Blueprint for Financial Prosperity is doing a neat thing where he looks at his site stats to see what Roth IRA questions people are typing into Google that direct them to his blog, and then he answers them in a post.

investing

The More You Stuff You Sell Through Walmart, The Lower Your Gross Profit Margin

To measure the “Wal-Mart effect” on profits across different industries, Forbes analyzed information compiled by Revere to compare the percentage of sales that various firms generated through Wal-Mart in fiscal 2006 to the gross margins those firms produced during the same period, as compiled by FactSet . The survey covered 333 companies in six industry sectors–apparel & accessories, consumer games & electronics, household accessories, food & beverage, personal care and leisure goods–that Revere identified as heavy Wal-Mart sellers and their competitors.

We’ve summarized their results inside.

Financial Advisors Often Give Poor, Expensive Investing Advice

Want to get some investment advice that is expensive and doesn’t perform any better than other, less costly options? If so, ask your broker or financial advisor for investing advice. They’re much more likely to point you toward an investment with a “load” — a fee that ranges in price but generally runs 3% to 5% of your investment’s value — simply for them “recommending” it (some would say “selling” it is more accurate.)

Become A Google Finance Power User

Ask The Advisor has 13 tips to maximize your experience with Google Finance, a free online stock and company information tool. Number 11 tells you how to get multiple quotes at the same time:

25% Of Americans Say They Have No Savings At All, Including Retirement

All but the lowest earning men should have accumulated in a nest egg 12 times their income by the time they retire, EBRI estimates. That’s $900,000 for a man earning $75,000. A woman, because of a higher life expectancy, should have 14 times her income

Damn. Women live so long they can pull that “put one penny in a savings account and in the future you’ll be a zillionaire, but it’ll only pay for one dinner” thing from Restaurant At The End Of The Universe.—MEGHANN MARCO

Spend It All: A Depressing Look A Taxes, Inflation And Saving

If I said to you, “You can have $10,000 to spend now–or $9,500 to spend in 10 years,” which would you choose? Probably the $10,000 now. And in doing so, you would be making the same choice many Americans make when deciding whether to save or spend their hard-earned cash.

The article goes on to consider some strategies for saving money such as T-bills and stocks, as well as proposing some changes to the tax code. The author suggests making long-term savings tax exempt, which sounds like a lovely pipe-dream. —MEGHANN MARCO

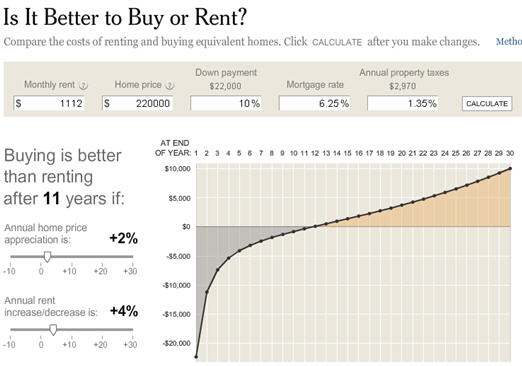

Is it Better To Buy or Rent?

The New York Times has a nifty calculator that will help you decide if its better to rent or buy. It told us that based on our rent vs what it would cost to buy a place similar to the one we rent…buying was only better after 24 years. Sobering news. —MEGHANN MARCO

Rent While The Renting Is Good?

According to the New York Times, if you’re renting you’re smart.

Over the next five years, which is about the average amount of time recent buyers have remained in their homes, prices in the Los Angeles area would have to rise more than 5 percent a year for a typical buyer there to do better than a renter. The same is true in Phoenix, Las Vegas, the New York region, Northern California and South Florida. In the Boston and Washington areas, the break-even point is about 4 percent.

Ride The Real Estate Rollercoaster!

Thinking of buying a house as an investment? You may want to ride this roller coaster first. No, it’s not a real roller coaster, it’s the graph of US Home prices (adjusted for inflation) mapped out with Roller Coaster Tycoon. It’s oddly fun, with a “cliffhanger” ending. Enjoy!

Your Broker Is Just As Confused As You Are

She presented herself as a divorcee who had received a legal settlement and needed advice about investing, tax and estate planning, college savings, retirement and insurance (all true, by the way). She left out only that she would be writing about the experience. Of course, our field test was hardly scientific. But we found out that in their new roles, many brokers seemed just as confused as their customers. The good news: We picked up a lot of attractive graphs and pie charts, and a couple weeks’ worth of free coffee.

My, that’s comforting. Sadly, the article didn’t come to many helpful conclusions. No broker performed significantly better than any other, so you’ll just have to shop around for someone who seems like they know what they’re doing and then do some research about how they get paid and what their title means. SmartMoney did say that they got the most accurate advice from a “total jerk.” Hmm.—MEGHANN MARCO

Is Your Broker a Crook? Check Their Background!

While most small investors are better served by using a discount broker, there are times you may want to invest with a real human being. If you’re that kind of highfalutin investor, you can now see if a broker has a “record.”

An Argument For Index Funds

FreeMoneyFinance has a nice piece on why he invests mainly in index funds.

10 Steps To A Simple Financial Life

One day you woke up and you realized that you were an adult, and, as said adult, you would be mailed something called a “fund prospectus.” What? How did this happen to you? What should you do about it?

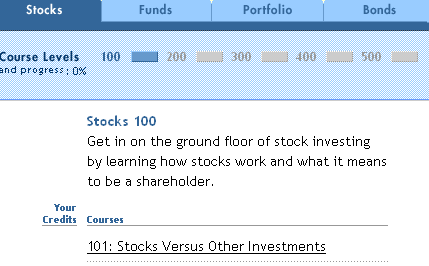

Free Online Investment Classes From Morningstar

Don’t know what the hell you’re doing when it comes to investing? Hey, join the club. Good thing Morningstar is offering free investment classes on their website. They’re organized like college classes, and you can earn points for completing the quizzes at the end of each class. Points can be traded for prizes, but really, isn’t knowledge its own reward?—MEGHANN MARCO

Boiler Room Made Flesh

So, we put out the call for something as good as the AOL cancel call. Mark steps up with a link to his buddy Aaron’s site who hosts a call between himself and a Boiler Room type crapola stock seller, Josh.