That’s why credit-card companies have had to rein in their lending and shed accounts. Since that risks shrinking profits, they’re also trying to get as much as they can out of their existing customers, by doing things like sharply increasing their interest rates.

interest rates

Canceling Cards, Raising Interest Rates, Actually Part Of Same Horrible Party

Why Can Capital One Raise My Rates Just Because The Economy Is Bad?

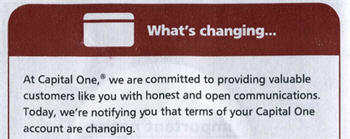

We’ve been getting a lot of shocked letters from Capital One customers asking how the company can get away with raising their interest rates on their cards when they “haven’t even been late with a payment.” There is, in fact, no such thing as a fixed rate card and credit card companies don’t need a “reason” to raise your rates. They can do it whenever they like.

Capital One Does Not Appreciate You Being Responsible, More Than Doubles Your APR

Beverly, who always pays on time and recently started paying off her balance in full every month, just saw the rate on her Capital One card more than double, from 13.9% to 29.4%. That’ll teach you to not help sink the economy, Beverly!

Capital One: Sorry, Due To "Extraordinary Changes In The Economic Environment" You Need To Pay More

Capital One apparently believes in “honest and open communications” (even though they’ve been accused of purposefully dicking their customers around in the hopes of generating more fees). How do we know this? Because they’ve written their “valuable customers like you” letters letting you know that due to “extraordinary changes in the economic environment,” everyone needs to pay a little more interest. Don’t worry, you haven’t done anything wrong. That’s just the Capital One honesty you’re feeling. Read the letter inside.

Fannie Mae Relaxes Standards For Refinancing

Bloomberg says that Fannie Mae will loosen standards for refinancing in the hopes that more homeowners will be able to take advantage of historically low interest rates.

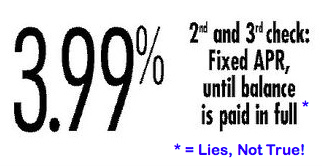

Chase Promises To Honor Promotional APR Until Balance Is Paid Off Or They Change Their Mind—Whichever Comes First

Chase doesn’t want to honor an old promotion promising to lock in a customer’s APR until their balance is paid off, so they’re just ignoring the original terms and jacking up interest rates. The bank wants to hike a promised 3.99% rate to either 7.99%, or 5% of the total balance plus a $10 monthly service charge, terms that are dull enough to put you to sleep until you receive the next month’s bill. Inside, Credit Slips walks us through how this is legal, along with tips for recapturing the stolen promotional rate.

../../../..//2009/01/22/to-fix-the-economy-the/

To fix the economy, the Fed needs to lower interest rates below zero. Trouble is, that’s impossible. [Business Week]

Bank Of England Cuts Interest Rates, Lowest Since 1694

Remember 1694? No? Well, the Bank of England has cut the benchmark interest rate “to the lowest since the central bank was founded in 1694 as policy makers tried to prevent the credit squeeze from deepening Britain’s recession,” says Bloomberg.

Now Is The Time To Lock In Interest Rates With CDs

If you’re a saver, the Fed flipped you the bird this week. They dropped interest rates and introduced “quantitative easing,” two things that will make interest rates plummet. Here’s how you can protect yourself.

Fed Cuts Rates To ZERO. Yes, Zero. 0%.

The Federal Open Market Committee today established a target range of zero to 0.25% for its fed funds rate. This, as you might imagine, is unprecedented.

20% Of Citigroup Cardholders Can Expect Rate Increases For 2009

If you have a Citigroup-issued credit card and you haven’t had a rate increase over the last two years, expect to be notified of a 2-3% rate increase on your November statement. Congratulations! You’re going to help Citigroup offset its losses in the global credit card division, whether you were directly part of those losses or not. As the New York Times points out, by doing this Citigroup is breaking the promise they made to Congress in 2007 that they would not arbitrarily raise rates on accounts—which may be why they’re offering a fairly lenient opt-out policy.

Planet Earth Cuts Interest Rates

Six central banks of the world did a coordinated interest rate cut to try to help the credit crisis. The group included the US and the European Central Bank. What does this mean for your wallet? It’s possible, at some point, that you’ll be able to get or renegotiate loans or mortgages to a better interest rate, and you’re like to see saving account rates drop, but given the apocalyptic economic climate, don’t count on it happening anytime soon.

Car Title Loans Are Liable To Leave You Taking The Bus

You surely already know better, because you’re a loyal Consumerist reader, but stay far, far away from the form of legalized usury known as car title loans! CNN has published an overview of the industry, noting that APRs frequently exceed 200%, and that added fees and loan “rollover” options help keep borrowers in a cycle of debt.

Reader Pays Off $14,330 In 20 Months With Our Tips

Stuck in a $14,300 debt hole, reader Trixare4kids was able to dig herself out using tips she learned about on Consumerist.com. Let’s learn how she attacked her personal finances and learned to live frugally, and did it all in 20 months.

10 Things To Expect From The New Post-Apocalyptic Economy

Kiplinger’s has put together a list of 10 things that you, fair consumer, can expect from our new post-wall-street-apocalypse economy. Should you be scared? Maybe.

Advanta Raises Your 8% Credit Card To 20% Because The Economy Is Bad

I have had an Advanta Credit Card for a little over a year now. My interest rate prior to a few days ago was 8%. My credit rating is very good, and I have always made my payments on time. As I was looking over my bill for September I noticed a fee of $75 dollars. A few clicks later I found that my interest rate had been raised to 20%.

House Passes Credit Card Bill Of Rights… But Senate Is Too Busy With The Bailout

The House of Representatives passed legislation that’s commonly known as the Credit Cardholders’ Bill of Rights today, but the bill is expected to be ignored by the Senate while they work on that whole $700 billion bailout thing.