The Ponz is everywhere! Seriously, was anyone doing any real investing over the past several years? John M. Donnelly of Charlottesville, Virginia, was arrested earlier this week and “indicted for fraudulently taking at least $11 million from as many as 31 investors in an alleged Ponzi scheme,” says their local paper the Hook. He was promising investors returns of up to 22% annually, but naturally had failed to make any investments with his clients’ money since 2002. One anonymous person—who may or may not have been a client, we don’t know—told the paper, “I visited his office once. He had a bunch of computers. It seemed like a very sophisticated operation.”

investing

Madoff Pleads Guilty, Could Get 150 Years

Well, it’s official. Bernie Madoff has plead guilty to 11 counts of fraud, money laundering, perjury and theft. The maximum amount of prison time for these crimes is 150 years.

Craigslist: Fall Guy For Your Hedge Fund (Financial District)

Is your hedge fund in dire financial straits? Are you totally screwed and now realizing that someone has to take the fall? Has your ponzi scheme enveloped numerous celebrity-endorsed charities benefiting Laotian children with AIDS and been discovered by the SEC?

Markets Rally On Bernanke Comments, Citigroup Profits

Full Text of Bernake’s Speech [Federal Reserve] (Photo: AGRR 4059)

Stocks: Old Bulls Losing Their Steam

Even eternal stock market optimists are losing their nerve these days, but Fidelity’s Peter Lynch still says, “But at some point in the future, I think you’ll look back and see that we’ve gotten through this,” and that “stocks turned out to be the best bet.” Personally, I’ve started to look at it as throwing money down a magic wishing well, or planting magic seeds that will take 10 years to grow (it’s amazing how adding the word “magic” to anything makes it a little more psychologically palatable). [NYT] (Photo: ynskjen)

Single Men Trade Stocks Too Much

Nick Kapur at The Motley Fool says that men trade stocks more frequently than women. This is not a good thing; the result of all this hyperactivity and overconfidence is lower earnings on your investment. He writes, “Worse still (for unmarried guys like me) is that single men trade a whopping 67% more than single women, earning them annual net returns of 2.3% less! The authors cite increased trading costs, taxes, and a greater tendency to speculate as reasons for this underperformance.”

Ladder Your CDs For Fun And Profit

Here’s a way to get around the worst part of CDs (certificates of deposit) which give you a higher guaranteed interest rate but lock your money in for a certain period of time: Make a ladder!

NYSE Thinking About Chucking $1 Rule

The New York Stock Exchange is thinking about getting rid of the pesky rule that your company’s stock needs to trade above $1 for it to remain listed. [Yahoo! Finance] (Photo: woodendesigner)

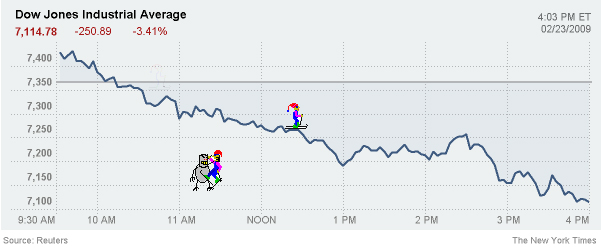

Freak Out Continues: Markets Close At Lowest Level Since 1997

Bad day on Wall Street today, folks. The S&P 500 closed at the lowest level since April 1997.

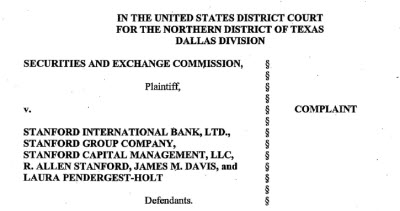

SEC Charges Texas Businessman With $8 Billion Fraud

The SEC has charged Robert Allen Stanford, a prominent Texas businessman, in connection with an $8 billion fraud in the sale of so-called certificates of deposit that promised unrealistic rates of return. Stanford guaranteed fixed-income investments by “promising improbable and unsubstantiated high interest rates,” according to a statement by the SEC.

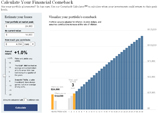

Calculate How Long Till Your Portfolio Recovers

How long will it take your portfolio to recover from this financial Armageddon? NYT’s cool calculator tells me it’s going to take about three years. Check it, just punch in how much your portfolio was worth at its peak, its current value, how much you contribute on a regular basis, and play with the annual return. It generates a nice Times-quality graph of how long it’s going to take you to get it all back, and what the outlook is for years to come. Good way of putting the whole shebang in perspective.

Is Suze Orman Nothing But A Lying Shill?

Slate’s James Scurlock has some harsh words for Suze Orman. He says she’s a liar who is more interested in shilling cruises and luxury car leases than anything else.

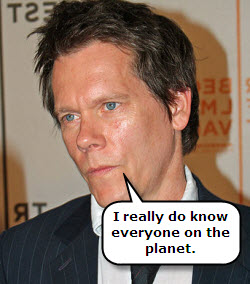

Kevin Bacon, Sandy Koufax, Mets Owners All Got Screwed By Madoff

A court filing in U.S. Bankruptcy Court in Manhattan made public a 162-page document listing his various clients, which include Hall of Fame Pitcher Sandy Koufax, actor Kevin Bacon, and the Wilpon family, owners of the New York Mets.

Anti-Fraud Websites Emerging To Fight 'Massive Ignorance'

The website Scam Victims United warned its readers about last week’s arrested ponzi schemer, Nick Cosmo, nearly four months ago, based on a visit one of its forum members made to Cosmo’s office. Reuters points out that this site and others like it—Fraud Aid and Scam Warners, for example—are enjoying healthy traffic spikes right now, which is great news in the fight against fraud.

Which Financial Gurus Are Worth Listening To?

We’ve already noted that author Eric Tyson believes Jim Cramer’s stock advice is worse than a coin toss. Now Tyson takes on the advice of “Rich Dad, Poor Dad” author Robert Kiyosaki. In summary, Tyson berates Kiyosaki’s disdain for mutual funds and refutes many of the arguments Kiyosaki uses to favor real estate over them. Tyson also points to a larger review of Kiyosaki’s teachings that is, shall we say, less than complimentary.

Personal Finance Roundup

Here’s our weekly roundup of the best personal finance news. Inside: investing lessons, gadgets to buy, mentoring, career tips for women, and fixing money mistakes.

Oprah & Orman Give Out Free Book: "2009 Action Plan"

“Suze Orman’s 2009 Action Plan” is free to download from Oprah.com for the next week. Unlike last year’s “Women & Money,” this book is intended for pretty much everyone. We haven’t read it, so here’s a line from the Amazon editorial review: “There are safeguards to put in place, actions to take, costly mistakes to avoid, and even opportunities to be had, so that you are protected during the bad times and prepared to prosper when things take a turn for the better.”