissa Daly, VP of Corporate Communications:

Video: What Are Margin Calls?

What are margin calls? The term has been bandied about lately as being one of the reasons for the steep declines in the market. Basically, it’s when depositor’s margin account at a brokerage falls below minimum levels and the brokerage tells the depositor to either deposit more money or they have to sell off some of their holdings. And a spate of selling drives down stock prices because as supply increases, prices drop. But why are there margin accounts and why are brokerages making margin calls in the first place? Marketplace’s ever-salubrious Paddy Hirsch explains with girl scouts, girl scout cookies, a whiteboard, dry-erase markers, and stick figures, in the video inside…

The Great Depression Diaries, Part 2

Aug. 5, 1931. I went to the fruit market house this evening. It was almost deserted. The farmers cannot sell their produce because men are not working and it has become fashionable for each family to have its own vegetable garden.